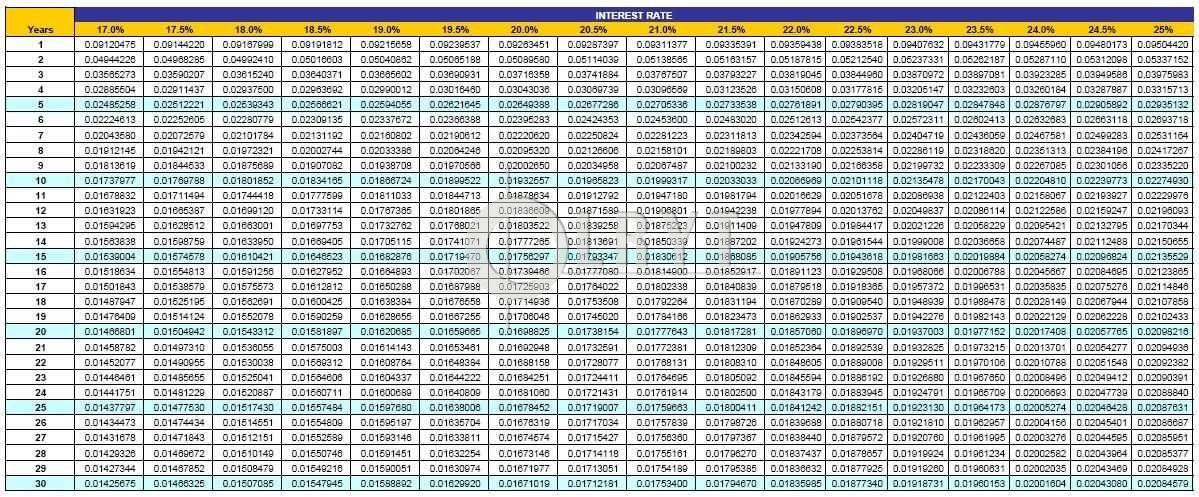

Factor Rate

And before you sign on the dotted line for any business loan with a factor rate make sure you know just how much that financing will be costing your business.

