Driverless Cars Insurance

This risk has already been exposed with security researchers successfully taking remote control of a jeep driving down the highway in a demonstration for wired magazine.

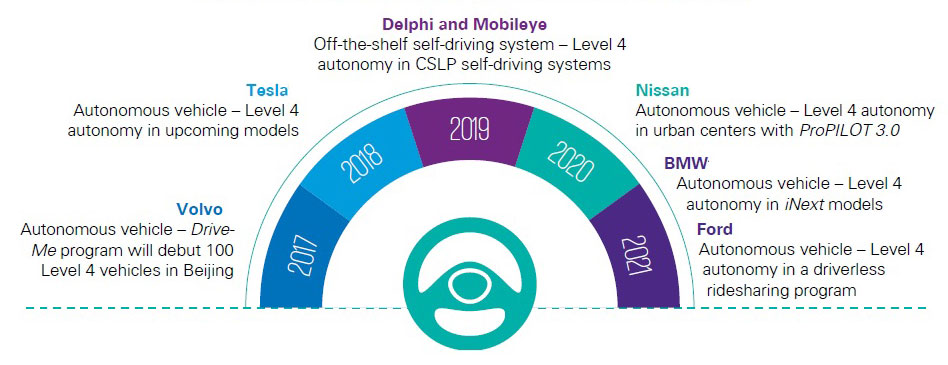

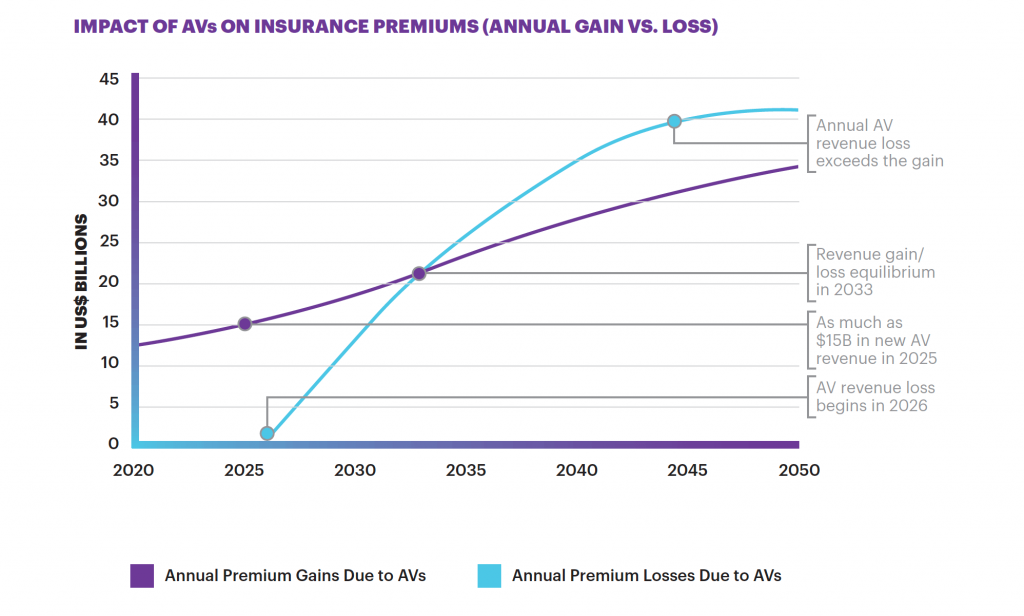

Driverless cars insurance. The bill states that insured automated vehicles will be covered for accidents that happen while the car s artificial intelligence ai is driving. Insuring a driverless car. The introduction of driverless cars will have a significant impact on the motor insurance industry. A forecast shows that the drop in individual premiums due both to decreased private.

When the car is driving itself this paradigm is completely disrupted. Traditionally auto insurance has followed the driver regardless of what vehicle they re driving. Driverless cars will have a huge impact on the auto insurance industry that much is expected but exactly how and when is still unknown. That enshrined in uk law the principle that the driver is insured when they are driving and when they have put the car in fully automated mode.

