Get Liability Insurance For Business

Employers liability cover is to protect you against legal costs if an employee is injured gets ill or their property gets damaged as a result of your business.

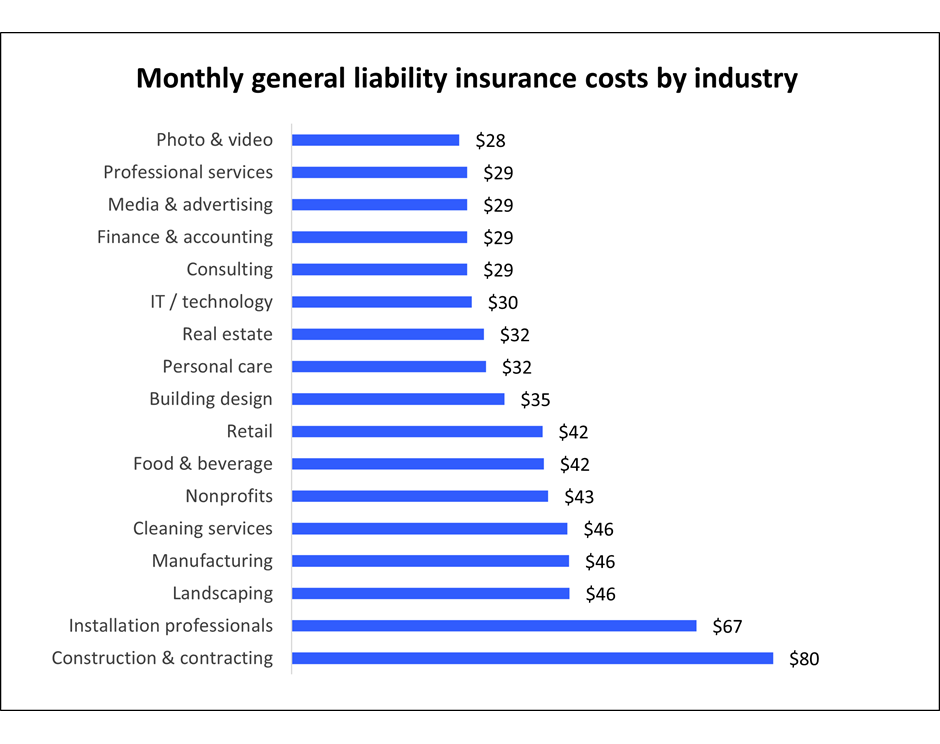

Get liability insurance for business. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations. General liability insurance costs vs average claim costs. General liability insurance helps cover your business from the cost of some of the most common liability claims this includes bodily injury to a third party damage to another s property and advertising liability claims. This coverage is also known as commercial liability and business liability insurance.

