Cross Collateralization Mortgage Loans

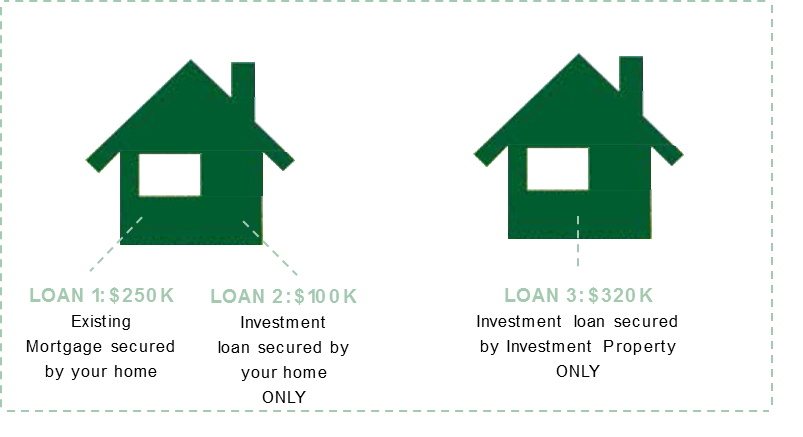

There are very few benefits of cross collateralization for the customer and it s often a misused substitute for multiple standalone loans due to lack of understanding.

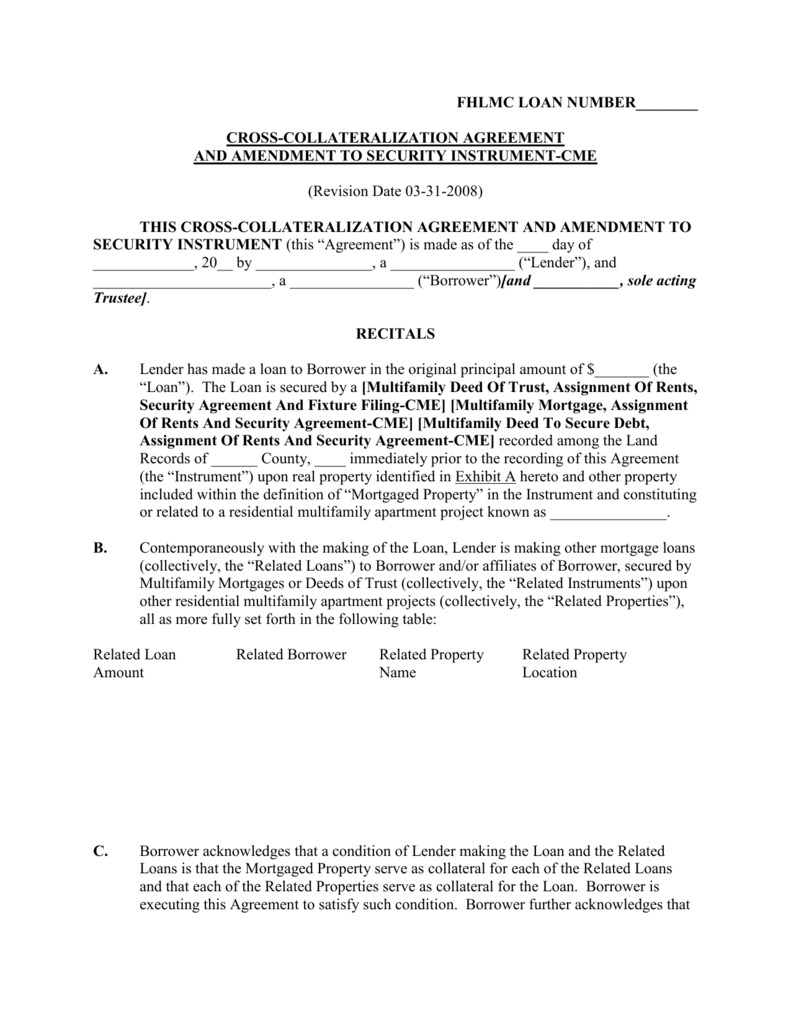

Cross collateralization mortgage loans. A cross collateralization agreement allows the lien against the collateral such as your car to secure additional debts other than the car loan. Cross collateralization is a method used by lenders like credit unions to use the collateral of one loan product to secure another one. Lenders who offer auto loans may use cross collateral loans. Any guarantor on any loan within the cross collateralised structure will be required to guarantee all loans within the cross collateralised structure.

