Home Appraisal Checklist Refinance

The second method of refinancing is done by acquiring a home equity line of credit through the homeowner s existing lender.

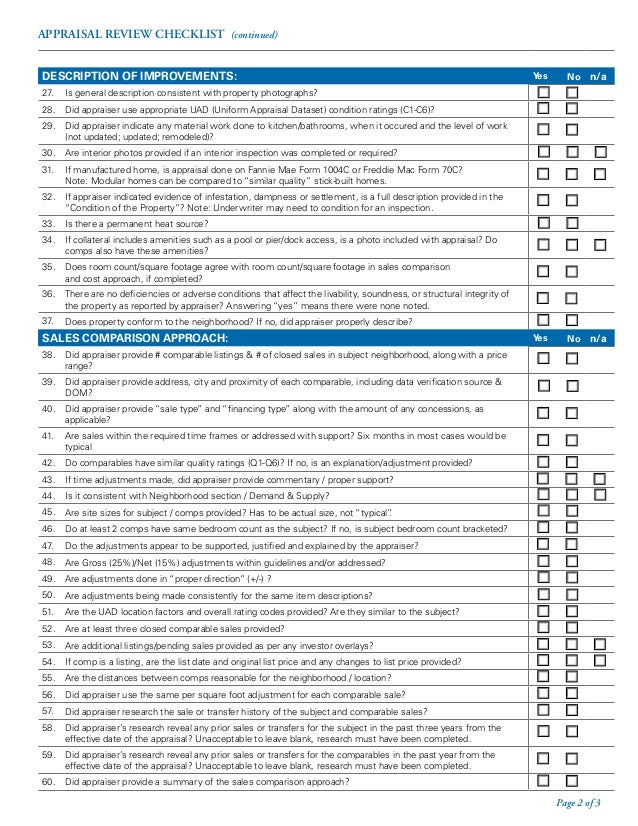

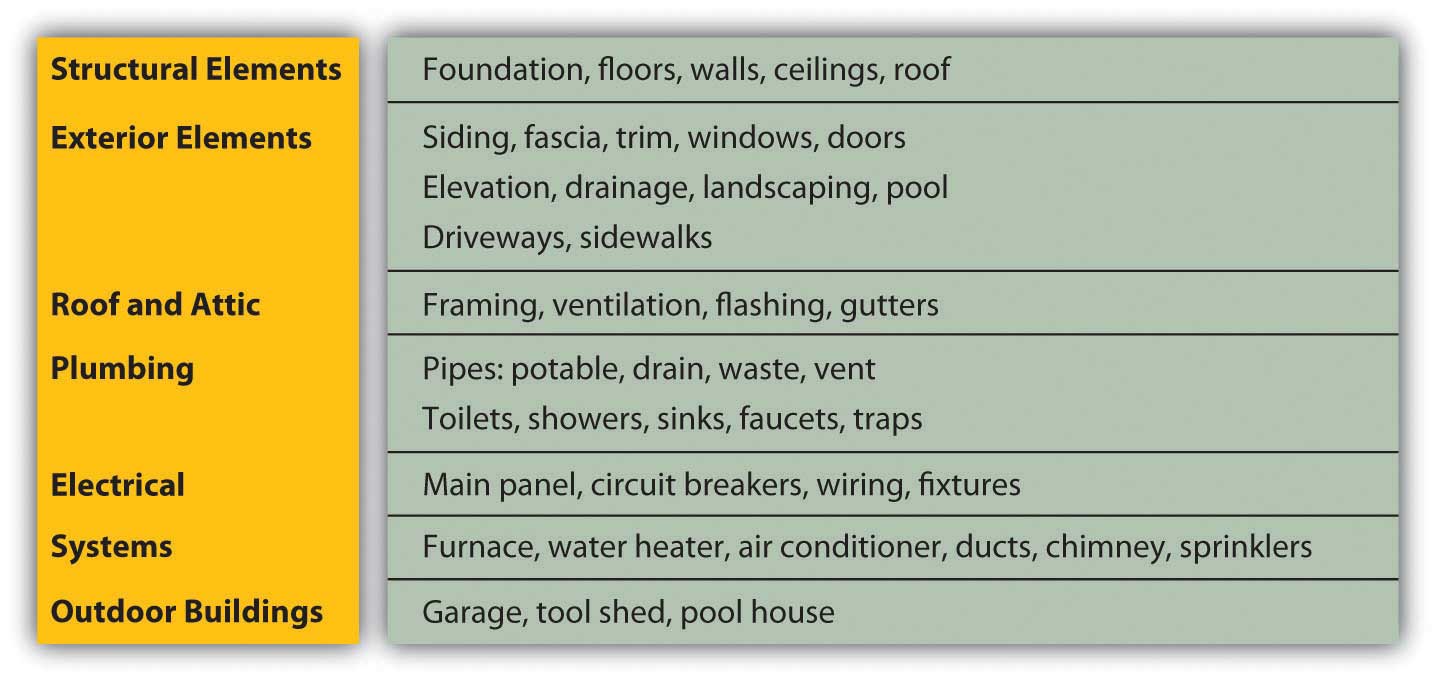

Home appraisal checklist refinance. A home appraisal is a survey of your home performed by a professional appraiser who is trained to determine the value of your property. Refinancing a mortgage often means jumping through some serious hoops. Include an appraisal contingency so your offer can be withdrawn if the appraisal comes up short. Invest in a few small upgrades do some decluttering and make plans for children and pets before the appraisal.

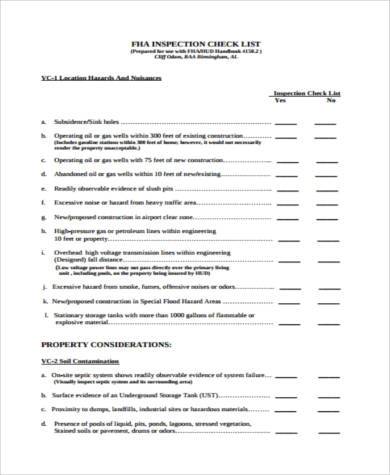

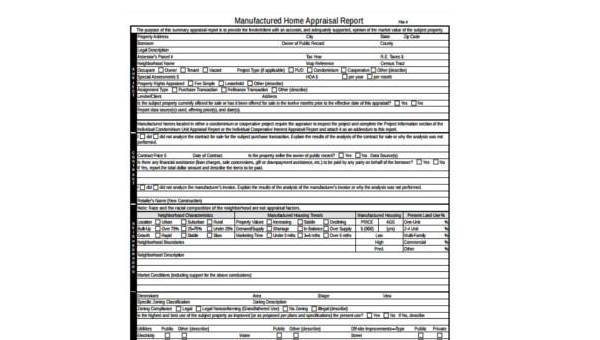

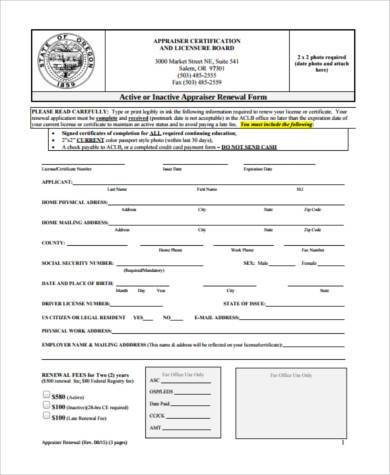

When you buy a home or refinance your lender usually requires an appraisal before they give you your loan. An appraisal is done by a state licensed professional who is trained to give an unbiased evaluation. The mortgage lender may decide you don t have enough equity to qualify for a refinancing at which time you have to pay the difference out of pocket to close the deal. An unbiased home value expert will take a look around your property or the property you want to buy during an appraisal.