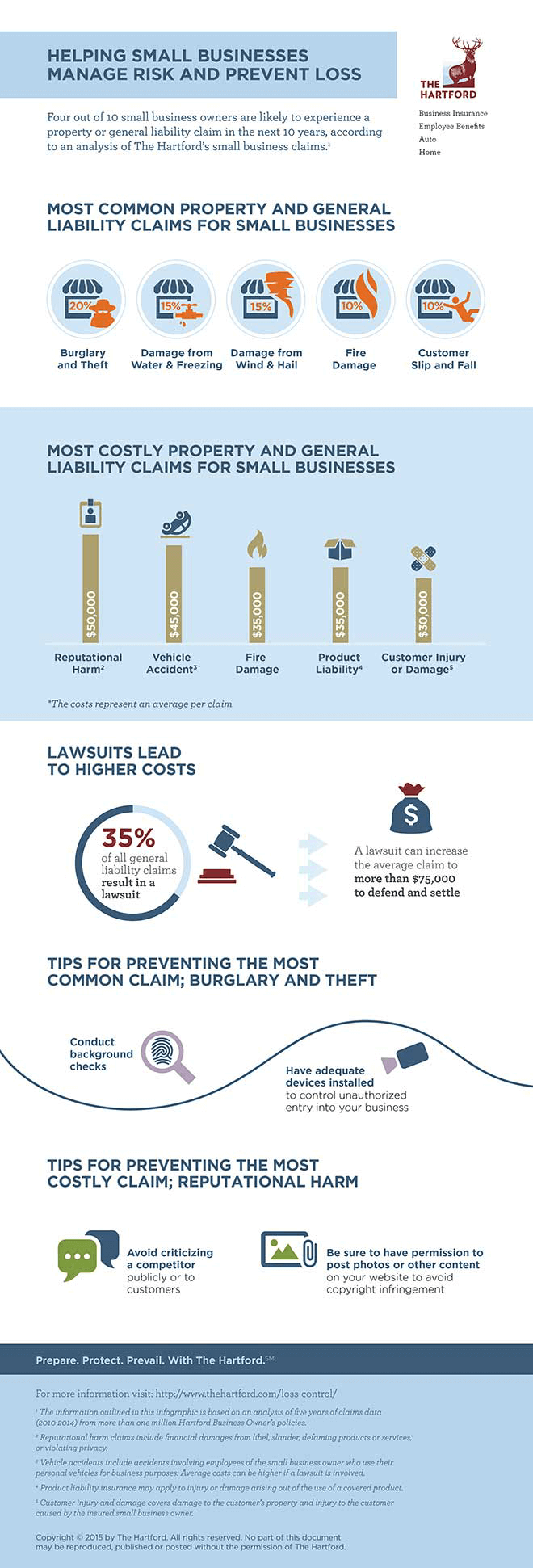

Aside from public liability insurance you can also find other types of cover for your business. Accidents natural disasters and lawsuits could run you out of business if you re not protected with the right insurance. However insurance requirements vary from state to state for different types of businesses. Business liability insurance protects a company s assets and pays for legal obligations such as medical costs incurred by a customer who gets hurt on store property as well as any on the job.

