General Liability Insurance California Small Business

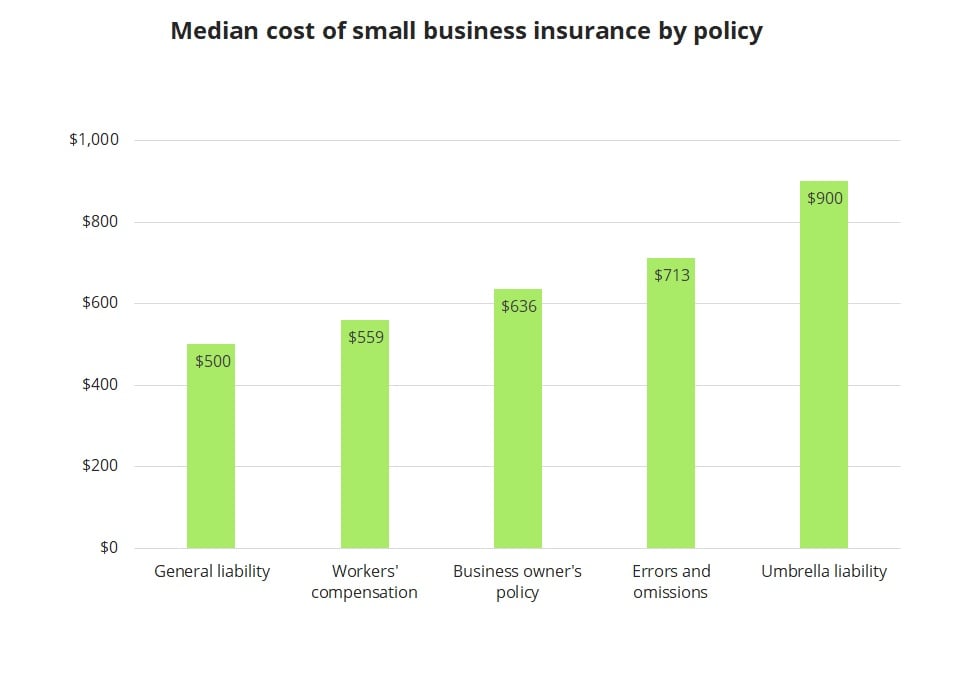

While each small business is unique insurance carriers have recommended that small businesses in california carry at least 500 000 1 000 000 in commercial liability insurance to cover bodily injury personal injury advertising injury and legal defense and judgments.

