How Does Apr Work On Credit Card

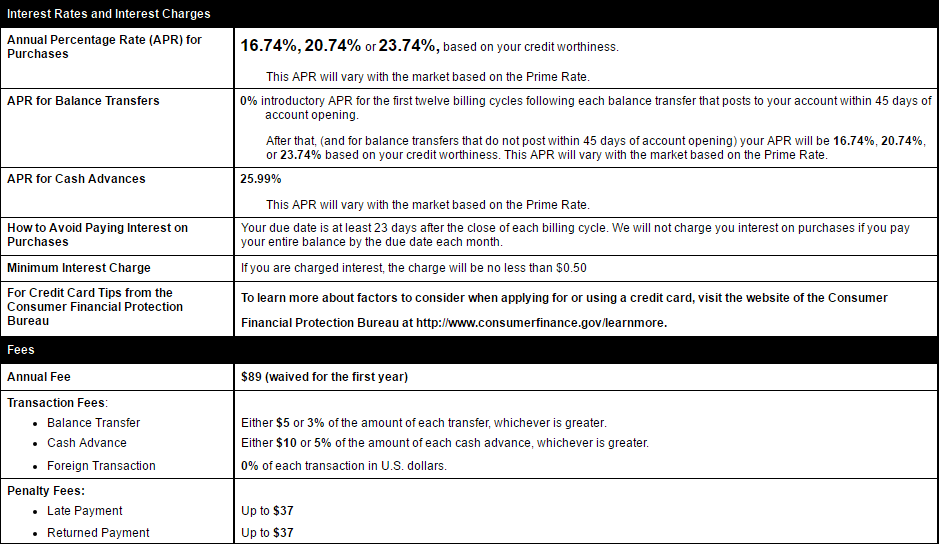

This number will vary from card to card and person to person depending on factors such as credit scores.

