How Long Are Federal Tax Liens Good For

See internal revenue code 6323 g 3 and internal revenue manual 5 17 2 3 3.

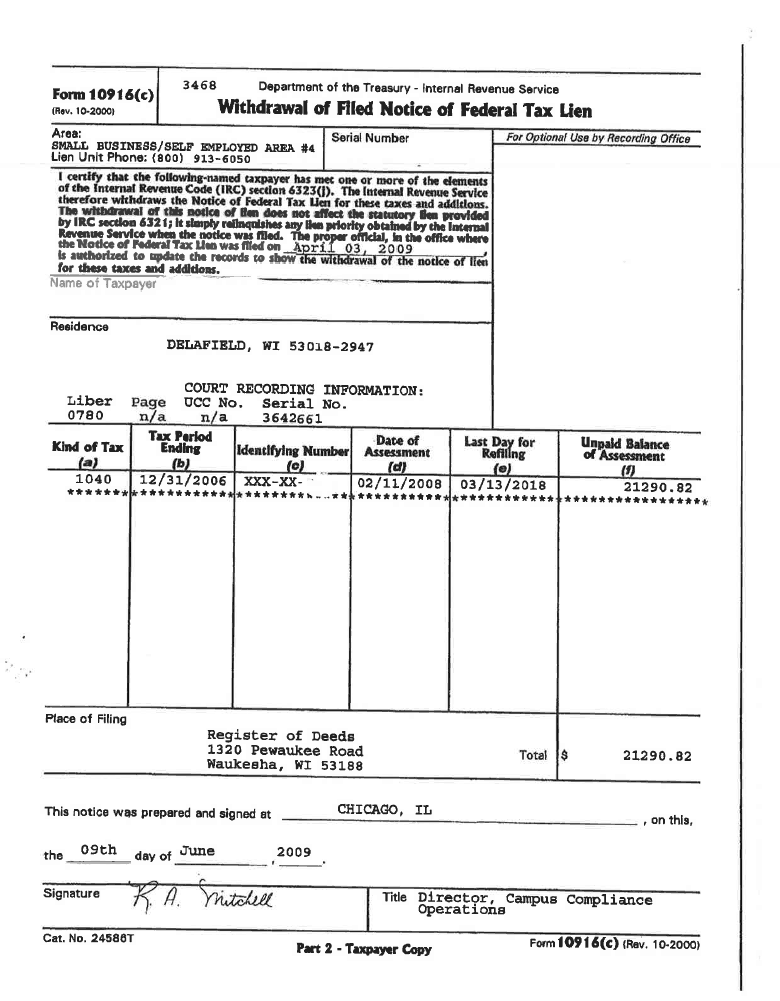

How long are federal tax liens good for. The text next discusses the different methods for seeking relief from the federal tax lien including subordination releases and certificates of discharge. When does an irs tax lien expire. County records will be updated to reflect that the lien has been released. A withdrawal may also occur if the taxpayer enters an installment agreement to pay the debt once they receive the notice.

A federal tax lien filed on your property is a serious problem and can feel suffocating. That means when ten years passes it automatically expires. Releasing a federal lien means that the lien no longer encumbers your property. Releasing a federal tax lien.