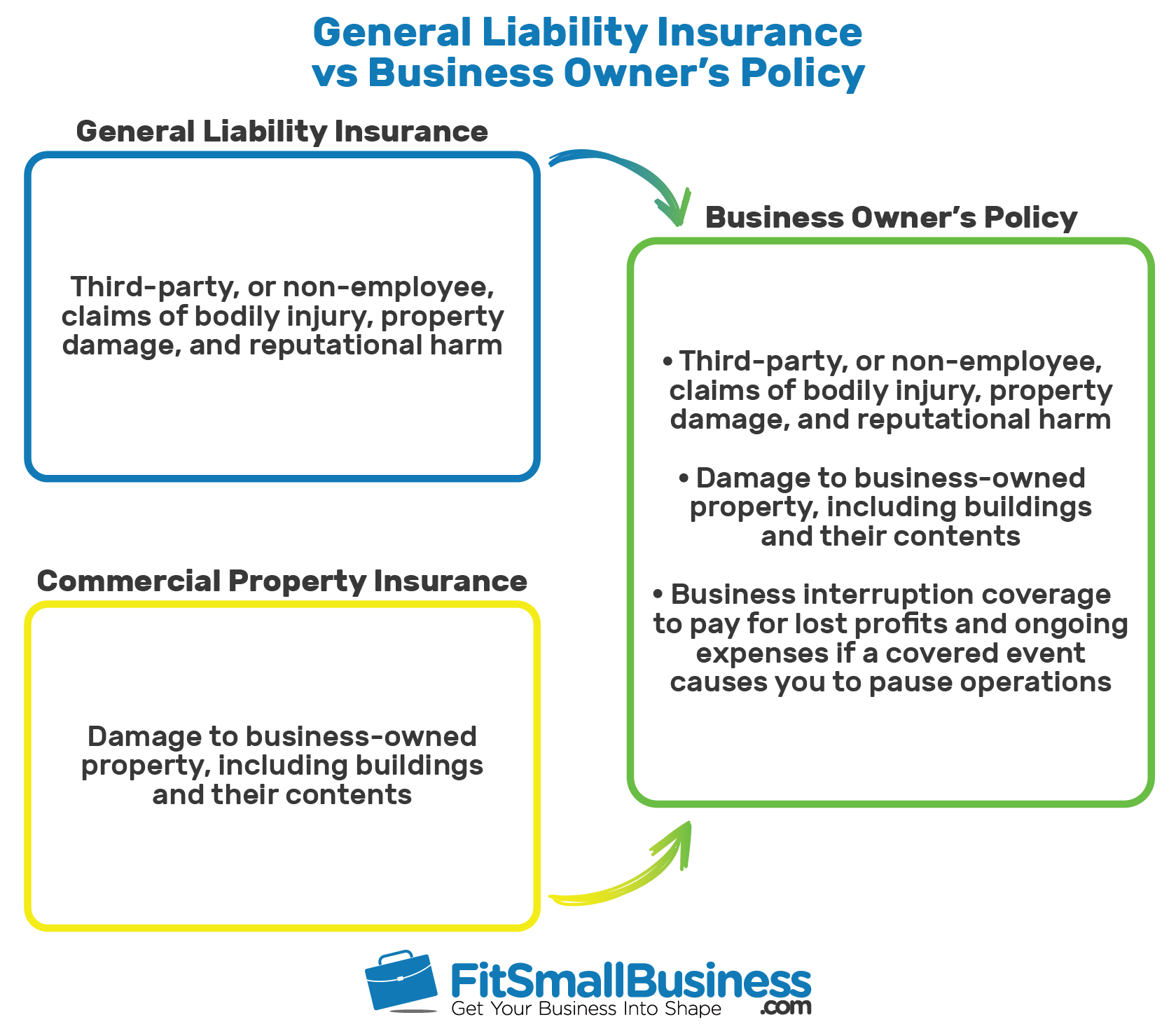

General liability insurance california small business. Learn about california small business insurance requirements costs and coverages including. A bop is often used to provide coverage for small businesses that want to also protect business equipment that can be damaged in a fire theft or another disaster. Each situation is unique but as a general guideline the type of business you operate or products you manufacture should determine how much california commercial liability insurance you need. A good rule of thumb for most small businesses is between 500 000 and 1 million.

