Exercising A Call Option

In options trading when you buy to open bto or go long a call or a put option you have three choices on closing the trade.

Exercising a call option. Four reasons not to exercise an option. Exercise the call or put option early. Choices when exercising options. You may also want to exercise a call option if it was based on underlying stock that was due to pay a dividend.

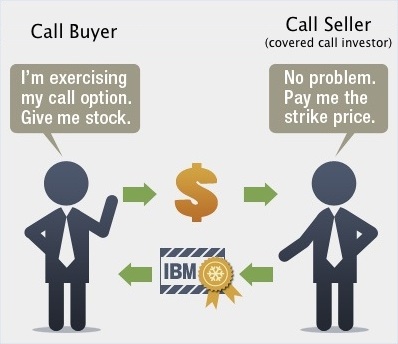

You could exercise your option buy the stock at the favorable price and then hold on to it. Sell to close stc the option again hopefully for a profit. If you re exercising a call option on the other hand you need the resources to purchase the underlying stock at the strike price. By definition if you own a call option you have the right to buy stock at the strike.

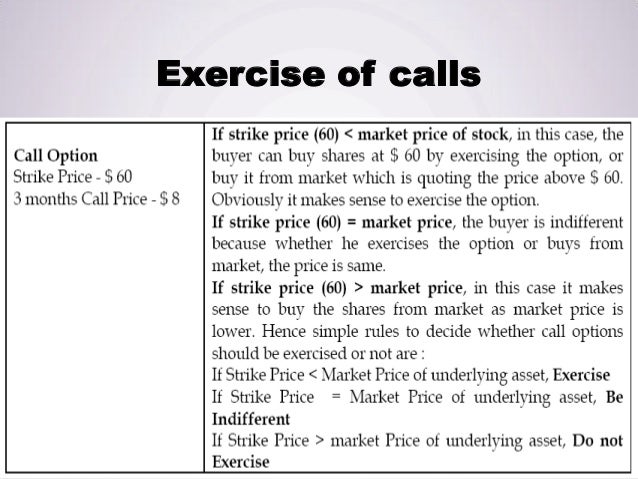

Exercising a stock option means purchasing the issuer s common stock at the price set by the option grant price regardless of the stock s price at the time you exercise the option. When you exercise a call option you would buy the underlying shares at the specified strike price before expiration. Call options can be bought and used to hedge short stock portfolios or sold to hedge against a pullback in long stock portfolios. You could exercise buy the stock receive your dividend and then either sell the stock or keep hold of it.

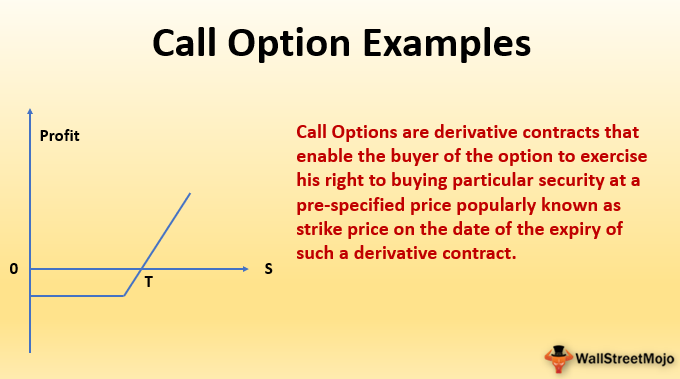

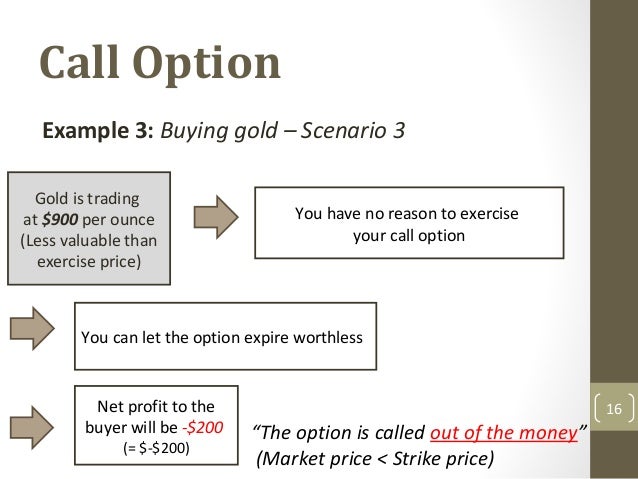

To exercise an option you simply advise your broker that you wish to exercise the. Let s consider an example of a call option on xyz corporation with a strike price of 90 an expiration in october and the stock trading for 99 per share. The holder purchases a call option with the hope that the price will rise beyond the strike price and before the expiration date. Definition of exercising options.

To exercise a put option you must first own the underlying stock. Exercising a call option allows you to buy the underlying security at a stated price within a specific timeframe. See about stock options for more information. Buying a call option.

Your broker may have its own rules about how much money you need to have in your account to exercise your options. The buyer of a call option is referred to as a holder.