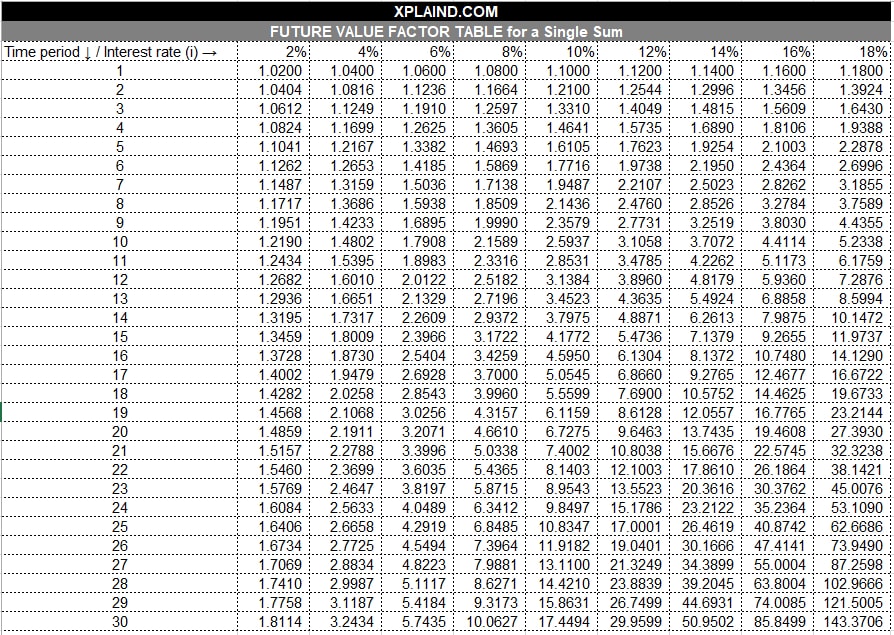

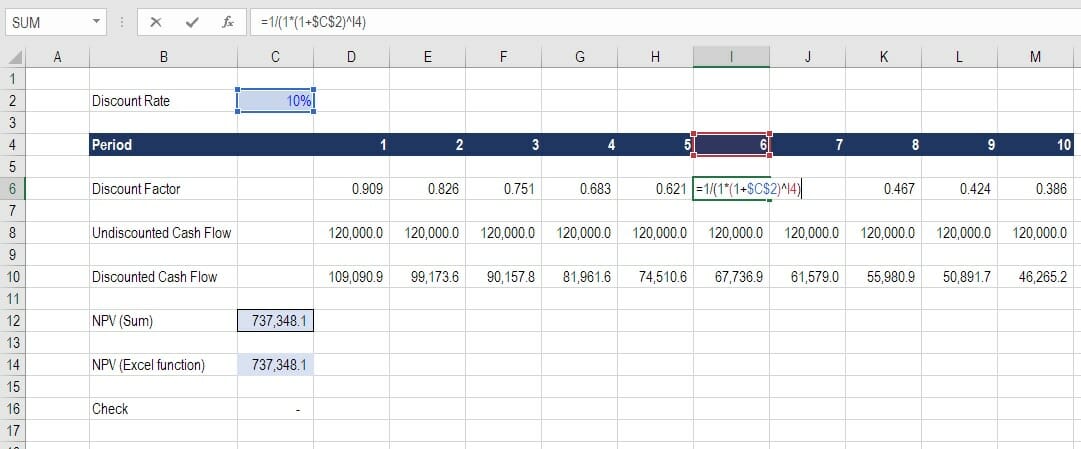

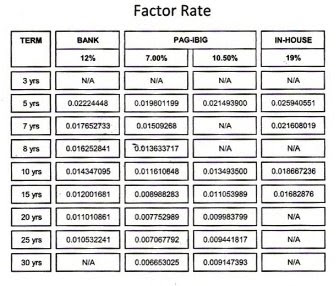

Factor rate. When you see a factor rate the first thing you need to know is that it doesn t mean the same thing for your business as an interest rate or apr does. It is similar to the interest rate paid on a loan and it is also based on a customer s credit score. To calculate the discount factor for a cash flow one year from now divide 1 by the interest rate plus 1. For example increasing temperature past a certain point may denature reactants or cause them to undergo a completely different chemical reaction.

