How Can I Get A Va Loan

The va guaranty is the amount of each va loan that is backed by the federal government.

How can i get a va loan. Veterans can have previously used entitlement restored to purchase another home with a va loan if. If the borrower defaults on the loan that guaranteed amount is paid back to the va lender by the. If you can get a va loan should you. Although va loans can only be used for a primary residence they make sense for many borrowers parker says.

There are no real disadvantages associated with va loans he says. Spouses can take the va form 26 1817 to their lender for processing see apply through lender above or may mail the 26 1817 and dd214 if available to the following address. Next steps for getting a va direct or va backed home loan applying for your coe is only one part of the process for getting a va direct or va backed home loan. The va stands behind every loan it makes.

Credit ranges for a va mortgage. The va has determined the acceptable ratio to be 41 and it is used as a guide. In most cases they are an eligible borrower s best option. Download va form 26 1817 request for determination of loan guaranty eligibility unmarried surviving spouses.

Fico credit score ranges from 300 to 850. Va small business loans are not made by the veterans administration. If you own a house you can get another va loan with your full entitlement guarantee if you ve paid off the loan for the home you own or refinanced the mortgage to a non va loan. You can get a loan even if your credit score is less than 620 but you might need to pay a higher interest rate.

If you have any questions about your eligibility for a va home loan please call your va regional loan center at 877 827 3702. Calculations by this tool are believed to be accurate yet are not guaranteed. We re here monday through friday 8 00 a m. Here s a look at five factors that will determine how much va loan you can get.

They are partially guaranteed by the small business administration and made by financial institutions. The property purchased with the prior va loan has been sold and the loan paid in full or a qualified veteran transferee buyer agrees to assume the va loan and substitute his or her entitlement for the same amount of entitlement originally used by the veteran seller. If you haven t paid off or refinanced the loan you can still use a partial entitlement which offers a limited guarantee. In circumstances where the ratio exceeds 41 the va automatic underwriter can consider the ratio in conjunction with all other credit factors.

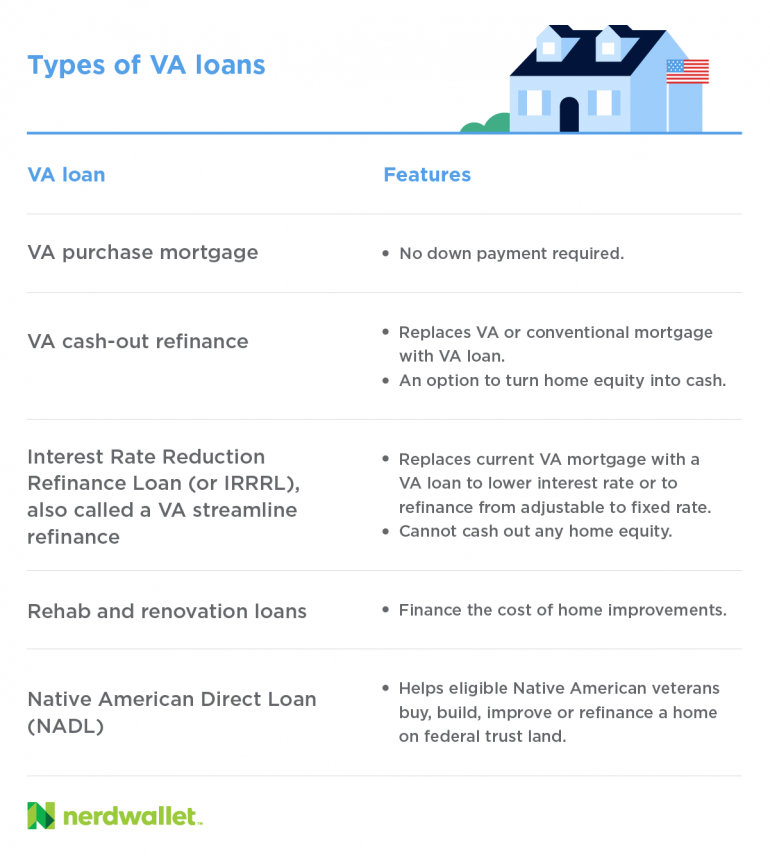

For the native american direct loan we ll be your lender.