How Does Errors And Omissions Insurance Work

What does this mean.

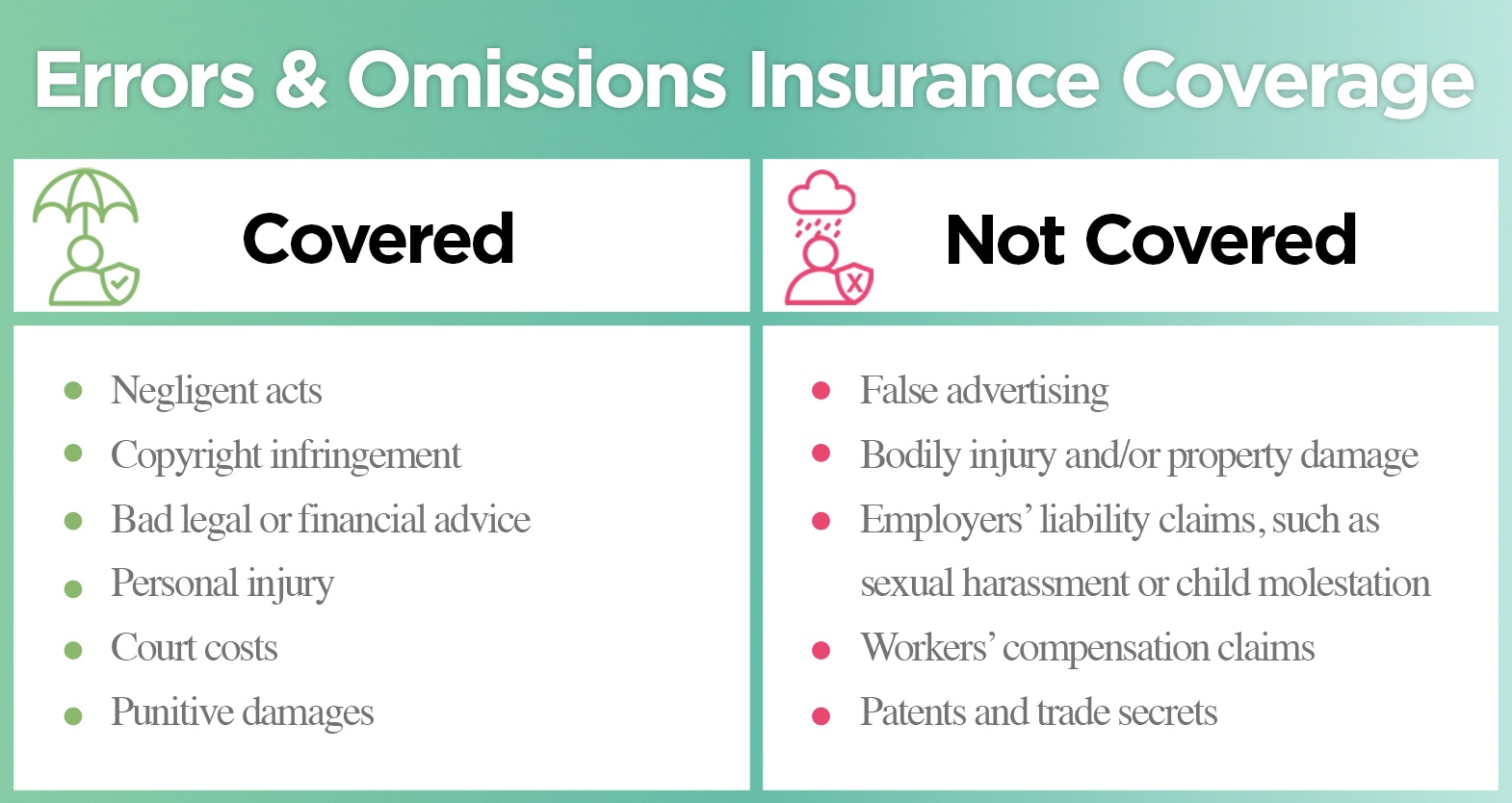

How does errors and omissions insurance work. To recoup the fine. Easycover errors and omissions insurance offers a unique benefit. Errors and omissions insurance e o is a type of professional liability insurance that protects companies and their workers or individuals against claims. The cost of errors and omissions coverage will vary based on a number of factors mainly what you do and where you work.

