Home Equity Loan Forms

Apply online by clicking the appropriate link below call us at 1 888 842 6328 or visit a branch.

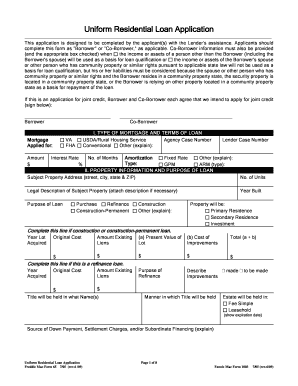

Home equity loan forms. Federal law requires financial institutions to obtain sufficient information to verify your identity. No form 1098 for my home equity line of credit as stated you can enter the information that you have with the interest if you did not receive a 1098. Print this loan application and gather the information you ll need. Personal banking business banking.

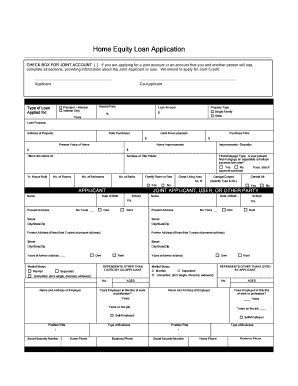

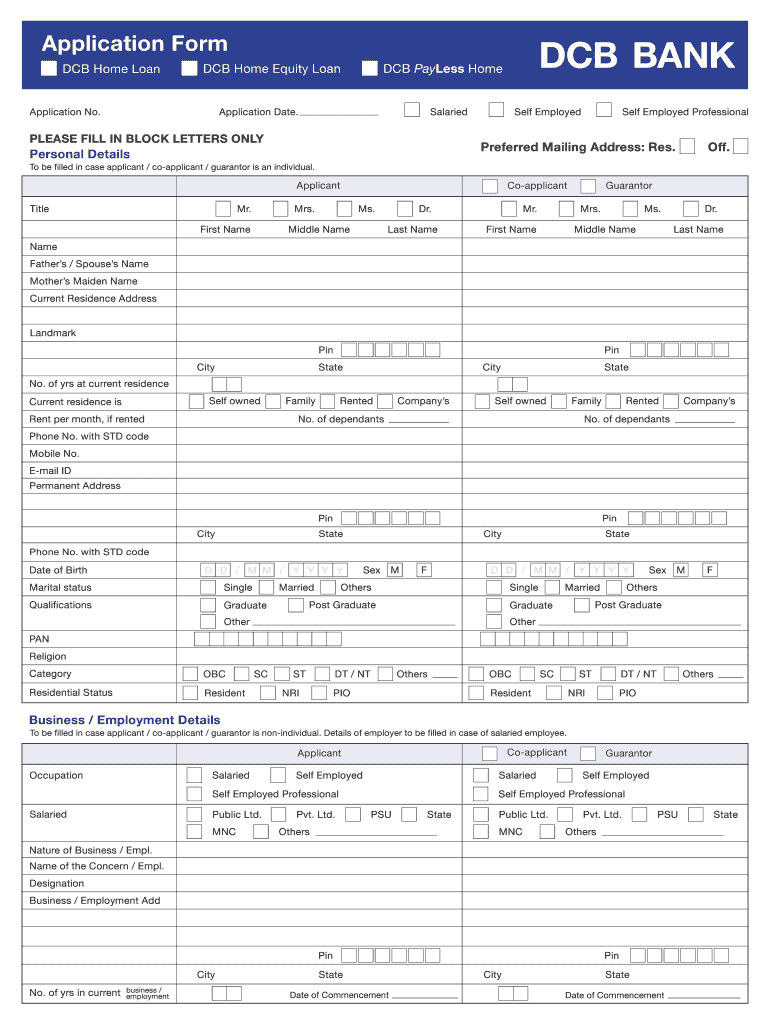

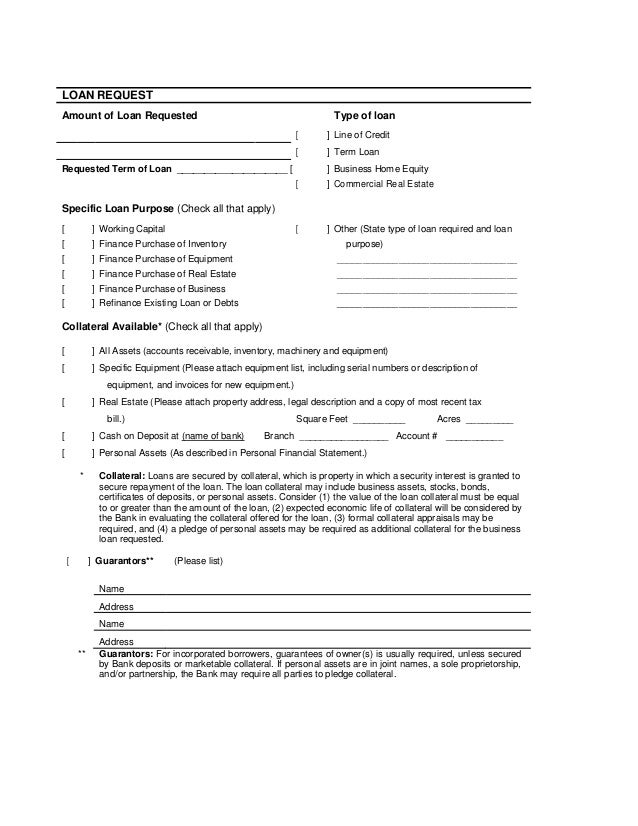

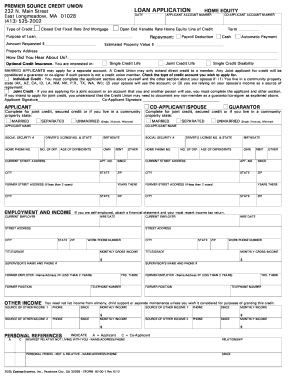

Home equity loan application join the conversation. This loan application is for personal loans only and is not intended for commercial use. A processor will be assigned to review your application and will contact you within a few days to discuss the details. Home equity loan application please type or print important applicant information.

Sign up for our newsletter. Provident bank 239 washington avenue jersey city nj 07302. Home equity lines are also available for 2 4 family homes that are primary residences excluding texas. The line of credit has a draw period of 10 years plus 1 month after which you will no longer have access to borrow funds and will be required to repay the borrowed balance within a 20 year term.

The following is a brief list of information you may need to obtain to complete your home equity loan application quickly. You may be asked several questions and to provide one or more forms of identification to fulfill this requirement. A home equity line or loan is available for single family residential properties including co ops in new york illinois district of columbia new jersey and maryland. Fixed rate equity loan home equity line of credit.

Use our branch locator to find your closest provident bank location. Complete your home equity application. There is a required minimum monthly payment of 100. To make completing the home equity loan application process as easy as possible you should gather all of your financial information and required documentation in advance.

Complete application on line and click submit application or fax it to 715 394 2791. Complete and submit your application. As a reminder some citi home equity products have eligibility requirements. The account is subject to application credit qualification and income verification.

Since a heloc is secured by the equity in your home your interest rate may be lower than many unsecured types of credit. Additional evaluation and verification criteria may apply. However if the information is inaccurate then you may have to file an amended tax return since all tax documents are filed with the irs. To apply for a home equity line or loan you ll first complete an application including information about yourself your finances and your home.