Homeowners Insurance Quote Indiana

Compare quotes from top providers and save now.

Homeowners insurance quote indiana. 2 this feature applies to one claim every five years. Not available in all states. The average annual cost of home insurance in indiana is 1 000. We collected thousands of home insurance quotes from every zip code in the state of indiana.

Insurance premium saving tips in indiana. Request a indiana homeowners insurance quote. Our free online tool is designed to help you find the best deals by providing you with a list of insurers in your area. The easiest way to acquire a cheap homeowners insurance policy in indiana is to get quotes from as many homeowners insurance companies as you can.

Average cost of homeowners insurance in indiana. 1 features are optional and a part of the enhanced package. If you own a home in indiana you need the right homeowners insurance policy to protect your home in the event of the unexpected. Median home price in indiana.

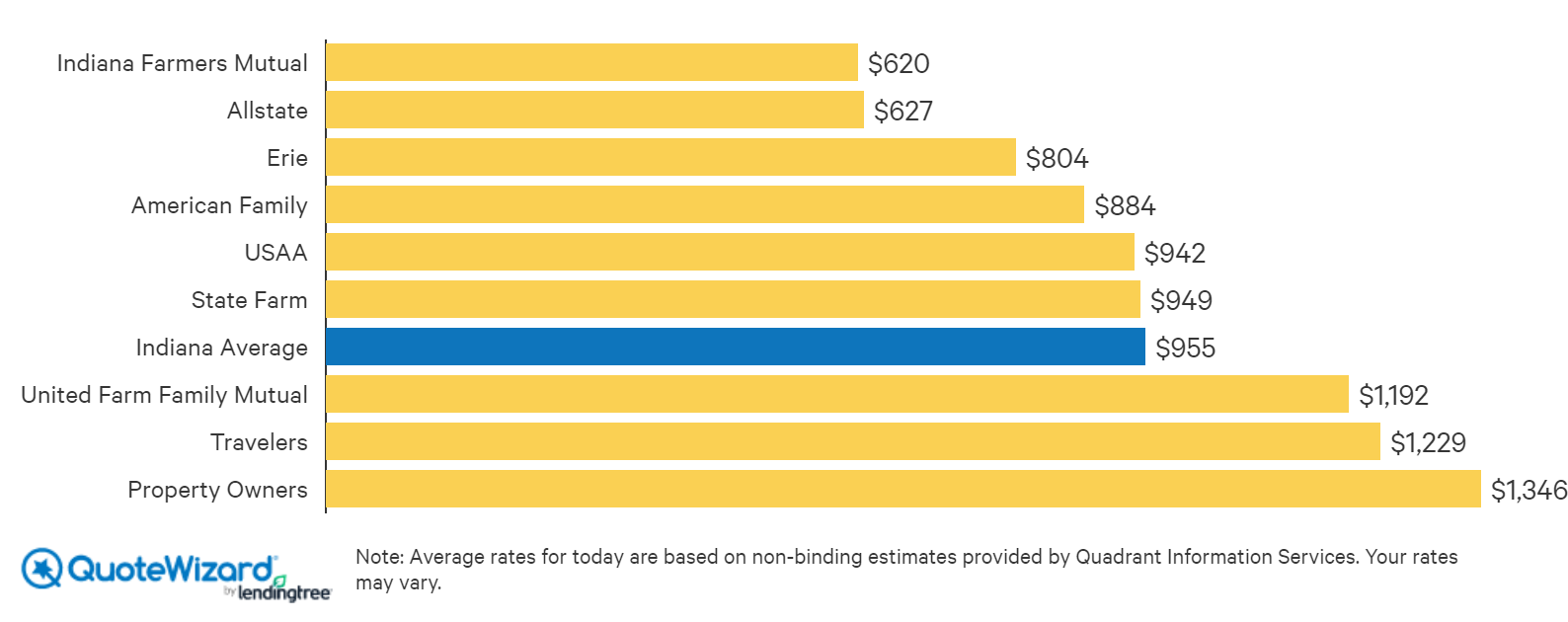

Average cost of home insurance in indiana. Our sample property is a 2 100 square foot home built in 1973 with 141 100 of dwelling coverage the state s median home value. This is down from 983 in 2015 and further down from 1 003 in 2016. Enter zipcode go average homeowners insurance in indiana.