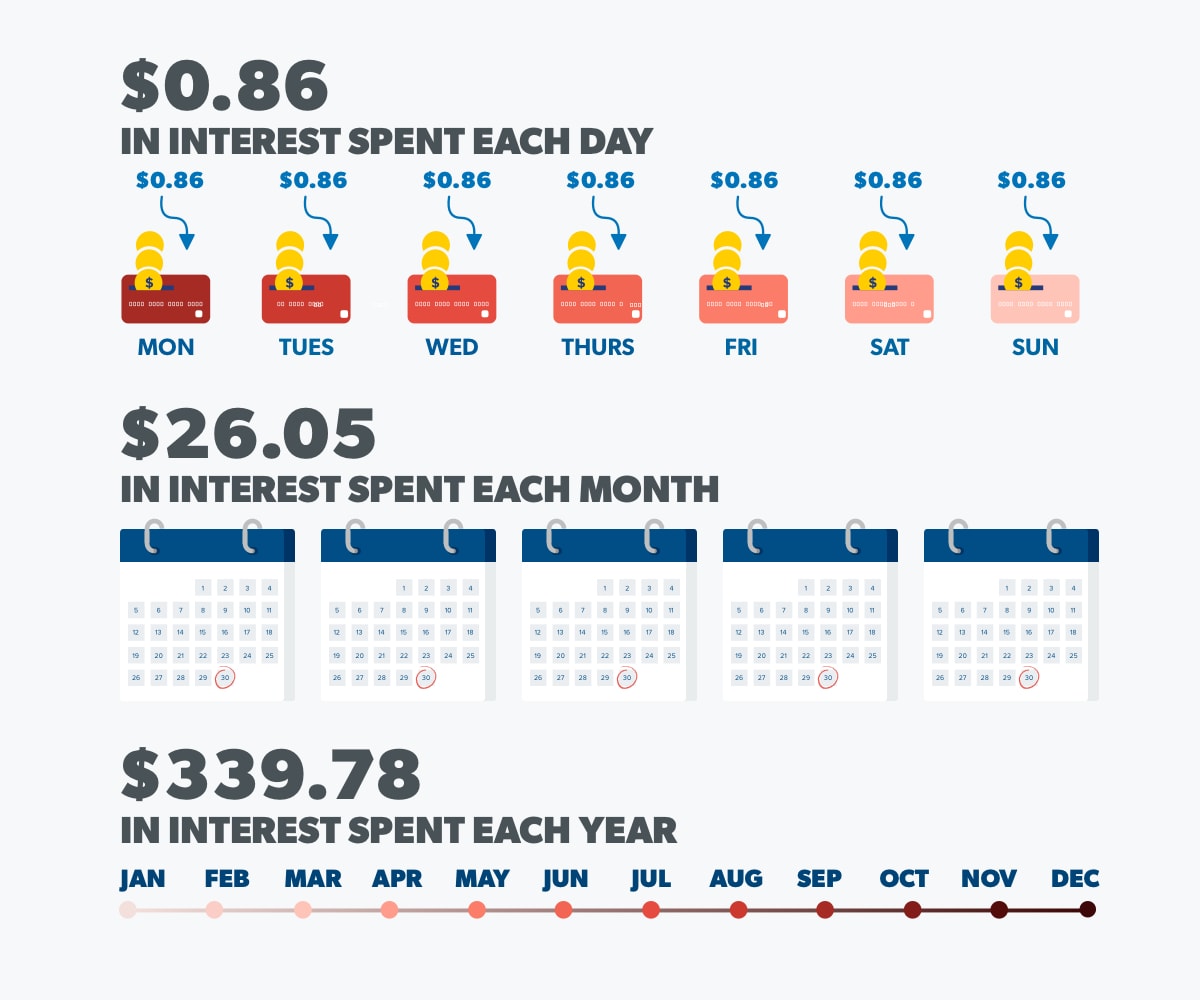

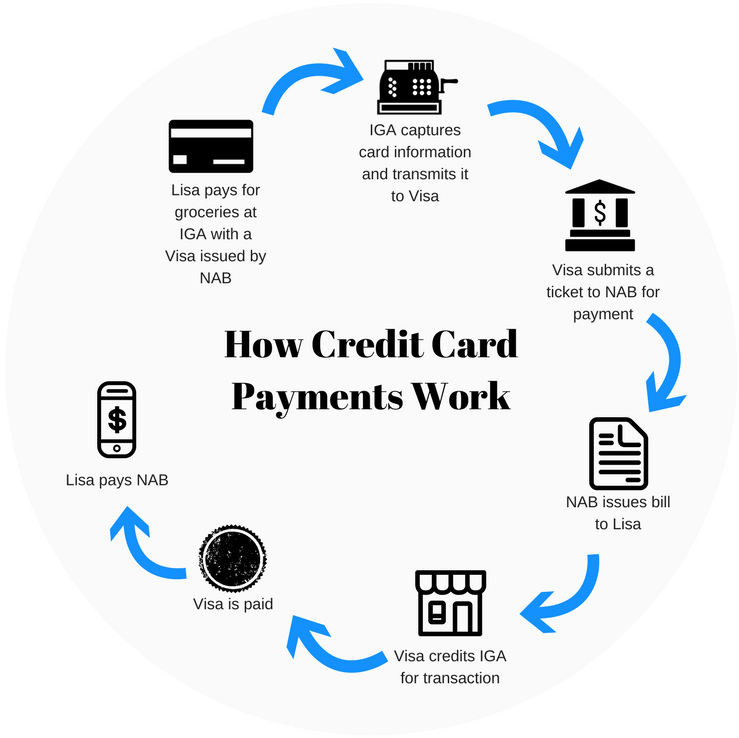

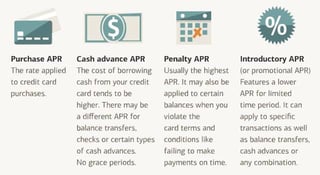

How does apr work on credit card. Apr stands for annual percentage rate which is the total cost for a debt over a 1 year period. Your apr is expressed in terms of a year but credit card companies use it to calculate charges over your monthly statement period. It refers to the annual cost of borrowing money either with a credit card or a loan such as a mortgage auto loan student loan or personal loan. For credit cards apr is directly equal to the annual interest rate for the account.

In annual terms a credit card s apr merely is an estimate of what the interest rate is or will be in the near future. Apr stands for annual percentage rate. Every credit card save for charge cards has an annual percentage rate apr. What is credit card apr.

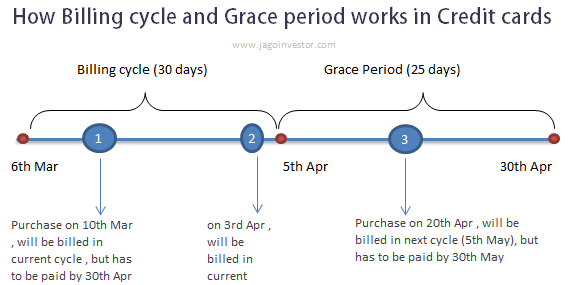

To calculate a credit card s interest rate just divide the apr by 365 days in a year. How does apr work on a credit card. The interest rate is the basic amount shown as a percentage that a lender charges you to borrow money. A fixed apr typically remains the same but it can change in certain circumstances such as if your payment is more than 60 days late or when an introductory offer expires.

But the two are closely related. The usual misconception with credit card annual percentage rates aprs is this number is the actual interest annually charged for the account. Credit card apr typically ranges between 10 30. Your credit card purchases are subject to a standard interest rate called the annual percentage rate or apr.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)