Under these new insurance rules and with the hindsight that driverless technology provides such as dash cams the question of blame and the claims process would be easier to clear up. Driverless car insurance the government recently announced plans for a compulsory insurance model for driverless vehicles covering both the driver and car if in autonomous mode. Instead car owners will buy one insurance policy that covers both driving modes. As when most new technology enters the market in the very short term there is the possibility that the cost of repairing driverless cars may be higher but we would expect this to fall quickly as volumes increase and we see a noticeable reduction in accidents and claims.

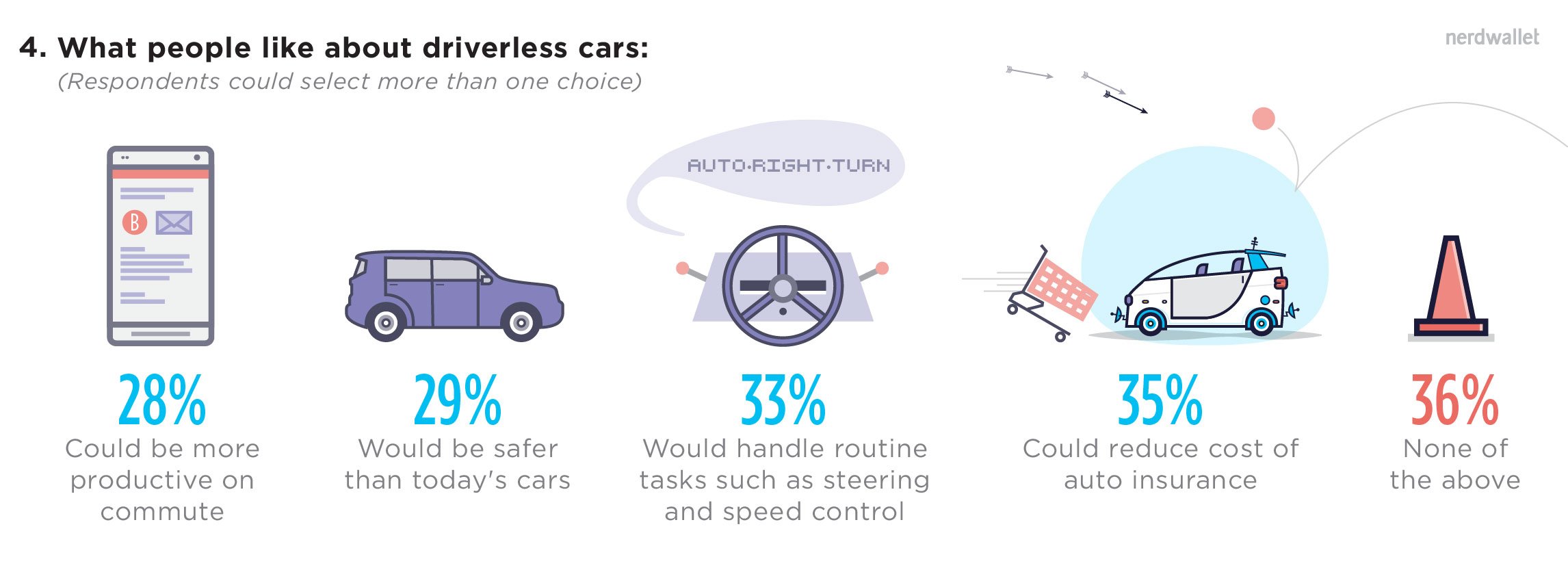

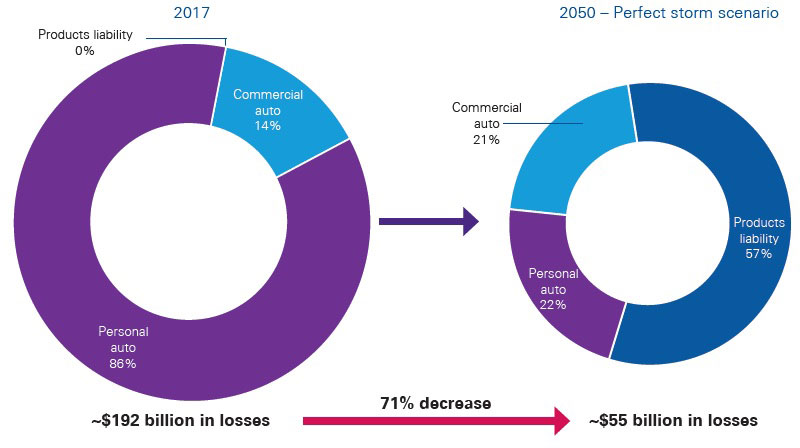

Cyber driverless cars insurance with driverless cars expected to operate as a linked network through the internet there is a risk it could become another platform for hackers to infiltrate. Autonomous vehicles will have a huge impact on the automobile insurance industry. As cars become increasingly autonomous fewer accidents are likely to occur and this will push premiums down. The insurance sector is changing to meet the demands of a world in which driverless cars are going to become more common.

