Does Mortgage Pre Approval Affect Credit Score

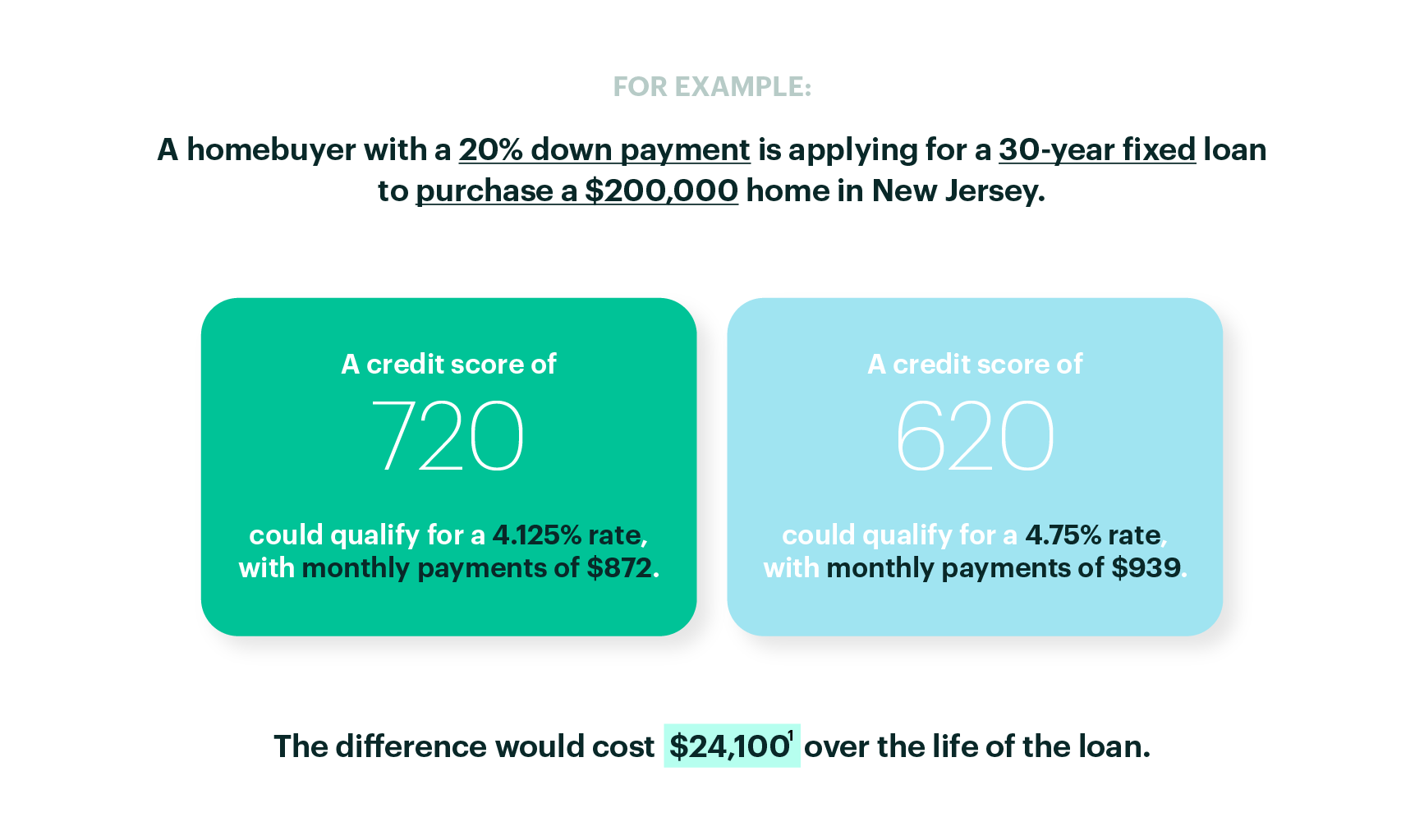

How mortgage pre approval affects your credit the process of pre approval secures a loan in your name based on your income and credit score.

Does mortgage pre approval affect credit score. Compared to credit cards personal loans or car loans having one or even two pre approval enquiries on your credit file within 12 or even 6 months won t affect your credit score too much. Basically the bank takes a look at your current finances and credit score and helps you determine a price point when you re house hunting. Repeated inquiries can negatively impact your credit score but having a lender pre selected and on board saves you from last minute hassles and failed closings. Mortgage pre approval helps you get everything lined up so closing on your new home can take place in just a few weeks rather than dragging on for months.

It s possible that several hard pulls could leave you with a lower credit score for as long as 90 days. However if you decide to go ahead and apply for the card that. The short answer is no.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

:max_bytes(150000):strip_icc()/best-egg-inv-12de376284274e8c8845129473ff2743.png)

:max_bytes(150000):strip_icc()/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)

/denied-credit-card-application-960247-v1-0aa7e53830ea4a508ab8366f8d5bde26.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)