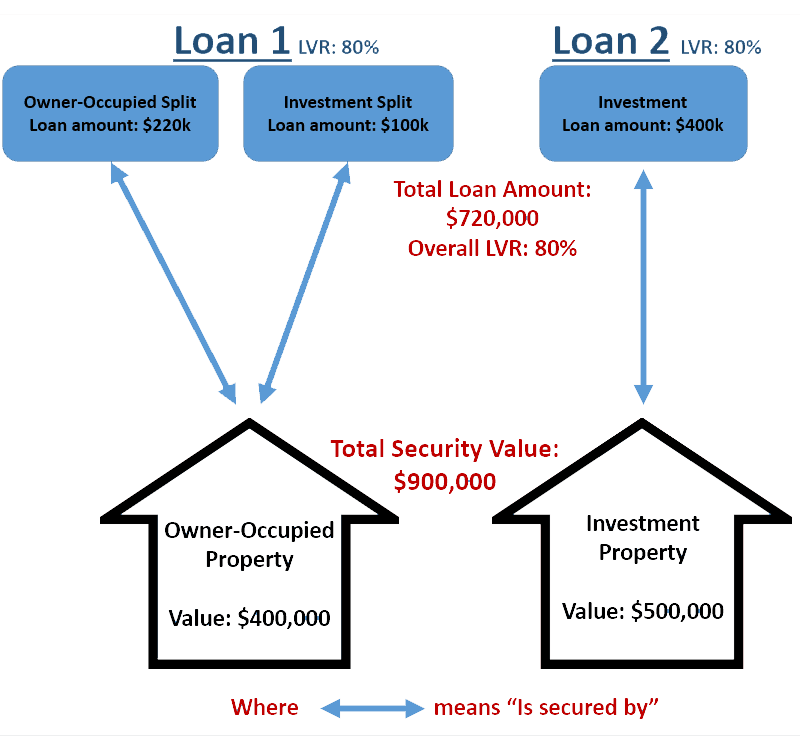

This means that if you don t pay a credit card that is cross collateralized with your car then the creditor can repossess your car. Cross collateralization is the process of using collateral from one loan as the security for an additional loan s. It s a good option for real estate investors borrowers who need large loans and those who cannot get approved for a loan due to bad credit. If you have a home and borrowed additional money for an investment property from the same bank they often cross collateralize or cross secure the properties to lend you additional money.

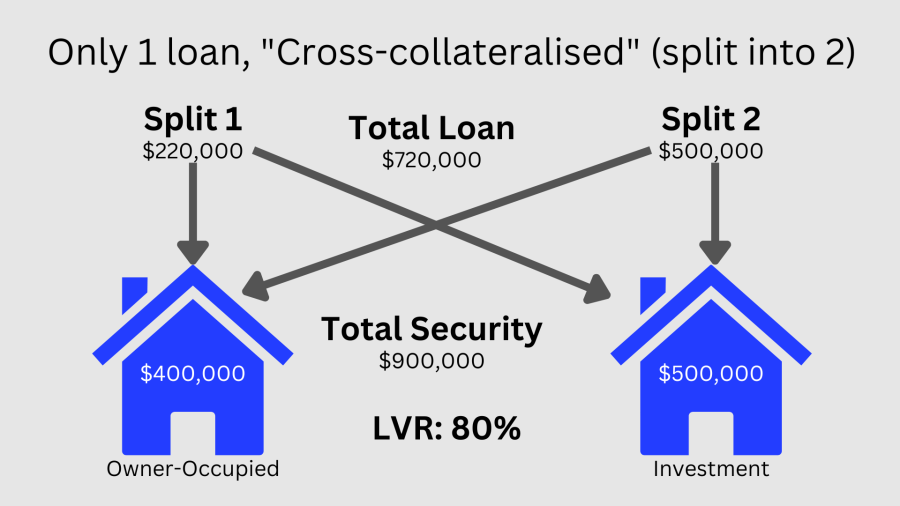

Cross collateralization is a finance term that is used when a loan is secured by two or more properties. Cross collateralization commonly refers to the act of pledging two or more assets under one loan or using a single asset to secure multiple loans. Cross collateralization is the act of using an asset that is currently being used as collateral for a loan is also used as collateral for a second loan. If a person has borrowed from the same bank a home loan secured by the house a car loan secured by the car and so on these assets can be used as cross collaterals for all the loans.

The mortgage lender will benefit from using cross collateralization since it gives them more security for the loan being made. If the debtor was unable make either loan s. In the event that the borrower defaults and a foreclosure occurs the lender can foreclose on both properties although this is not necessarily the lender s focus.

/shutterstock_42645244-5bfc3d40c9e77c00587b7965.jpg)