How Do I Apply For A Business Credit Card

The best practice is to keep business and personal expenses separate use a business card for business expenses and a personal credit card for personal expenses.

How do i apply for a business credit card. Most business credit cards won t appear on your personal credit report including chase business cards so they don t add to your chase 5 24 count. However while some credit card issuers don t report business credit card activity to consumer credit bureaus others do. But once you have a business card that line of credit will be separate from your personal one so actions on a business account generally won t affect your personal score unless you default on payments of course. It s not essential the business be profitable.

The application requirements are different the credit limits are usually higher and the legal protections that consumer credit cards provide do not apply. Applying for a business credit card when you re just starting out can make you feel more official. You should wait at least 30 days before trying again. If it s set up to make money by selling something or performing a service where others pay you you can apply for a business credit card.

Finally business credit cards are a vital part of a healthy miles and points strategy so if you ve been on the fence about getting one take another look at where you make money outside of your normal day job and see if you might qualify. It s a little different than applying for a. First of all don t apply for another credit card right away as this is likely to harm your credit rating. There are some important dos and don ts if you re turned down for a credit card.

More purchasing power having a separate business credit card will mean that you have more credit for business expenses also business credit cards tend to give higher credit lines than personal cards. Applying for a business card will also result in a hard pull on your credit report and banks will look at your personal credit score when considering you for a business card. What you need to apply. So why get a business credit card.

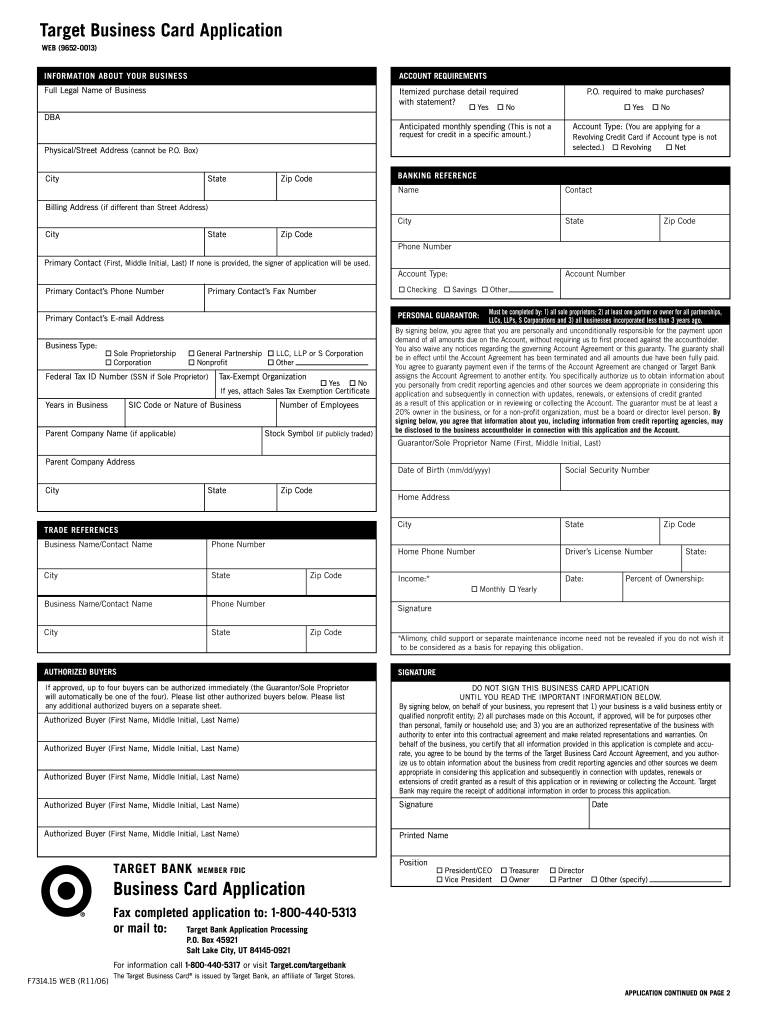

You may qualify for a business card even if you think you don t basically if you ve sold something in the past year or so that may be counted as business revenue. The best thing to do is read the response letter or email you were sent. Business credit cards are similar to personal credit cards in many ways but there are a few key differences. Applying for a business credit card is pretty much the same as applying for a personal card except you also have to provide information about your business.

Here comes the fun part. You can apply and get approved for as many small business credit cards as you want without worrying about going over the limit of 5 new accounts in 24 months.