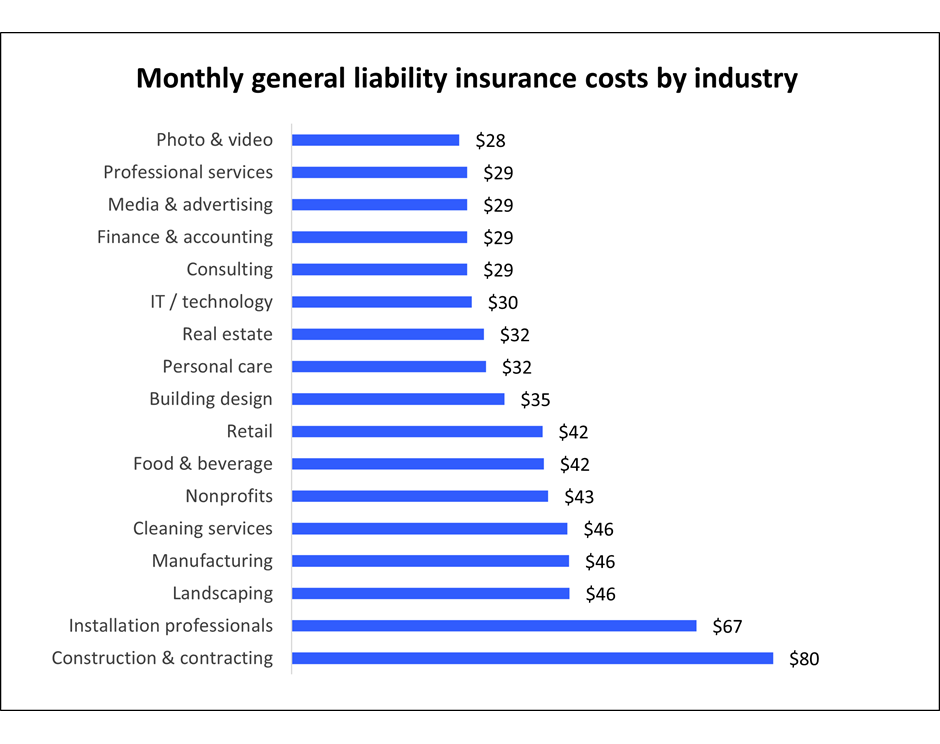

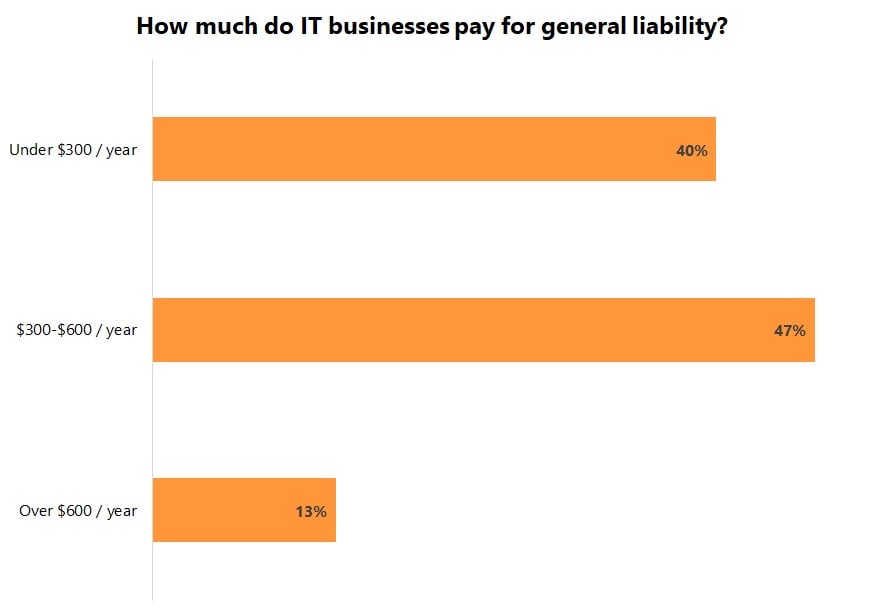

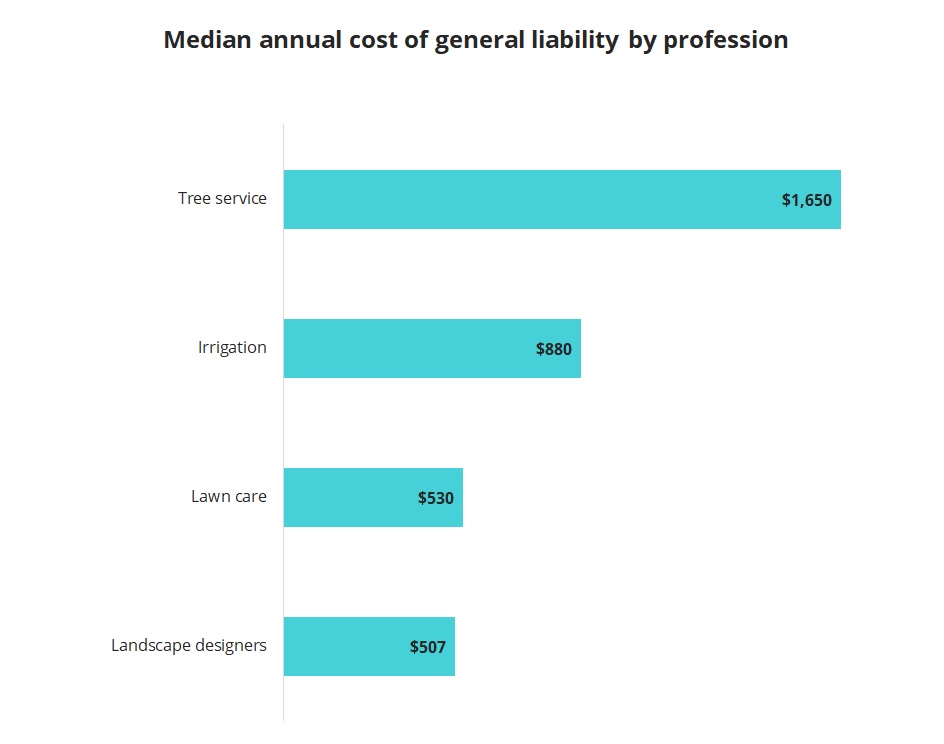

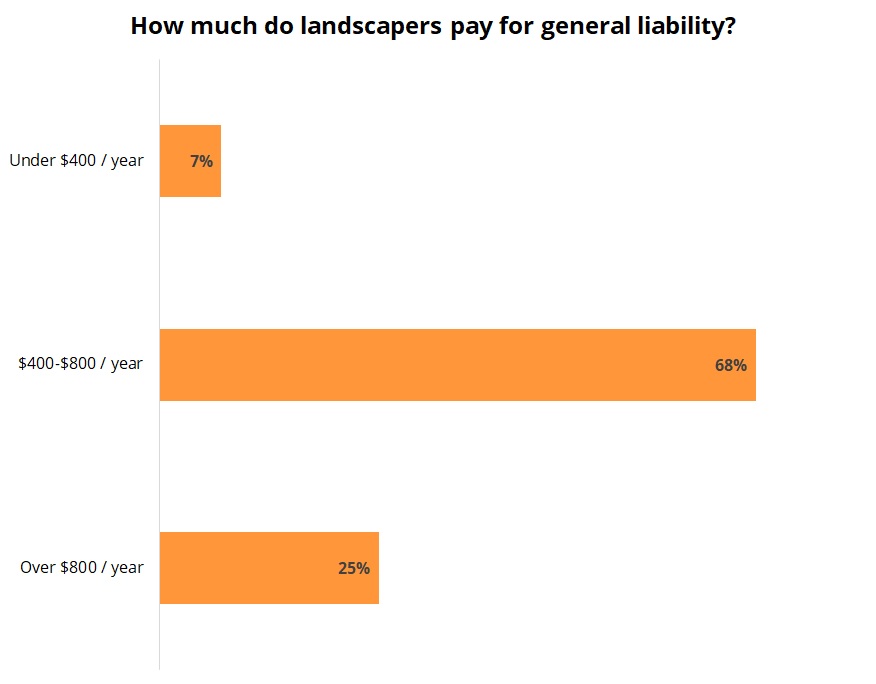

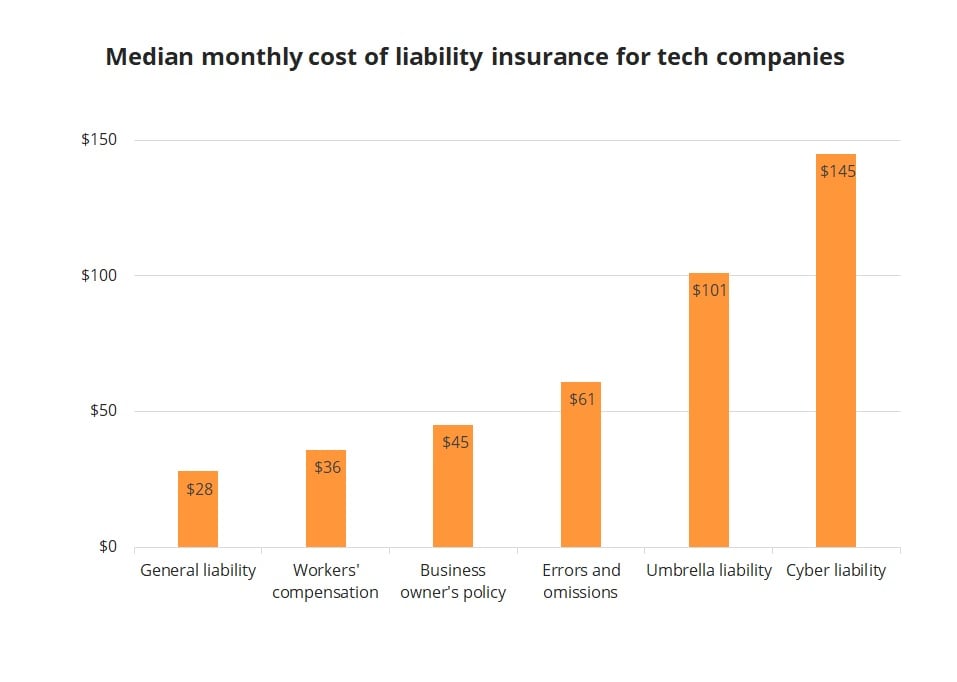

Though it s not required personal vehicles driven for work purposes should be covered by hired and non owned auto. California general liability insurance provides important protection against claims of property damage bodily injury and advertising injury. A typical small business in california can expect to pay anywhere between 300 and 5 000 annually for their