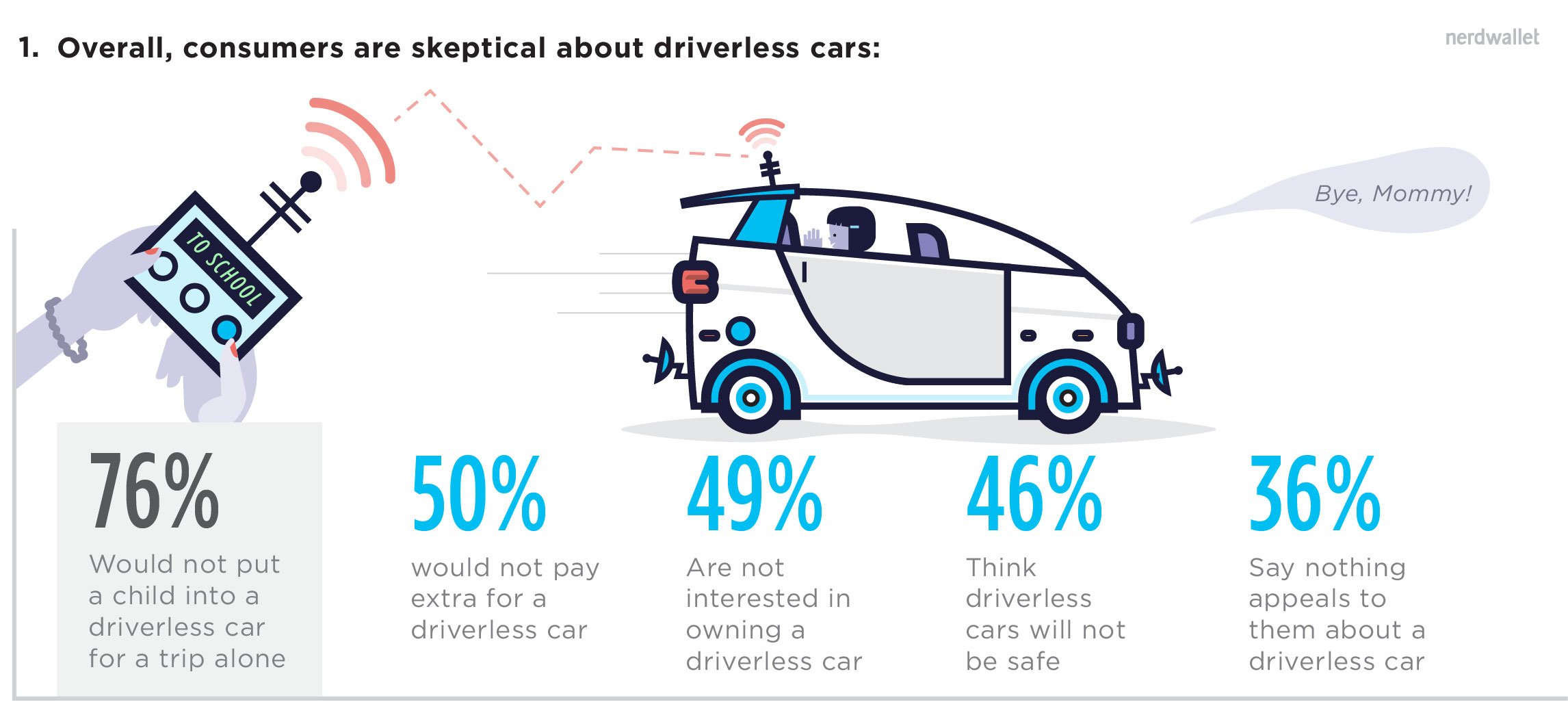

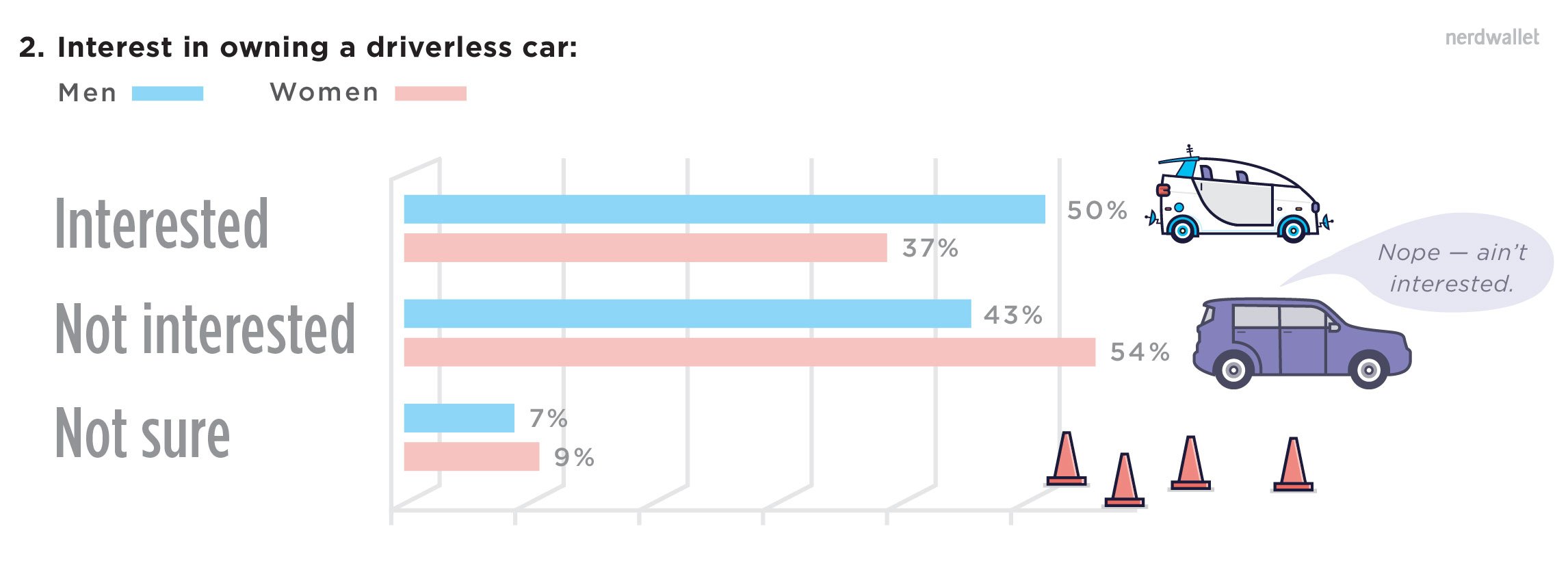

So will driverless and connected technology help lower car insurance premiums. Insurers will continue to pay out for claims but could recoup some costs from carmakers when their technology. Driverless vehicles are neither technologically nor logistically ready for mainstream use but since they will almost certainly affect the auto insurance industry insiders are speculating and making their preferences known and some overarching themes have emerged.