Does Credit Affect Car Insurance

Insurance companies use credit based insurance scores along with your driving history claims history and many other factors to establish eligibility for payment plans and to help determine.

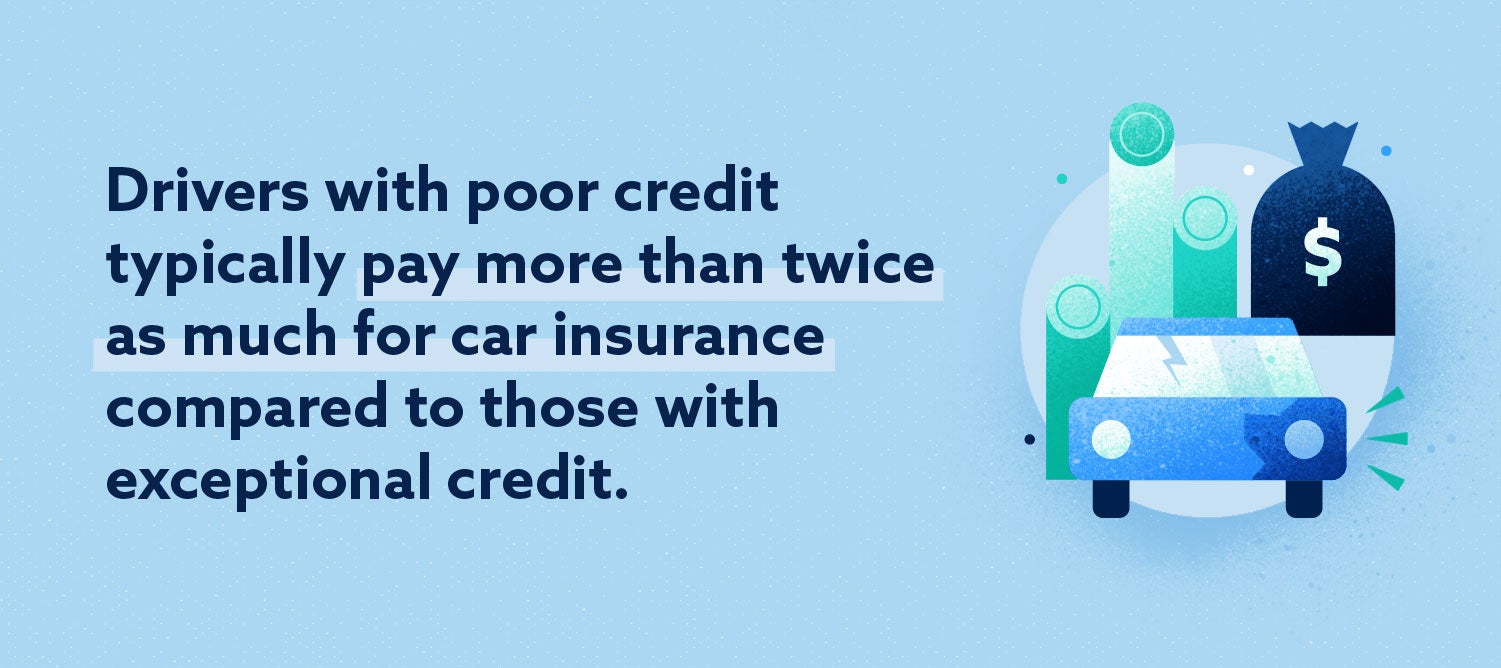

Does credit affect car insurance. Car insurance companies use them to help determine the likelihood of an insurance claim in the future. Better car insurance rates is just one of the benefits to having a good credit score. One of the risk elements that affects your car insurance is where you park your car at night. How credit based insurance scores work most u s.

You can do this for free via the credit reference agencies. Because the insurance credit score depends on your credit and loan history there are several things you can do to benefit your score. For more information on the factors that affect the cost of your car insurance read our car insurance premium guide. In the states where insurance companies don t use credit information the price of car insurance is based mainly on how people actually drive and other factors not some future risk that a.

For instance on its site progressive gives examples of favorable and unfavorable credit factors that could affect your insurance score. Your age gender and the type of car you drive also affect your car insurance rates. Ensure payments to all your accounts are made on time. If you want to pay monthly it may be worth checking your credit report to make sure it s correct.

How to improve your insurance risk score.