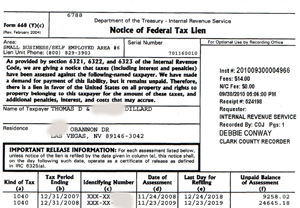

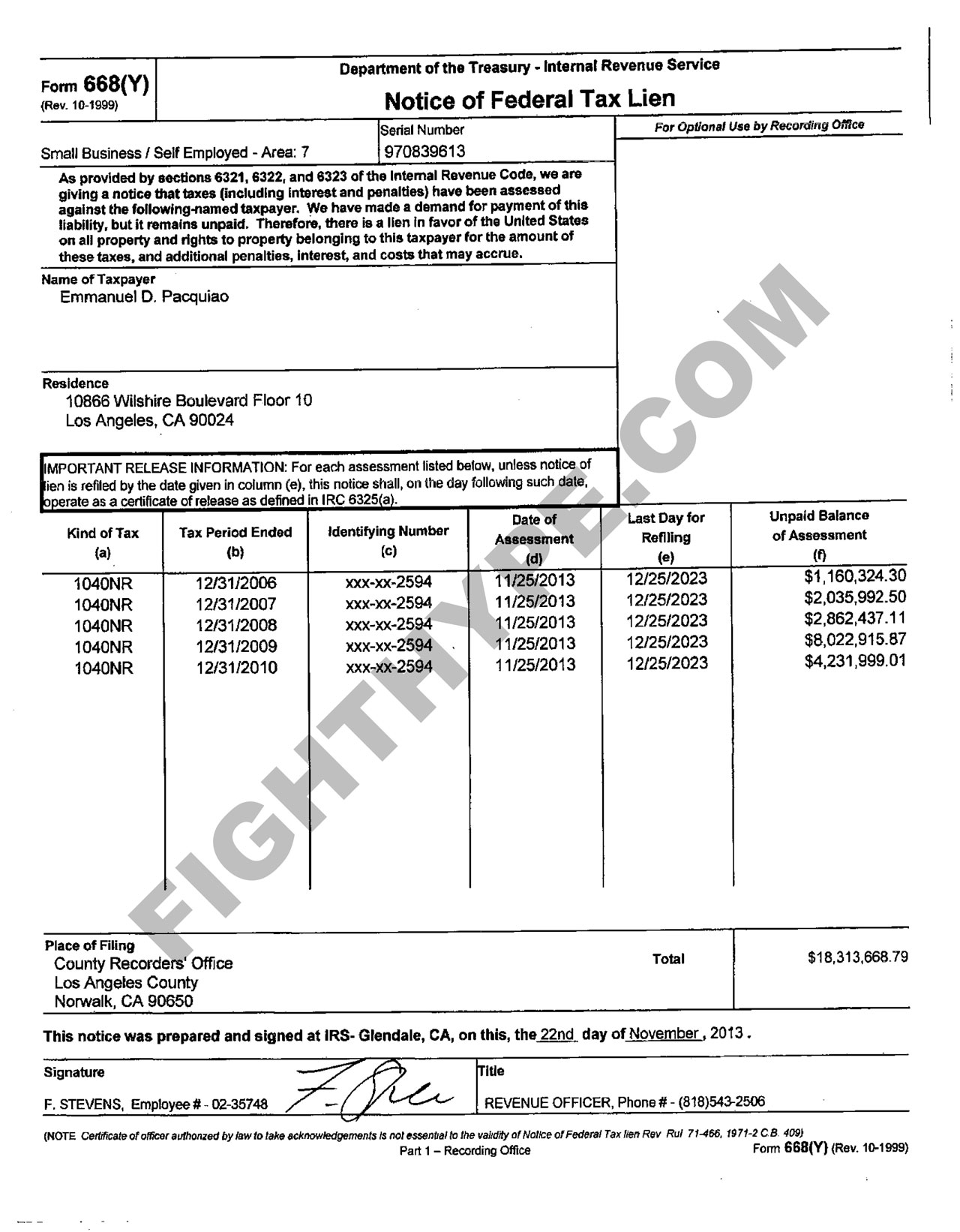

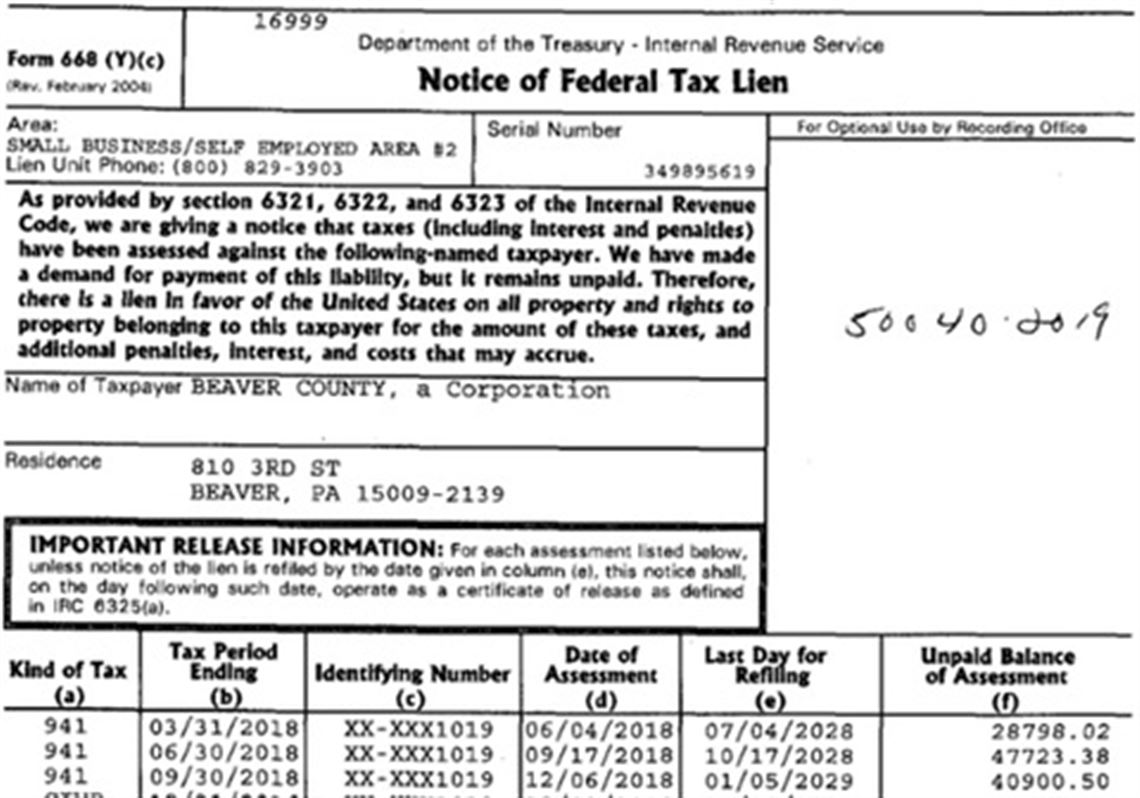

Under internal revenue code section 6502 the irs has 10 years to collect that tax deficiency. Once the irs issues a lien on your assets it will usually remain there until the statute of limitation expires or until the tax is paid in full. Liens don t last forever depending on when they were filed they expire after six or 10 years but waiting them out isn t advisable and if you can t simply pay off your tax debt you should explore other avenues of managing your lien. The irs has a right to file a notice of federal tax lien nftl against any taxpayer business or individual who owes the irs more than 10 000.

For this reason consider paying down your balance to below 10 000 if you are not able to pay the full amount. How long is a federal tax lien good for. A federal tax lien is the government s legal claim against your property when you neglect or fail to pay a tax debt. In most cases a lien is not filed for tax debts under 10 000.

The refiled tax lien will be valid for the extended timeframe the irs has to collect it is good for the extra time you gave the irs to collect. In this case collection action may be taken until the 89th day after expiration of the installment agreement. Liens are released within 30 days of full payment of the outstanding tax obligation or upon setting up a guaranteed or streamlined installment agreement. Puts your balance due on the books assesses your.

Nevertheless you should be aware of the details of the lien s. This section first explains how the federal tax lien arises its duration and the effect of filing a notice of federal tax lien nftl. If you have further questions regarding federal tax liens that are general in nature you may call 1 800 913 6050. The statute of limitations was extended at the same time an installment agreement was entered into.

The text then discusses the priority disputes between the federal tax and competing liens. The lien protects the government s interest in all your property including real estate personal property and financial assets. A federal tax lien is self releasing. If you think you may ever want to refinance your home sell your home or apply for a line of credit then you should know how long the irs has to collect on your tax lien.

It maintains any priority it has against liens of other creditors. However if the irs does not refile the tax lien.