Indiana homeowners will currently pay an average 955 per year or 79 a month in home insurance premiums. Therefore if you are a homeowner in indiana it is important to do your research find rates from different insurance providers and compare them based on the quotes and other benefits they provide. Indicates required field. Indiana homeowners might pay more or less than 1 000 depending on a number of personal factors.

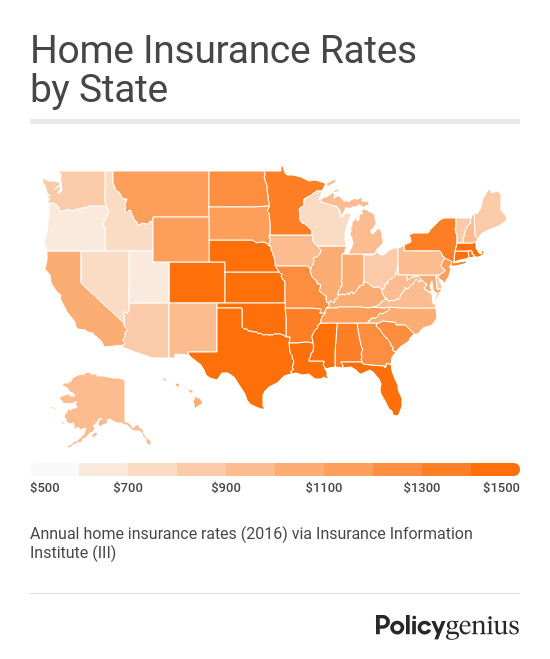

Indiana homeowners insurance rates in december 2013 stood at an average of 820 as compared to 830 in november 2013. Insurers also take a look at the frequency of claims filed in your area to assess your risk and will raise or lower your insurance quote accordingly. Enter a valid name i prefer to be contacted by. In indiana the cost of homeowners insurance is affected by weather events that can damage a structure such as thunderstorms tornadoes and hail.

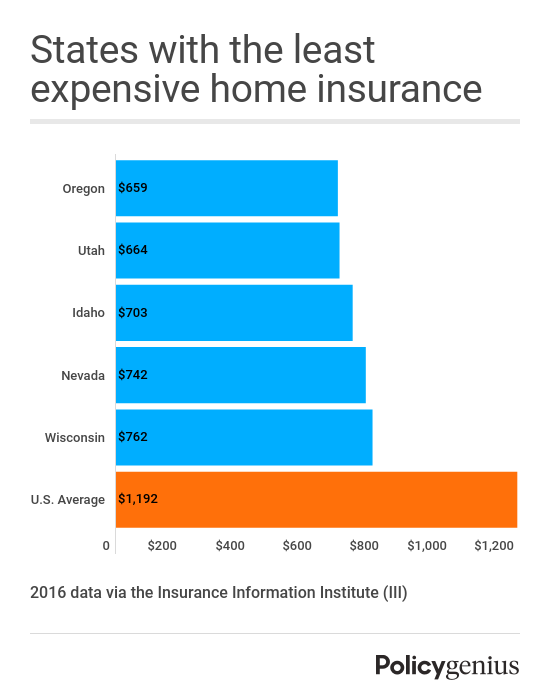

Max deductible rewards that can be used in event of a claim is. Do not respond to this field name. Home insurance policy prices by state may differ based on the number and total value of home insurance claims filed in the state and also on the value of the belongings and dwelling you re insuring. 3 must add enhanced packaged within 60 days of policy inception to earn an additional 100 reward at the 1st annual renewal.

You must select a contact preference. From fort wayne to bloomington to the ohio river indiana is a great state to put down roots.

/EarthQuakInsurance_2645855_Final_2-766403111a0d4c21bdfa1b5709a0e0b3.png)