How Does Apr Work On Credit Cards

What is credit card apr.

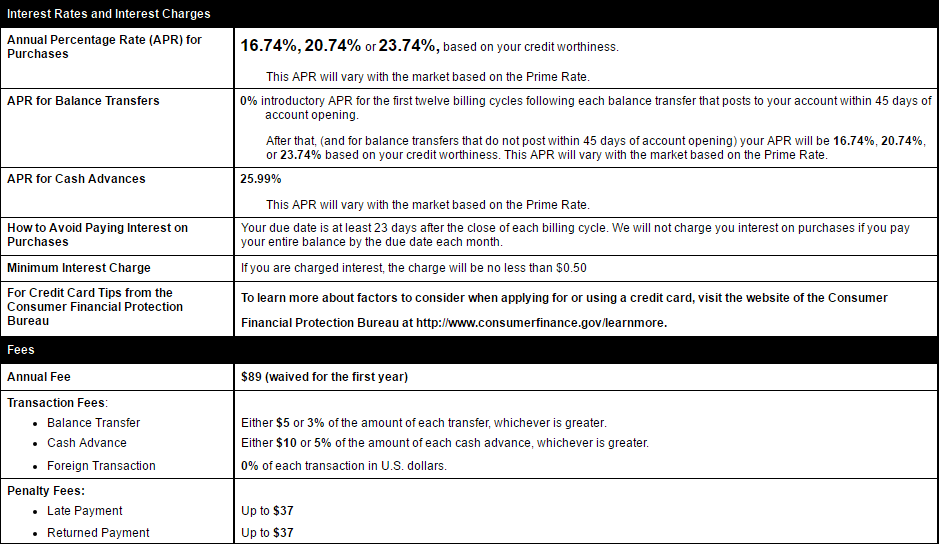

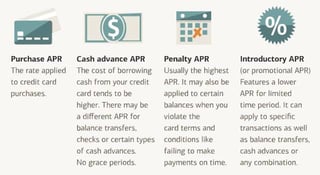

How does apr work on credit cards. Apr works differently on loans where it often includes standard fees for the loan. This number will vary from card to card and person to person depending on factors such as credit scores. Apr stands for annual percentage rate which is the total cost for a debt over a 1 year period. Credit cards and various types of loans like mortgages auto loans student loans and personal loans come with aprs.

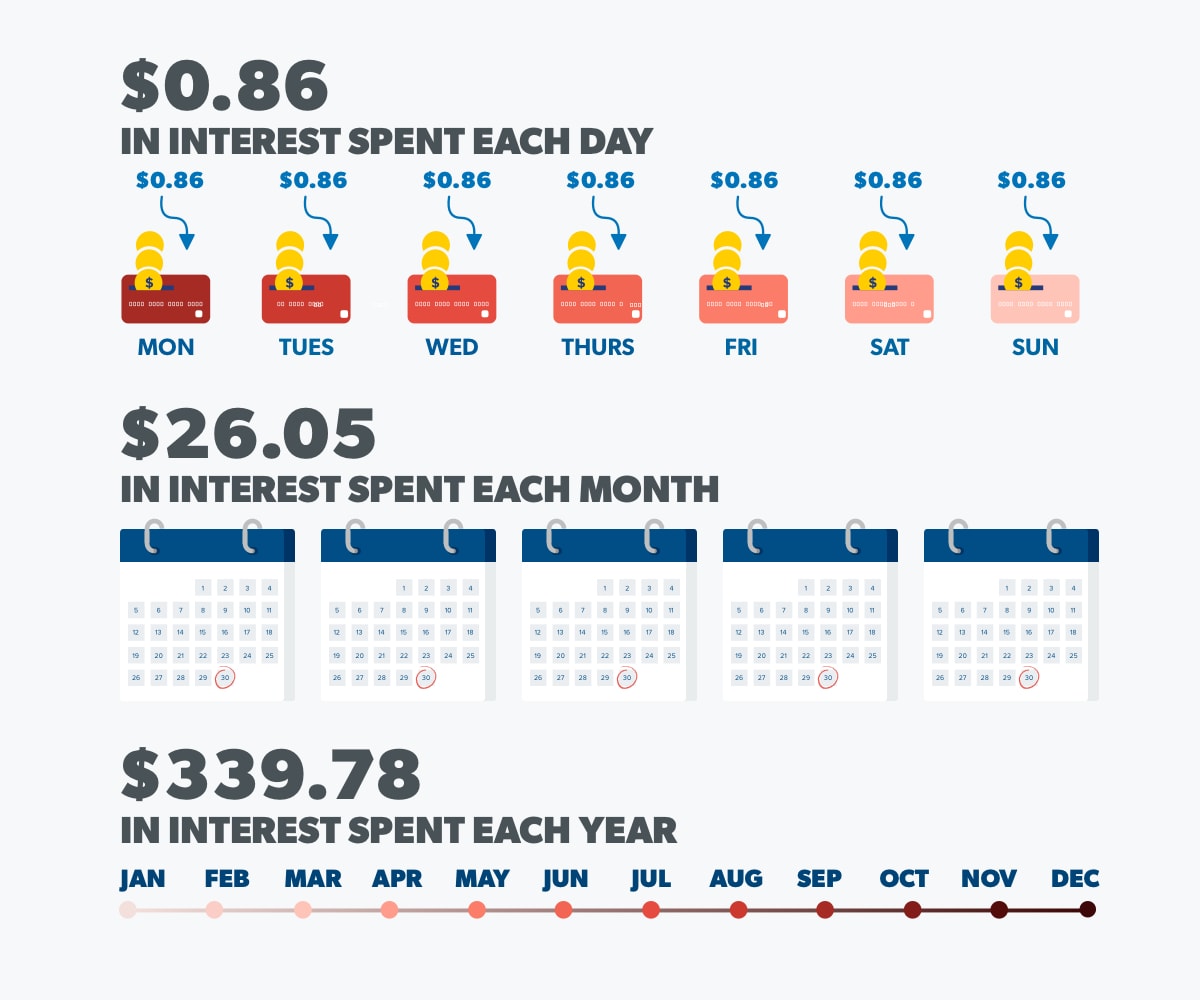

You may have seen the term apr or annual percentage rate used in reference to everything from mortgages and auto loans to credit cards. Given stable conditions an apr of 12 99 percent compounded for a year is the same as an ear of 13 88 percent. If your card comes with an apr of 24 then that means that if you spend 500 and don t pay it back for a year you ll be charged 120 on top of what you borrowed. Credit card apr typically ranges between 10 30.

But some credit cards are compounded monthly instead of daily. The apr on a credit card usually is an expression of the interest on the credit card if it were compounded daily not annually. Apr stands for annual percentage rate and is the basic way in which credit card issuers work out how much it will cost you to borrow money. Knowing what an apr is how it s calculated and how it s applied can help you make more.

A credit card apr does not include fees and other costs. Your apr is expressed in terms of a year but credit card companies use it to calculate charges over your monthly statement period. For credit cards apr is directly equal to the annual interest rate for the account.

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png)