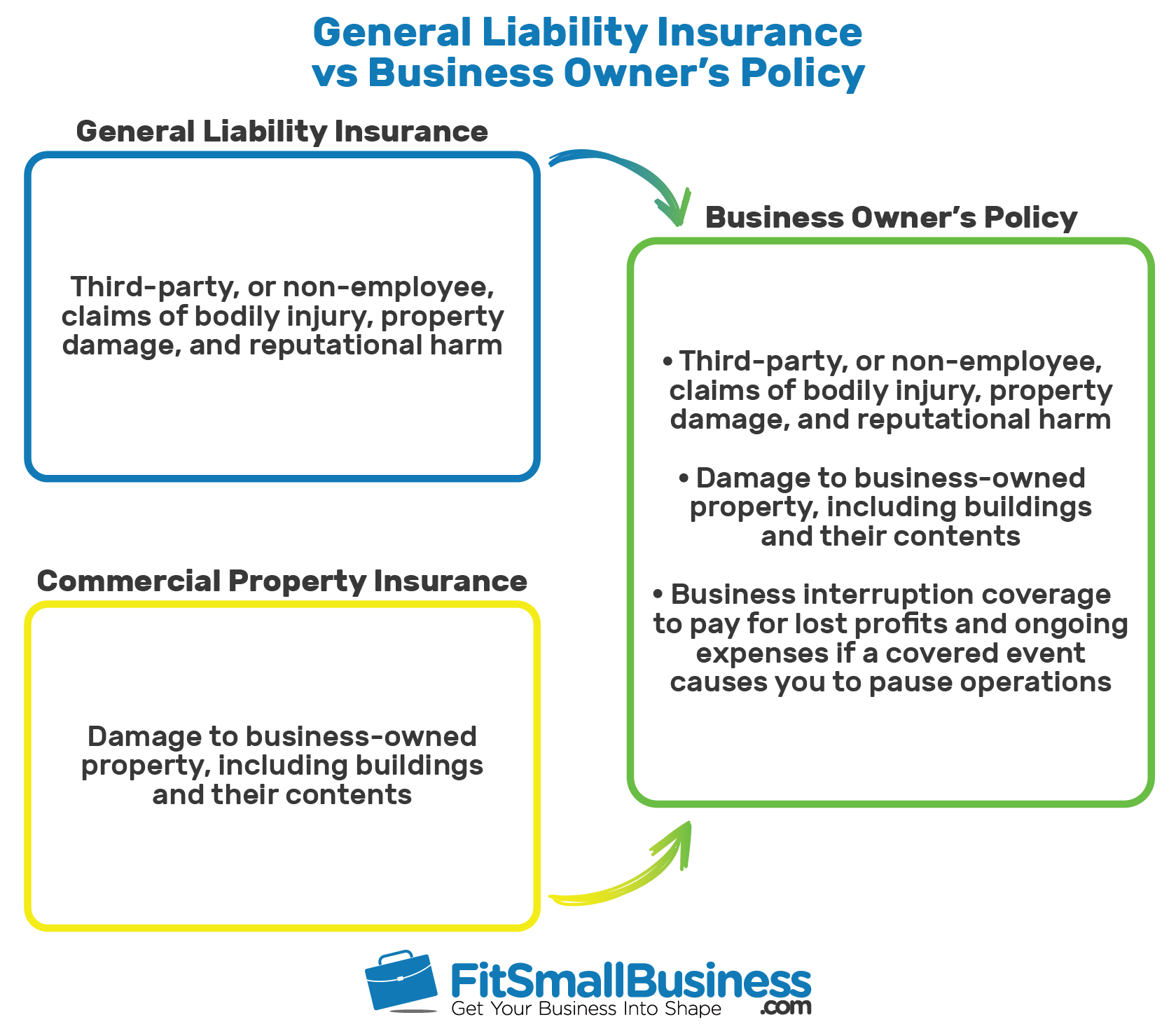

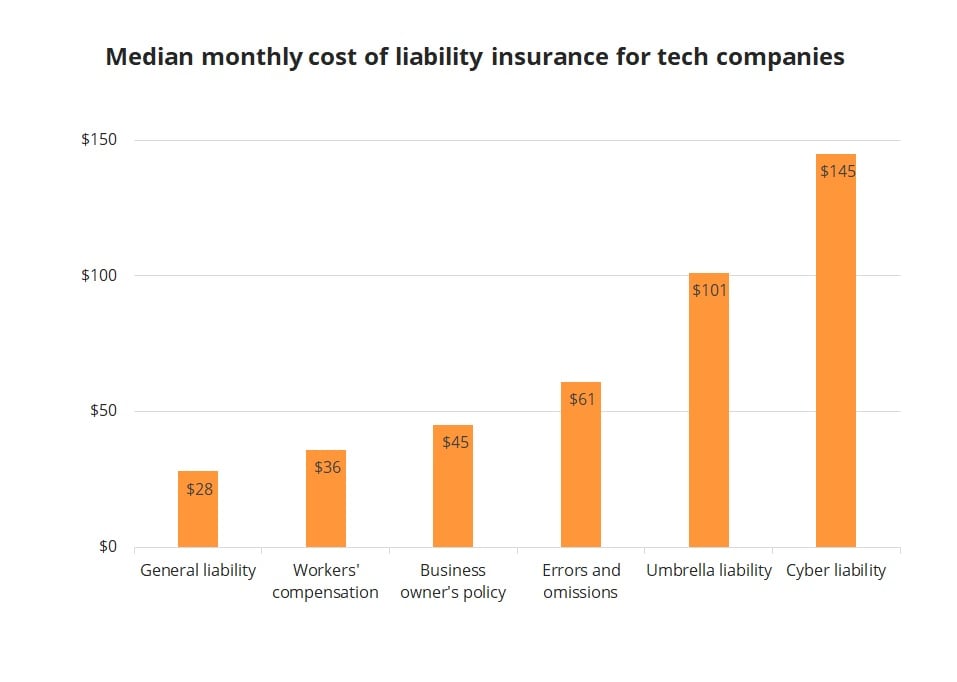

Business liability insurance is typically a part of a bop. General liability insurance is often packaged with commercial property insurance in a business owners policy bop but it s also available mono line to contractors and other specialty businesses. As a contractor or small business owner you need some form of business liability insurance to safeguard your livelihood. Business liability insurance can provide your business with coverage against claims resulting from property damage accidents and bodily injury.

Why get small business liability insurance from the hartford. It s legally required if your business employs others. That s why it s best for small business owners to work with licensed insurance carriers like the hartford. General liability insurance quotes usually include.

This insurance policy protects you and your business when third parties usually customers or vendors are injured on your commercial property. General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees. Business insurance protects you from the unexpected costs of running a business.