High Risk Small Business Loans

If a small business can prove they were unable to get a traditional loan they can apply for a loan with a sba enhancement.

High risk small business loans. A high risk small business loan is a funding option for business owners and their companies with poor or bad credit. Because lenders will determine the risk of the loan based on the business s credit history borrowers that are deemed high risk generally receive smaller loan amounts at greater interest rates if approved for anything at all. An sba loan is financing provided by traditional lenders to borrowers that are unable to obtain traditional bank rate financing. High risk business loans.

You can borrow. Typically high risk loans are issued to those debtors who have a bad credit history or are unable to supply the requisite collateral or have no clear idea of how they will go about repaying the loan. Tens of thousands of loans issued by the trump administration as part an economic relief program for small businesses struggling amid the coronavirus pandemic face a high risk of fraud waste or abuse according to a report issued tuesday by a house panel. Small business owners just need to know where to look and how to obtain these loans.

A lender will want to minimize their risks by charging greater interest or perhaps ensuring a short term agreement. High risk business loans are typically small business loans that are offered to businesses with poor or little credit. The process is fast and easy and you can apply online. Generally the perceived danger is a reflection of both the owners and the company s overall qualifications.

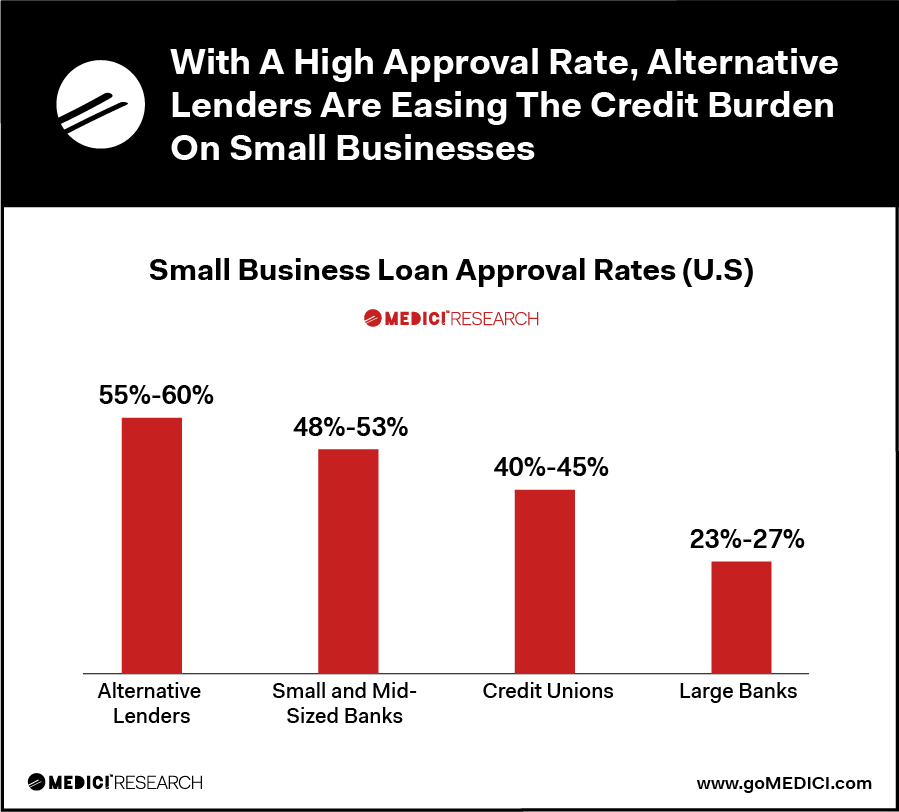

However like the other high risk businesses previously mentioned there are alternative lending options available. While lenders provide and administer the loan the sbfp steps in and guarantees fixed portions of unpaid debt in the event of default. High risk businesses aren t going to be able to just walk into a bank and walk out with a loan. Another place to look for a high risk small business loan with bad credit is a web based lender which is often a microlender.

While business loans and types of financing differ from high risk commercial lender to lender there are a few go to offerings suitable for business owners working to improve their credit or build a history. When seeking a high risk small business loan expect to pay a very high interest rate. What are my options for high risk business loans. There are as many reasons why a company is high risk as there are businesses.

Your top 3 options. Shield funding has been helping small business owners secure high risk business loans for more than a decade. High risk small business loans. As the term indicates a high risk business loan is one that involves high risk on the part of the lender as well as the borrower.

/dotdash_Final_Small_and_Mid-size_Enterprise_SME_Jun_2020-01-167470ed3ba847aaa6a9acc411e039a3.jpg)

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)