Equity Round

Seed round equity refers to the equity accumulated during the earliest stage of funding.

Equity round. Xometry is excited to announce a 75mm round led by troweprice durable capital and arrowmark partners to continue the expansion of our on demand digital manufacturing. Funding to fuel global expansion and meet growing customer demand. Rowe price associates inc. 9 2020 prnewswire xometry the largest on demand manufacturing marketplace today announced that it has completed an 75mm equity round led by funds and accounts.

A round financing is funding that a startup receives from private equity investors or venture capitalists. 9 2020 prnewswire xometry the largest on demand manufacturing marketplace today announced that it has completed an 75mm equity round led by funds and accounts advised by t. Venture debt venture debt is effectively borrowing to raise working capital and. Rowe price associates durable capital partners and arrowmark partners.

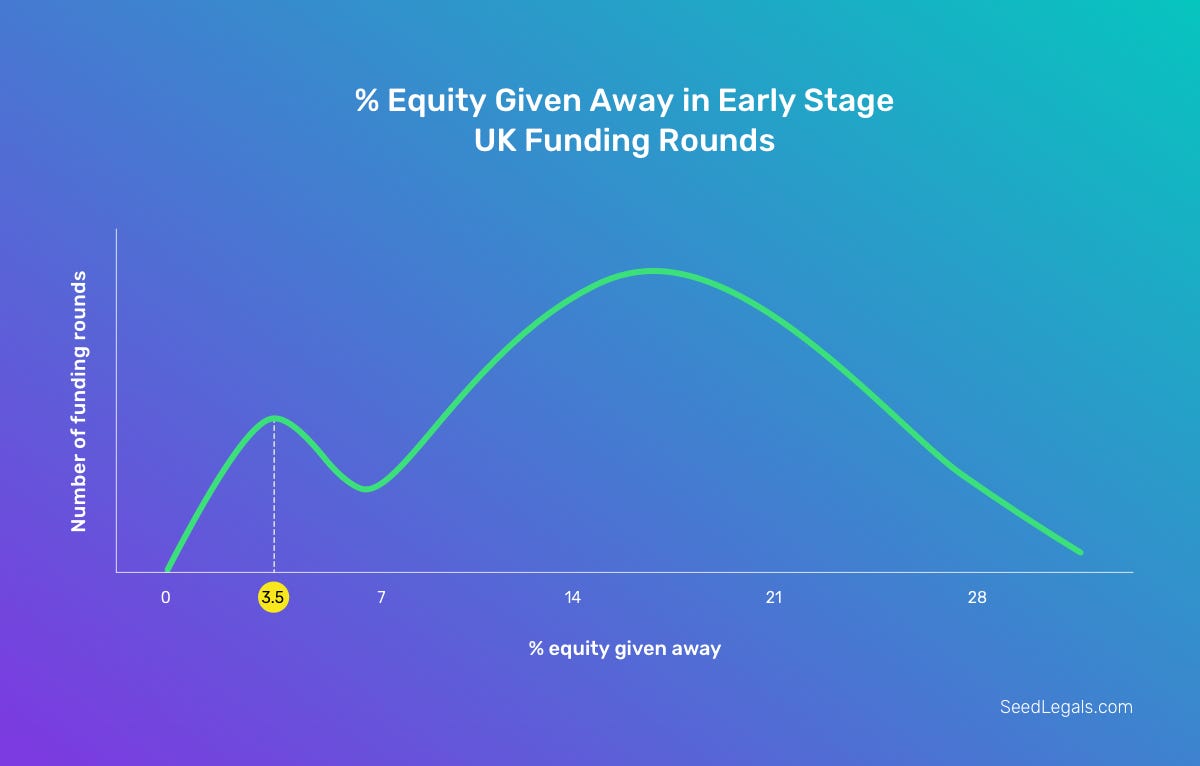

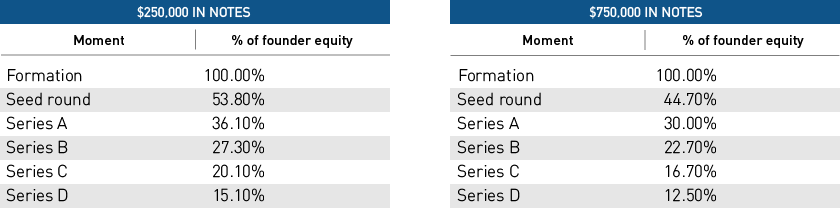

On demand manufacturing marketplace xometry announced this week that it had closed a 75 million equity round led by funds and accounts advised by t. It is normally the second stage of financing after seed capital and the first major. Usually seed rounds come from family members and angel investors which dilute the founder s ownership percentage by an average of 15 percent. 27 2020 proteantecs a leading developer of deep data solutions for electronics health performance monitoring announced today the closing of its growth equity financing round of 45m the round was led by koch disruptive technologies kdt and joined by valor equity partners and atreides management.

Qapita a singapore based startup that provides software to manage a company s equity has raised us 1 8 million in seed funding. Equity financing is the process of raising capital through the sale of shares. Durable capital partners lp and arrowmark partners also participated in the round along with previous venture and strategic investors bmw i ventures. Series b financing is the second round of financing for a business by private equity investors or venture.

6 2020 prnewswire act genomics is pleased to announce the completion of the first closing of the latest round of equity financing from a group of strategic investors including.