Due Date For Sep Ira Contributions

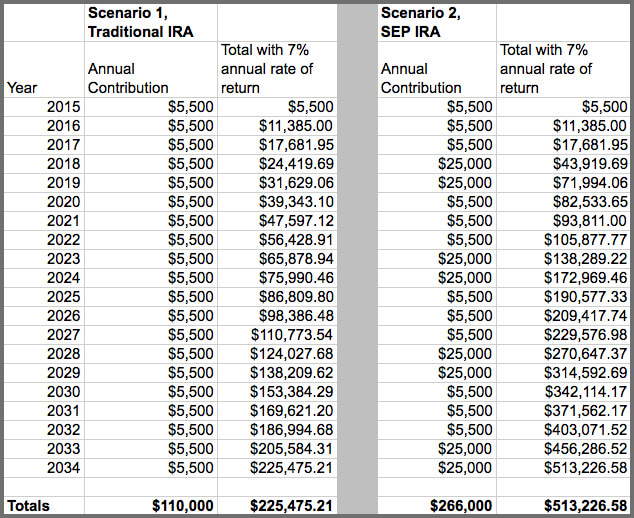

Ira contributions are generally due by the due date of the tax return for the year the contribution is made without extension.

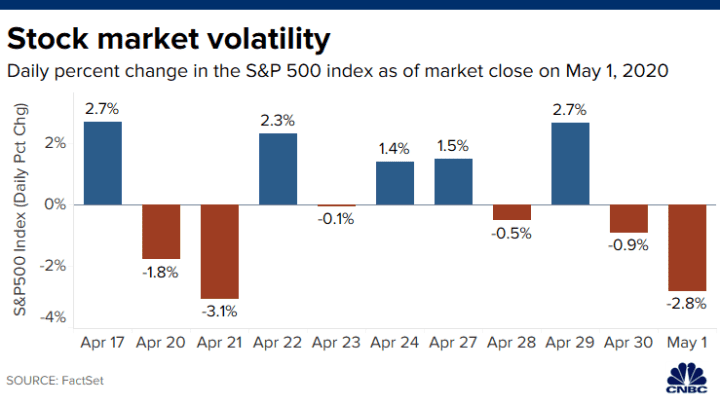

Due date for sep ira contributions. Nancy s employer jj handyman contributes 5 000 to nancy s sep ira at abc investment co. Contributions can be made to your ira for a particular year at any time during the year or by the due date for filing your return for that year. Therefore if you mail your contribution by july 15 you will meet the deadline. 1 for 2020 the filing deadline is july 15.

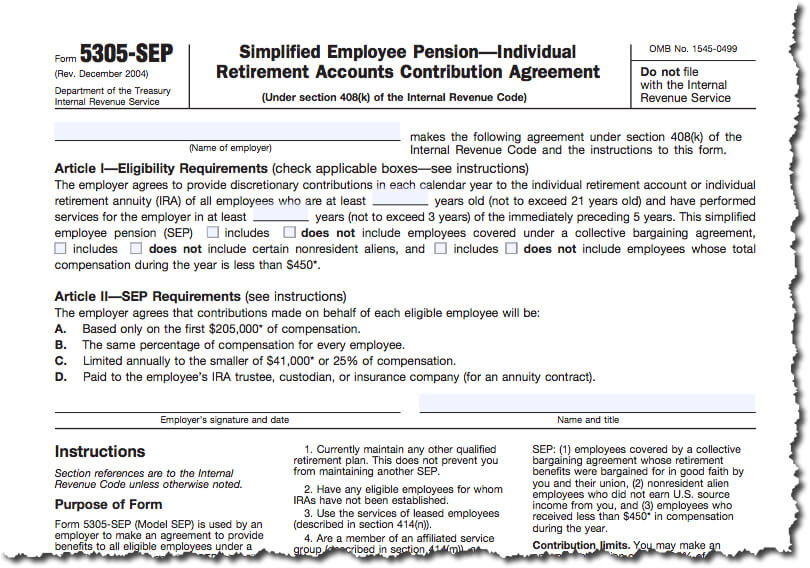

Lesser of 57 000 or 25 of compensation up to compensation limit of 285 000. In a typical year employers must contribute to a sep ira by the tax filing deadline which is april 15. See contribution limits earlier. All sep contributions are reported during the year in which contributions are made.

The deadline to make a sep ira contribution for the 2017 tax year is april 17 2018 october 15 2018 is the extension deadline. 7 for example the tax filing deadline for many entrepreneurs and small business owners for the tax year is generally april 15. Because the due date for filing federal income tax. If you are self employed or own a small business a sep ira must be established by your company s tax filing deadline plus any extensions for the tax year to which the qualifying contribution is made.

Since the deadline for ira. The same rule applies to contributions you make to your own sep ira. For 2019 ira contributions however the due date for contributions is july 15 2020. As with your tax return the irs honors the postmark date.

2 the maximum contribution to a sep ira is. 7 so in a typical year if you. Taxpayers can make a sep ira contribution as late as the due date including extensions of the return. For example an ira contribution for 2018 was due april 15 2019 no extensions.

You now have until july 15 to contribute to your ira taxpayers have always had until the april tax deadline to make ira contributions for the prior tax year. Based on the terms of the jj handyman sep plan.

:max_bytes(150000):strip_icc()/GettyImages-592232681-8b341e1080f541f6b2fd0d63c666ea67.jpg)

:max_bytes(150000):strip_icc()/iStock-512752254.kroach.IRA-7de1faaad37c4812a2221cd938a88810.jpg)

/GettyImages-530068611-a8c4148d99884755b56b5b9745ca612e.jpg)