Fha Loan Foreclosure Waiting Period

The three year clock starts ticking from the time that the foreclosure case has ended usually from the date that your prior home was sold in the foreclosure proceeding.

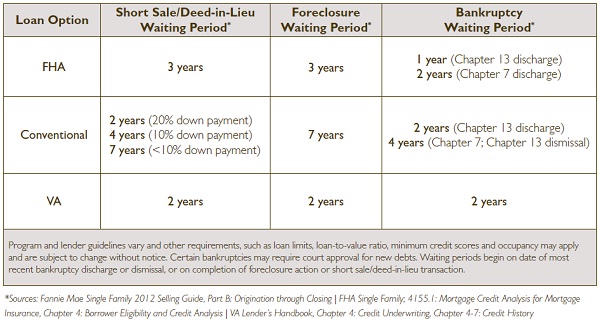

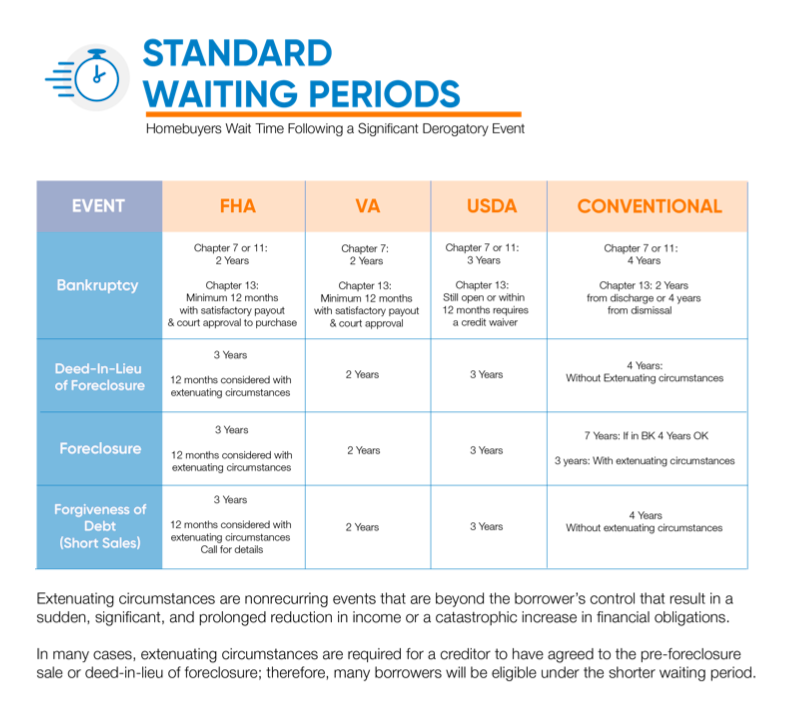

Fha loan foreclosure waiting period. The three year rule mentioned above confuses some potential fha borrowers because they don t know when the three year period begins according to fha guidelines. Fha considers the bankruptcy and the foreclosure as two separate hardships with two separate waiting periods. But there are exceptions for documented extenuating circumstances. There is a three year waiting period after the recorded date or the date of the sheriff s sale of a foreclosure and or deed in lieu of foreclosure to qualify for fha home loans.

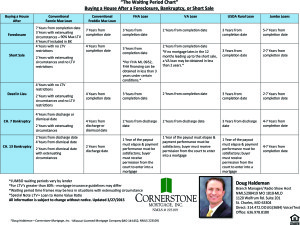

As with chapter 13 bankruptcy fha regulations demand a full explanation to be submitted with the fha home loan application. This is possible if the borrower can show that the bankruptcy was the result of extenuating circumstances beyond the borrower s control. The fannie mae general foreclosure waiting period is 7 years from deed transfer. The fha is contemplating new looser mortgage guidelines that would waive its standard waiting period after a significant derogatory credit event.

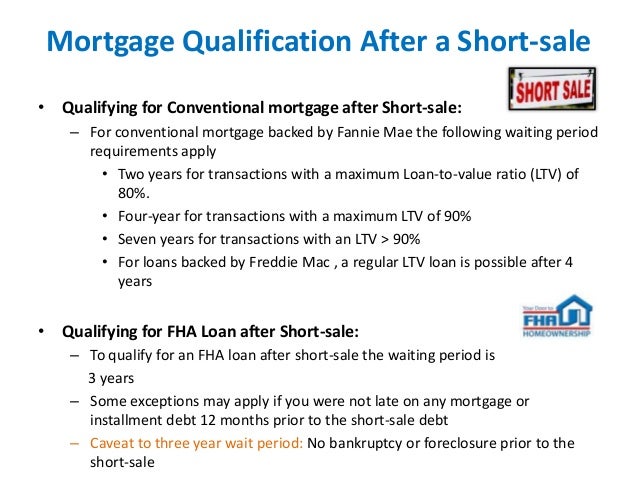

Fha loans are the most forgiving of foreclosures. As mentioned above all borrowers must wait least two years after the discharge date of a chapter 7 bankruptcy. In some cases the waiting period for getting an fha loan after bankruptcy can be shorter than two years but not less than 12 months. There is a three year waiting period to qualify for an fha loan from the date of a short sale.

There is a 2 year waiting period from the discharge of the bankruptcy and there is a separate 3 year waiting period after a foreclosure. To qualify for an fha mortgage loan you must wait at least three years after the foreclosure. There is a three year waiting period from the date of a mortgage charge off and or second mortgage charge off to qualify for an fha loan. This period often called a seasoning period or seasoning requirement is normally three years.

If there are extenuating circumstances and between 3 7 years from foreclosure date there are additional guidelines. The discharge date should not be confused with the date bankruptcy was filed. Home buyers with recent bankruptcy foreclosure. This mandatory three year waiting period again with certain exceptions mentioned below does not start when foreclosure proceedings are initiated.