Getting A Small Business Credit Card

Pay your bills on time.

Getting a small business credit card. A seemingly foreign and exotic world to many small business people. You don t need an established business credit history to qualify. We all understand how to get and build personal credit. Plus earn an additional 100 statement credit after you spend 3 000 on.

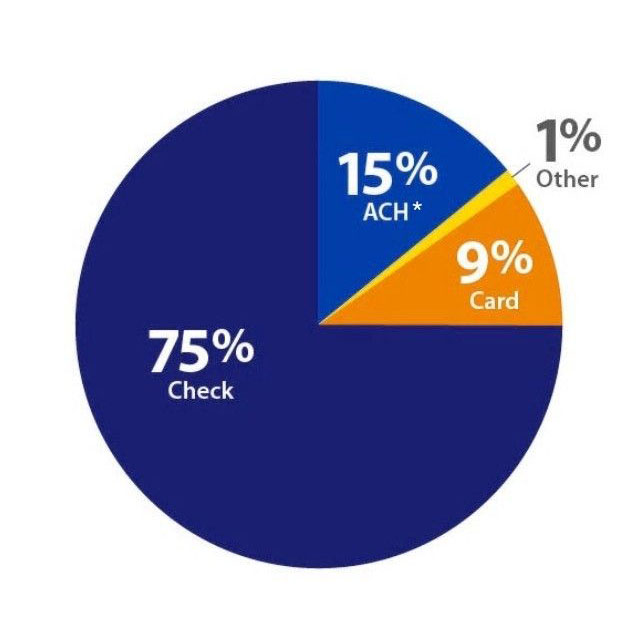

Don t have too much debt. Issuers usually look at your personal credit. Small business credit cards aren t just for people with storefronts or offices. This will however depend on the type of business credit card you choose.

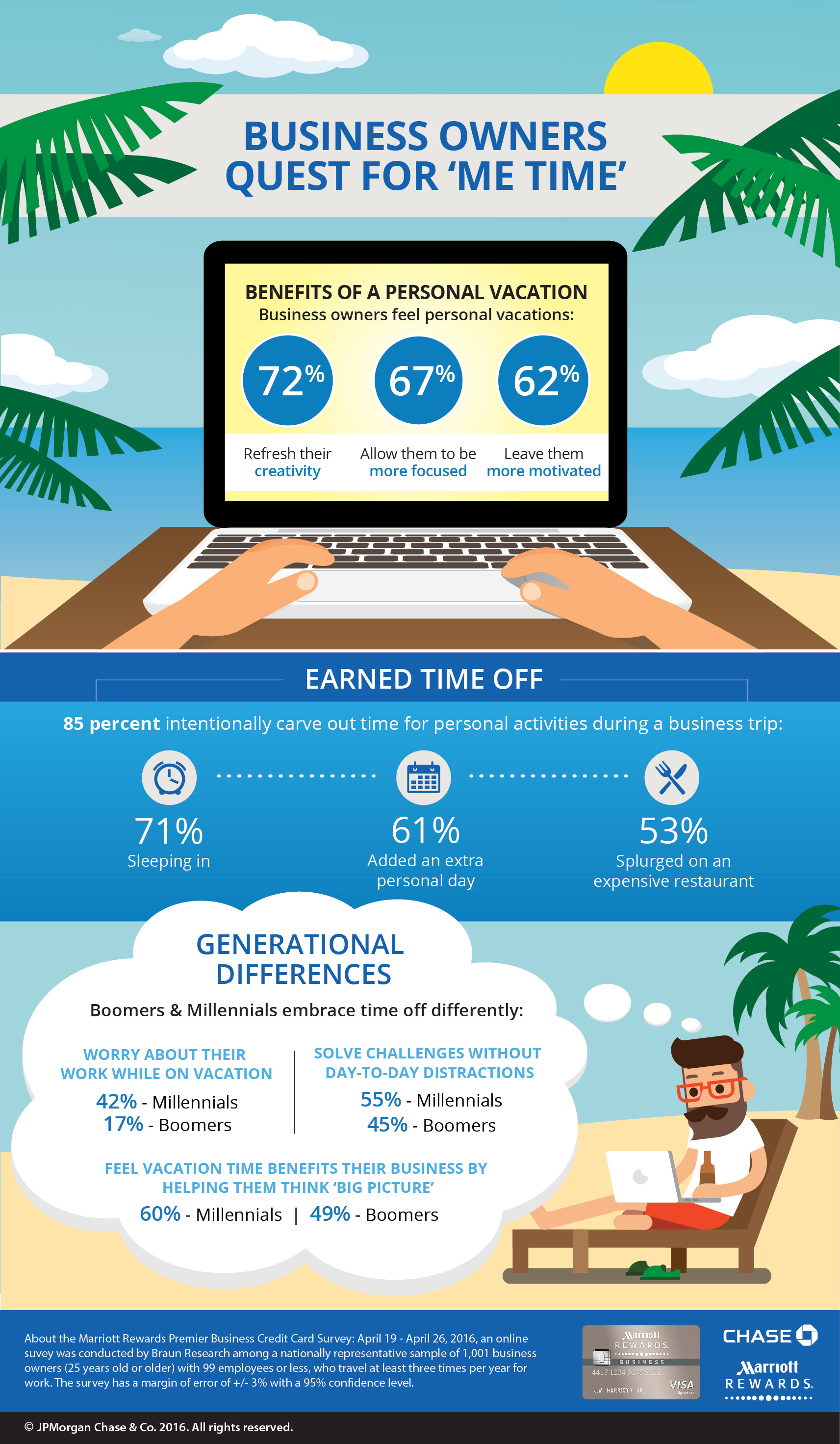

Getting a small business credit card is a great way to earn extra points and miles for your next big trip. The small business credit cards for fair credit have excellent features you can take advantage of while you improve your credit. That often seems like a mystery for many small businesses. If you re a small business owner a credit card could help keep your business finances straight save on interest and insurance and give you valuable rewards.

If you re a freelancer have a side hustle or do gig work you may be a candidate for a small business credit card. Plus business cards can have higher credit limits than personal credit cards and in most cases the activity on a business card won t affect your personal credit report although if you default. Therefore if you travel often plan on getting employee cards and want extra perks it might be worth paying a 95 annual fee. Getting a credit card for a new business or startup.

On the other hand if you d prefer to have a business credit card with no annual fee there are many options as well including cards with great benefits in fact the amex blue business plus card we discussed above has no annual fee in addition to the 12 month 0. We ve listed 5 of our favourites so you can arm yourself with the best. With the incredible sign up bonuses and bonus earning categories there is no question that you should significantly consider getting a credit card for your small business.