Federal Income Tax Taken Out Of Paycheck

If you notice your employer doesn t take federal taxes out of your paycheck there are some things you can do to correct the situation if necessary.

Federal income tax taken out of paycheck. States impose their own income tax on top of federal income taxes. Uncle sam will always get its cut of the action using the irs to collect whenever people happen to earn. Hopefully this article helped to explain why no federal income tax was withheld from your paycheck. Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Additionally electing additional federal income tax to be withheld from each paycheck on the w 4 increases the withholding amount. You must deposit your withholdings. Overview of texas taxes texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in texas. While you don t have to pay social security or medicare taxes typically about a combined 7 65 rate while receiving.

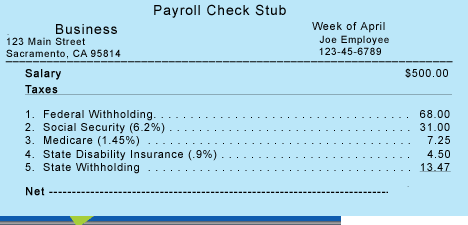

The percentage of taxes taken out of your paycheck depends on your income and your w 4 withholding allowances but you will pay 6 2 percent in social security taxes up to an annual limit 1 45 percent in medicare taxes and an additional 0 9 percent if your gross pay exceeds 200 000. Median household income in 2018 was 60 293. Social security and medicare taxes always apply except in rare exceptions such as if you are a student who works for a school where you are also a student. Tips you may have no federal taxes taken from your paycheck if you claimed you were tax exempt on your w 4 or if you had claimed several allowances.

While people who are self employed may end up with a different situation the average person with an employer will have taxes withheld from every paycheck. Federal income taxes are an unavoidable bother. But that money is considered taxable income even the new 600 boost. So for example if you were in the 24 federal income tax bracket and made a 12 000 pre tax contribution to your 401 k you would not have to pay taxes on the 12 000.

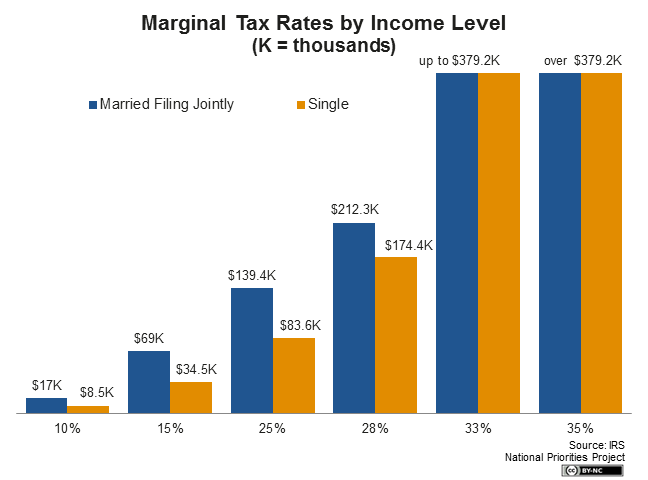

Federal paycheck quick facts. Employers generally must withhold federal income tax from employees wages. Federal income tax rates range from 0 to a top marginal rate of 37.