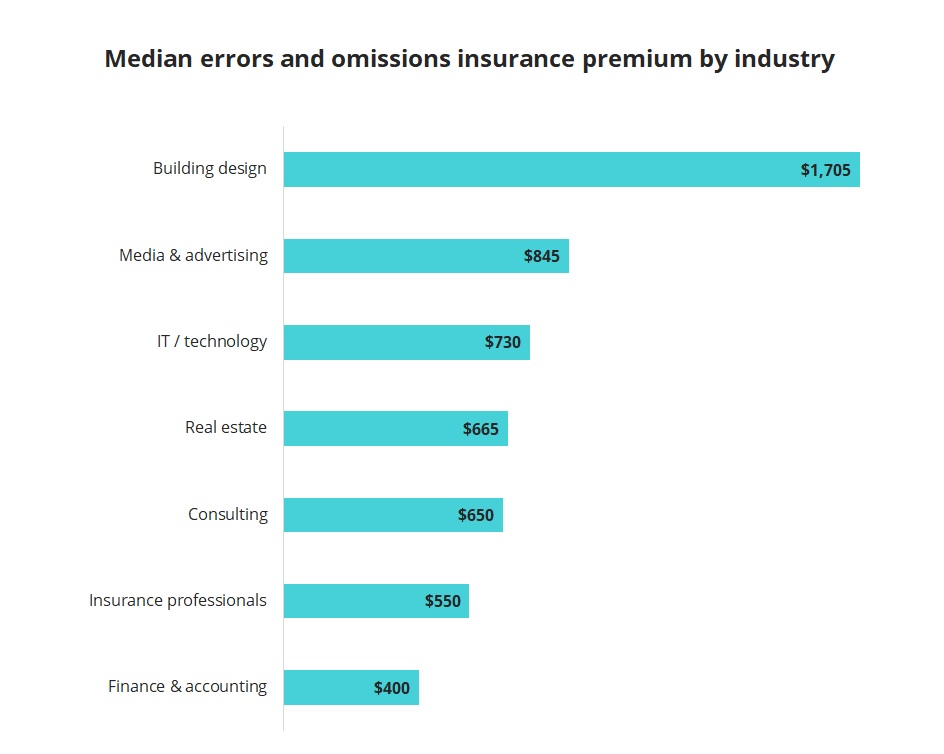

Contractors errors and omissions insurance also does not cover intentionally dishonest acts that cause damage to the value of the work. Overall both policies cover mistakes and errors made with customers by you or your employees. There is no easy answer as to how much errors omissions insurance will cost due to the vast differences each business can have. Even though the insurance terms professional liability and errors and omissions are often used interchangeably there are subtle and important differences that you need to know about.

Let s say a contractor knowingly substitutes cheap materials or otherwise cuts corners to save money and it results in damages to the value of the work. A tax preparer fails to file a client s tax return before the deadline and now the client is forced to pay a costly fine. E o insurance also known as errors and omissions insurance covers the costs of legal claims or alleged damage caused to a customer by errors or unintentional omissions from your work hence the errors and omissions title. Errors and omissions insurance protects you if a client or third party sues you for financial loss as a result of a provided or failure to provide professional service or advice.

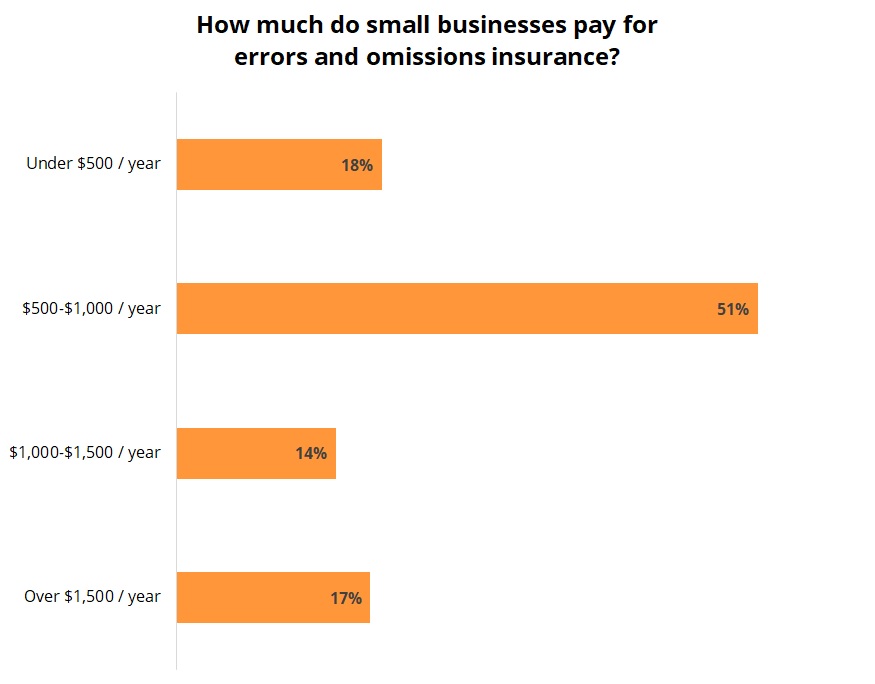

How does errors and omissions insurance work. How much does errors omissions insurance cost. An unlimited retroactive date. Your industry determines how much you re exposed to risk as some jobs come with a higher likelihood of professional liability and if you live in a metropolitan area you ll likely pay a little more to get insured.

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)