general liability policy. All business owned vehicles in california must be covered by commercial auto insurance.

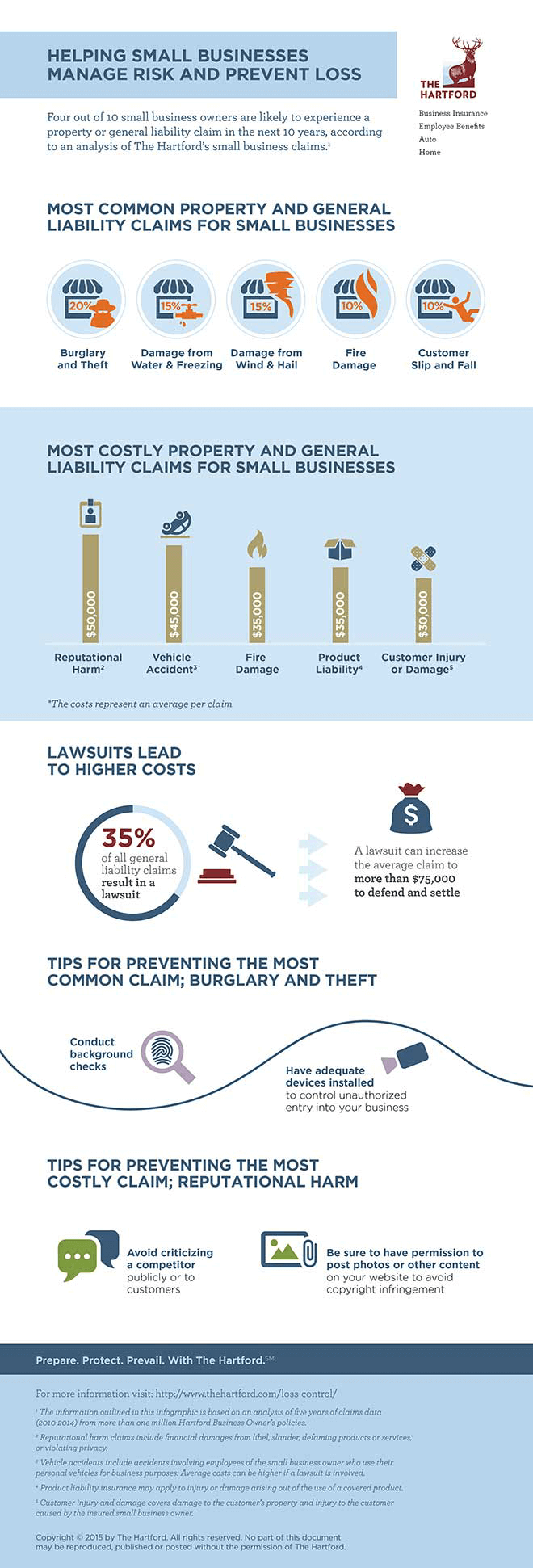

Without this essential coverage your business could be at risk. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. The final cost of liability coverage from one business to the next will vary significantly based on the sic code or the insurance company s own classification system for gl rating. Commercial general liability commercial property insurance ca workers compensation business owner s policy bop errors omissions professional liability ca commercial auto insurance and more.

A business owner s policy bop combines business property insurance and business liability insurance into one policy. Lawsuits against businesses are both common and expensive. To be sure about your specific business needs be sure to consult with a qualified business insurance agent. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries.

Protect your business with the cheapest general liability insurance small business. Here are some general liability insurance coverage rules of thumb.