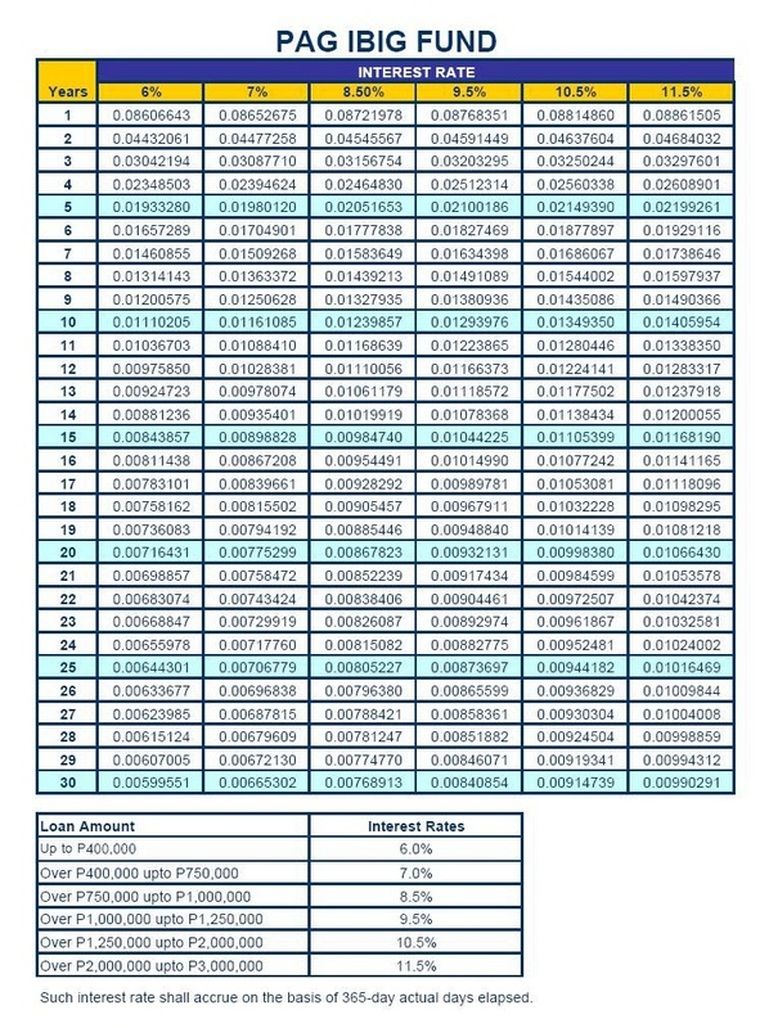

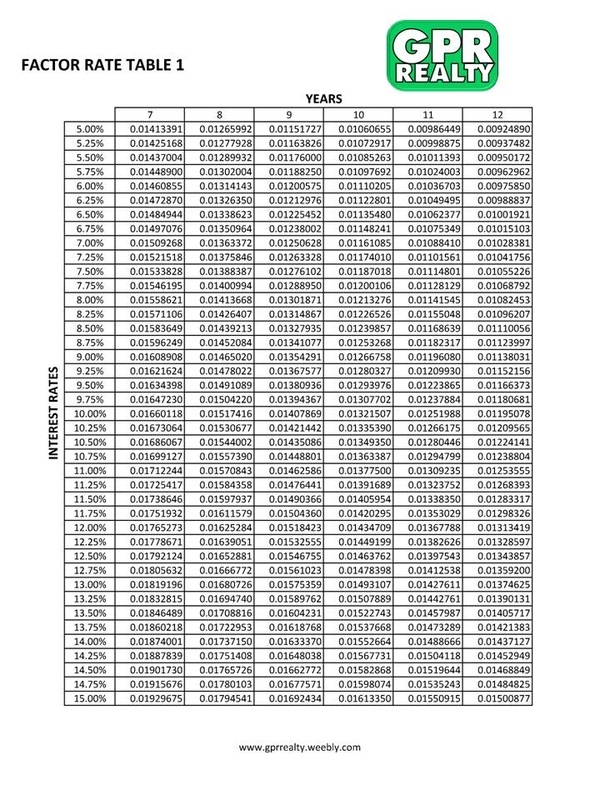

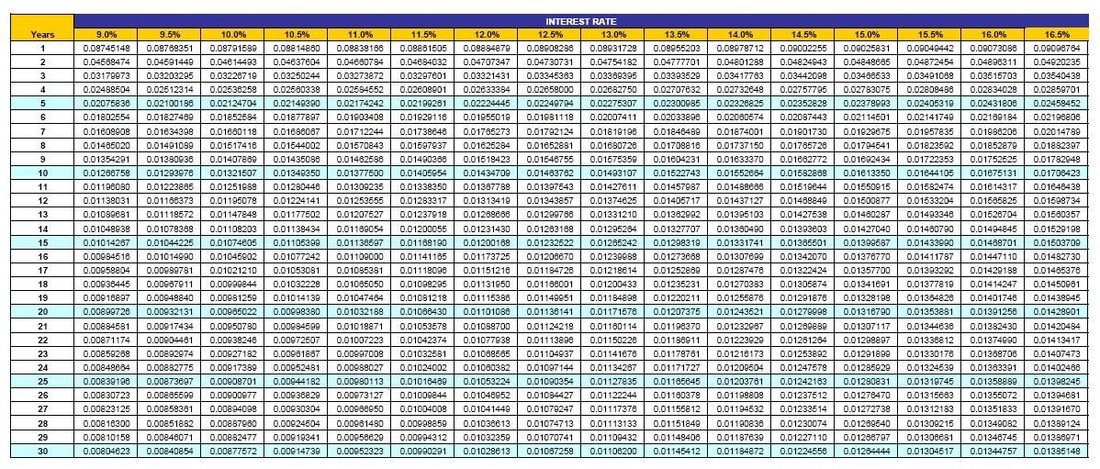

The full amount of the interest is charged to the principal when the loan or advance is originated. The bottom line on factor rates. Factor versus rate by removing the hours that the plant is not expected to run a smaller pie results with different percentages. The chart below is a summary of the main factors that influence the reaction rate.

The discount factor effect discount rate with increase in discount factor compounding of the discount rate builds with time. Aside from factors such as interest rates and inflation the currency exchange rate is one of the most important determinants of a country s relative level of economic health exchange rates play a. A factor rate is a tool expressing interest rates on business financing in decimal form. Certain short term funding like merchant cash advances or short term loans are more likely than others to illustrate the cost of funding with factor rates.

Factor whole pie rate portion of the pie. Additional fees are not included in the factor rate calculation but are included in the apr. Factor rates are expressed as a decimal figure rather than a percentage. What this is really saying is that the borrowing rate is not 1 2 or 1 5 but 120 or 150.

To calculate a discount rate for a cash flow you ll need to know the highest interest rate you could get on a similar investment elsewhere. For example if the interest rate is 5 percent the discount factor is 1 divided by 1 05 or 95. 5 4 fof versus 6 5 for. One can calculate the present value of each cash flow while doing calculation manually of the discount factor.

Notice the green slice percent changes from a factor of 5 4 to 6 5 for the rate. The money factor is the financing charge a person will pay on a lease.