Homeowners Insurance Rates Pa

We show average home rates for three other common coverage levels at the end of this article.

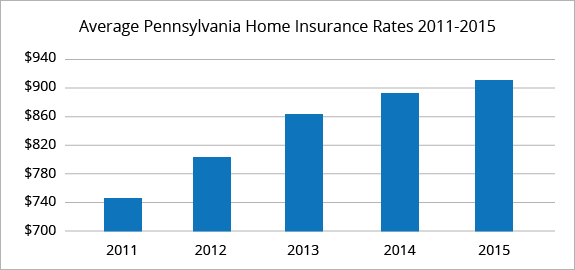

Homeowners insurance rates pa. According to the a study conducted by the national association of insurance commissioners naic in 2014 the average homeowners insurance policy in pa was about 900 00 per year in premiums. Pennsylvania homeowners insurance quotes. Amica sells dividend homeowners policies that pay as much as 20 of the. To find the most affordable homeowners insurance premiums in pittsburgh look no further than 15238.

Power rates amica mutual as one of the highest rated homeowners insurance companies. Pennsylvania homeowners insurance rates by zip code. As such the neighborhood you live in can dramatically impact your home insurance rates. Property claims study and.

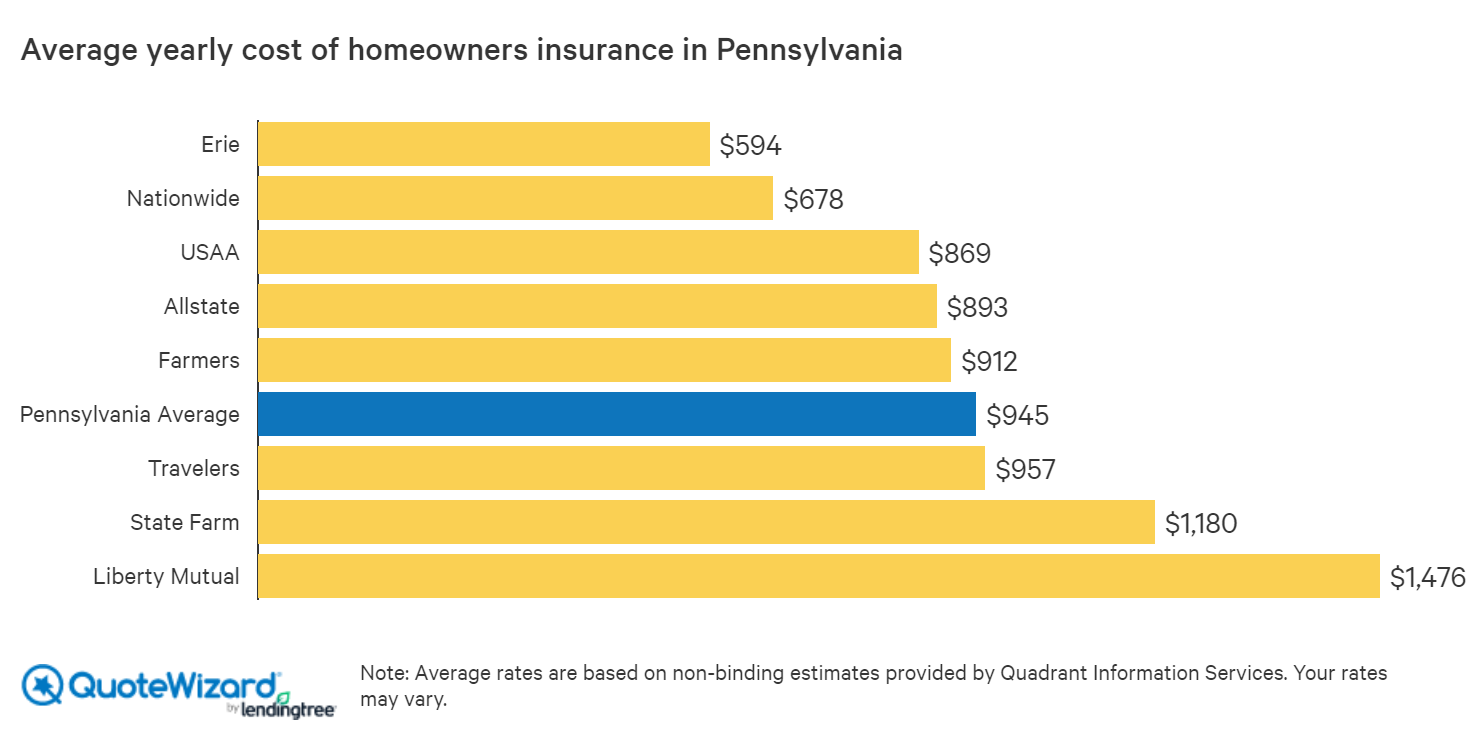

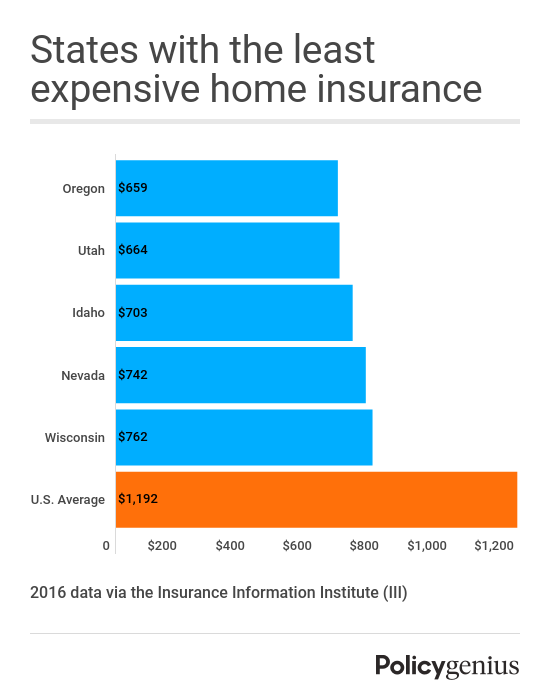

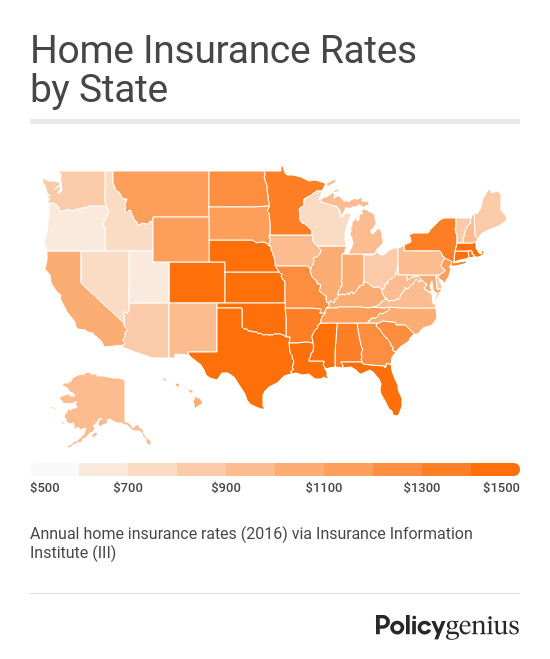

Compare multiple homeowners insurance rates in 19057. Pa rates for 75 coverage levels. The annual average home insurance rate in pa is 927 which is significantly lower in comparison to the national average of 1 192. Even though the premium amounts are more affordable than compared to the national average as the rates increase in pennsylvania for home insurance we could easily see the rates shoot past the national.

Pennsylvania has some of the cheapest home insurance in the country but that doesn t mean you ll pay little for your policy. The average premium for homeowners insurance in pennsylvania is 931 according to data sourced from the national association of insurance commissioners. Average for a homeowners insurance premium is 1 211 so pennsylvania residents can expect to pay less for their home insurance than in many other states. Pennsylvania homeowners insurance rates by zip code.

Common homeowners insurance perils in pennsylvania. As you ll see in the homeowners insurance cost by state chart below oklahoma is the most expensive state for home insurance 2 140 more than the national average for the coverage level analyzed. Please select one of the three options below based on your 19057 zip code to learn more about pennsylvania homeowners insurance plus review average rates and information per state county or city. In the 15238 zip home policies typically cost just 784 per year a full 50 less than the pittsburgh average.

When it comes to monthly rates homeowners here have to pay around 77 per month on average while the national. But we weren t impressed enough with its customer reviews to make it one of our top picks. It sells homeowners insurance life insurance auto insurance and a variety of other insurance and financial products. With a rock bottom price of 640 annually westfield insurance had the absolute lowest rates for pennsylvania homeowners.

Bucks county pa home insurance.