Do You Have To Pay Taxes On Cash Out Refinance

A cash out refinance s effect on your taxes is directly dependent on what you will be doing with the money.

Do you have to pay taxes on cash out refinance. Learn more about this program and other refinance options by making a 10 minute call to one of our mortgage consultants. Luckily you don t have to pay taxes on cash out refinance proceeds. The cash you take out of your equity during a refinance isn t considered income by the irs. A lack of capital gains.

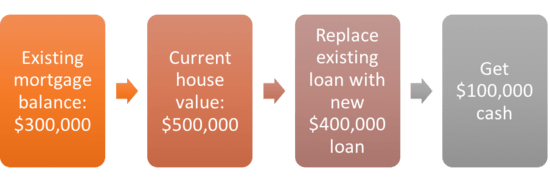

You may not think of it this way because you know you will have to pay the money back. Even though you increase the cash you have in your possession when you do a cash out refinance you don t increase your net worth. Cash back refinance mortgages are excellent ways to access large sums of cash. The closing costs are a.

If you don t use the proceeds to improve your home you have to prorate the points. So if you do a cash out refinance and use the funds for some other purpose than home repairs or improvement they re no longer qualified mortgage debt. A cash out refinance is a source of income to you and your home. If you are cashing out to improve your home the new debt is considered acquisition debt and the interest on your mortgage is deductible on the first 1 000 000 or 500 000 of the mortgage s balance depending on if you are filing as a married couple or with some other status such as.

If you are lucky enough to make more than 250 000 as a single person or 500 000 as a married couple you will pay taxes on any amount you make above that number. We help you understand the reasons below. A cash out mortgage refinance is a great option if you can get a good interest rate on your new loan and you have plans to spend the money wisely debt consolidation or home improvement. If you use the proceeds of the cash out to pay for home improvements you can either deduct the points in the year you pay them or prorate them over the remainder of the mortgage.

In this case the amount of cash you can get is limited to 240 000 minus 200 000 to pay off your current loan minus the 10 000 in costs for a net cash out of 30 000. That s what the irs looks at when deciding if they should tax your earnings. The irs knows the same thing so you will not be charged taxes on the income during the time the loan is alive in most cases. However there are limitations on deductions that you can take when you refinance your loan you may only discount interest you pay on your new loan if you use your cash to make a capital improvement on your property.

There s a special wrinkle that affects cash out refinancing though. If you have the equity you can use a cash out refinance to get money for debt consolidation remodeling paying for.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

:strip_icc()/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

/GettyImages-1171659710-149c5671e12b4e4d855730507df022ef.jpg)