Errors And Omissions Insurance Policies

These liability policies are not different terms for the same type of.

Errors and omissions insurance policies. Errors and omissions insurance e o. Protect your business from costly mistakes. Rice insurance services company risc specializes in mandated real estate errors omissions insurance risc provides policies in colorado iowa idaho kentucky louisiana mississippi nebraska new mexico north dakota rhode island south dakota and tennessee. Errors and omissions insurance e o is a type of professional liability insurance that protects companies and their workers or individuals against claims.

Errors omissions e o insurance is professional liability insurance that protects businesses and individuals against claims made for inadequate work or negligent actions. But their coverage differs drastically from other liability policies such as general liability insurance and employment practices liability insurance. As a professional operating in today s increasingly litigious environment you could easily be subject to allegations by unhappy clients who may feel they ve been harmed by your actions or inactions. It protects your business against claims arising from your negligent acts or your failure to provide the level of advice or service the plaintiff expected.

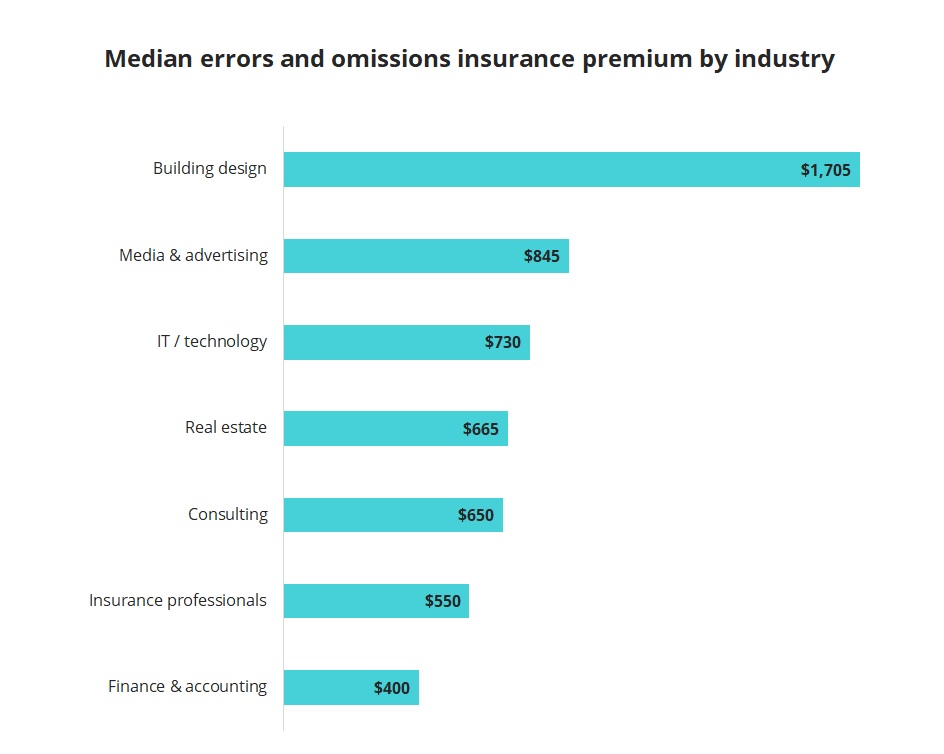

Who needs e o insurance. Errors and omissions e o insurance which may exclude negligent acts other than errors and omissions mistakes is most often used by consultants and brokers and agents of various sorts including notaries public real estate brokers insurance agents themselves appraisers management consultants and information technology service providers there are specific e o policies for software. Most errors and omissions policies are claims made. Errors and omissions insurance policies vary from company to company and are written to reflect inherent risks and common exposures particular to different types of businesses.

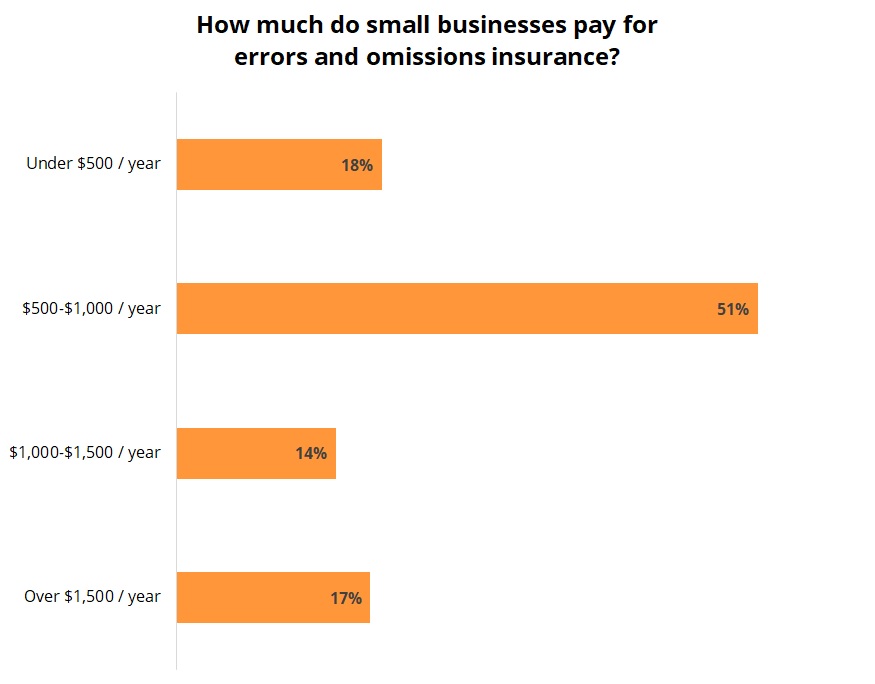

Errors and omissions insurance also known as e o insurance and professional liability insurance helps protect you from lawsuits claiming you made a mistake in your professional services this insurance can help cover your court costs or settlements which can be very costly for your business to pay on its own. Errors and omissions e o insurance is a type of commercial liability coverage. Generally any business which offers advice or provides a service needs an errors and omissions policy. Even if claims are found to be unwarranted legal fees and other related expenses can quickly eat up a company s cash reserves in no time causing a financial hardship.

Errors and omissions insurance e o often referred to as professional liability insurance protects your business in the event you re found legally liable for faulty advice or negligence related to a professional service. The insurance carrier for our programs is continental casualty company a cna insurance company rated a excellent by a m.

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)