How Do Gold Ira Plans Work

These precious metals iras have become increasingly popular in recent years as more uncertainty grows around the health of the global economy.

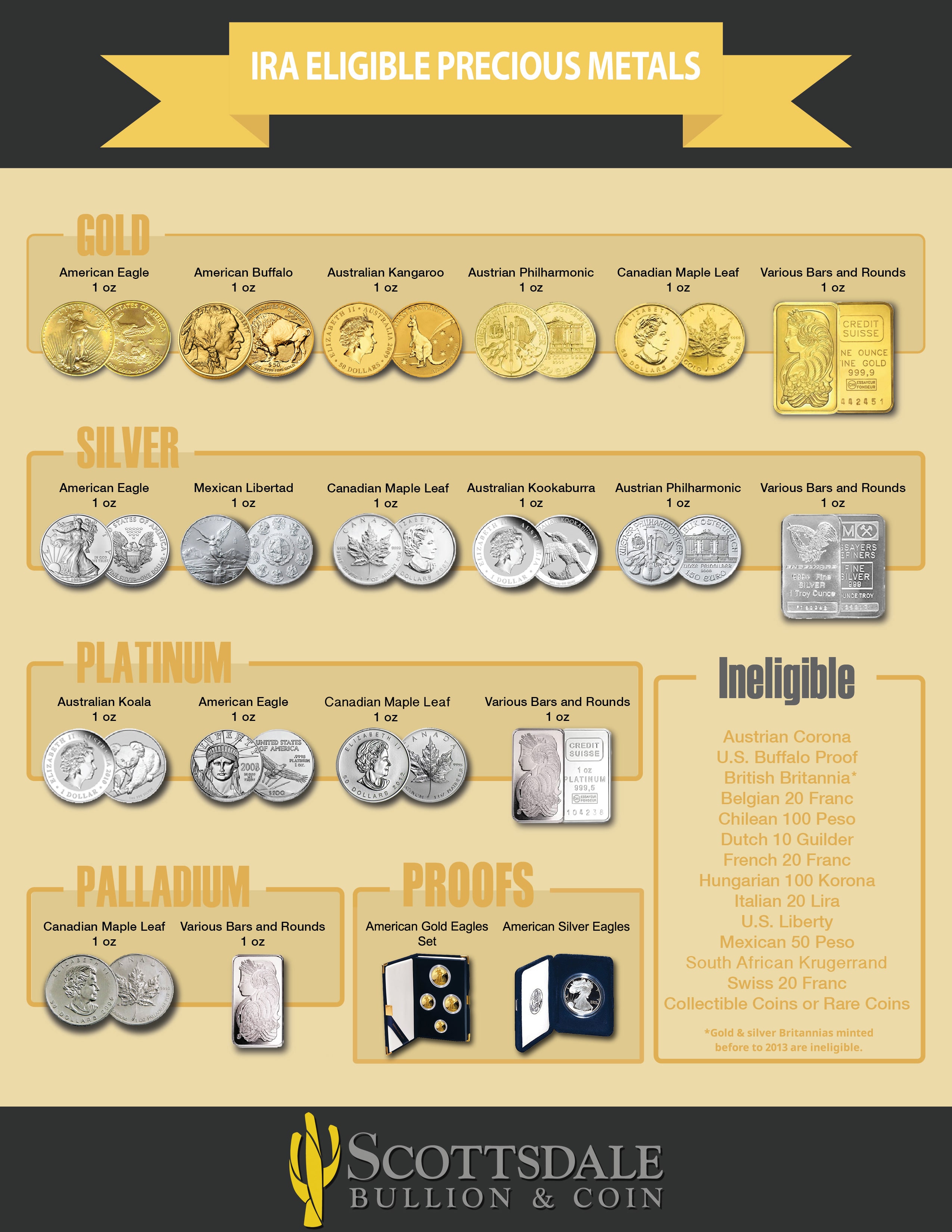

How do gold ira plans work. Gold ira plans work differently from other individual retirement accounts in how purchases are made how the assets are managed and how the account is cashed in when the owner reaches retirement age. A gold ira often comes with higher fees than a traditional or roth. Why include gold in your retirement plan. Rolling over current retirement savings is an easy hassle free way to diversify retirement savings from fluctuations in the market.

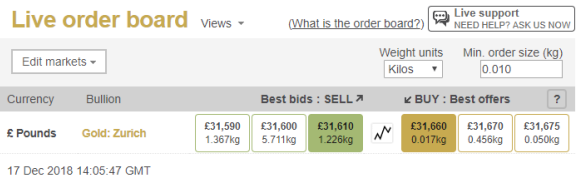

Gold and silver iras offer a unique alternative to conventional retirement plans by enabling you to add precious metals including gold coins silver platinum and palladium. The vast majority of 401 k plans do not allow individuals to directly invest in physical gold although gold iras do exist that specialize in holding precious metals for retirement savings. Do yourself a favor download this guide right now and see if a self directed gold ira makes sense for you. Gold ira rollovers are an ideal option for investors who have conventional retirement accounts as well as company owned pension plans and 401 k or roth traditional thrift savings or beneficiary ira accounts.

A gold ira is a self directed individual retirement account that invests in physical gold as well as in other precious metals. People have been fascinated by the allure of gold since the dawn of civilization and it can play a role in your retirement plan too. Contact your ira custodian and inform him that you would like to add gold to your ira. If your current custodian has little experience with gold based iras or doesn t offer precious metals.

We invite you to put our forty plus years experience in the gold business to work for you. The rationale for gold ownership within a retirement plan is the same as it is outside the plan. Additional qualified accounts typically include traditional ira roth ira sep ira simple ira tsp thrift savings plan 401 k 403 b 457 b pension plan or tax sheltered annuity. Ira new precious metals account or rollover.

/GettyImages-145158250_1800-76bf33b0d4a44f569a19ff048431831c-361ae2deabdf4ccf9f11183360d1cc26.png)

/gold-bullion--illustration-545864059-d362cfe06c4542bcb12690722a1f3279.jpg)

/GettyImages-174072047-4ca848d55c1a4c26a799fa60ad80b32e.jpg)