Prepare your home for the best possible refinance appraisal. Still it is important to have a full understanding of the home appraisal prior to starting the process of acquiring or refinancing a mortgage. Make sure that your home s appliances and systems work and that your home s exterior looks great. To avoid this situation prepare for the appraisal and present your property in the best light.

This type of credit line allows the homeowner to dip into a maximum of 80 of their home s value without having to break their original mortgage or pay the prepayment penalty at all. A home appraisal is a valuation of your property conducted by an expert licensed appraiser assigned to your case by a bank or other lending institution generally at random based on new banking regulations. Assess your desired home s condition so you can plan ahead for necessary repairs. If your appraisal is too low you risk being denied the mortgage refinancing.

It is used to determine a fair market value for the home so mortgage lenders like us are assured the amount we are lending does not exceed the home s true value. Home seller or refinancing homeowner checklist. If your appraisal value puts your home equity at less than 20 you ll get stuck paying for private mortgage insurance pmi or having to bring some cash to the table to do a cash in refinance. How to prepare for an appraisal for refinance.

A home appraisal is a fair and impartial estimate of how much a home is worth. You would think having a good credit score is enough but going through a home appraisal checklist for refinancing could save you a lot of money and a lot of headaches as well. Home buyer appraisal checklist. What is the home appraisal.