Direct Stafford Loan Interest Rate

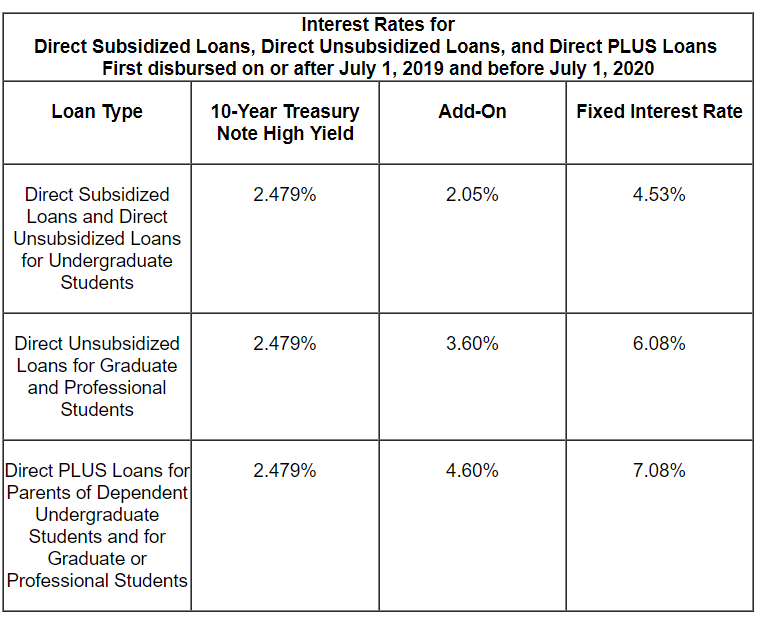

Interest rates on new federal direct stafford loans are fixed for the life of the loan.

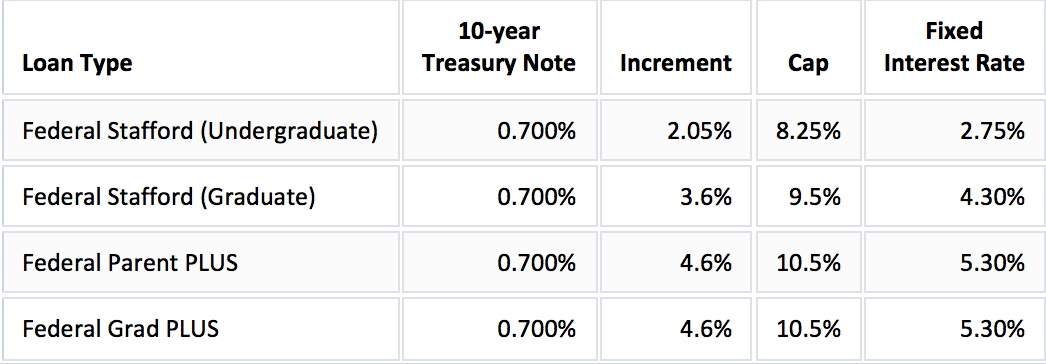

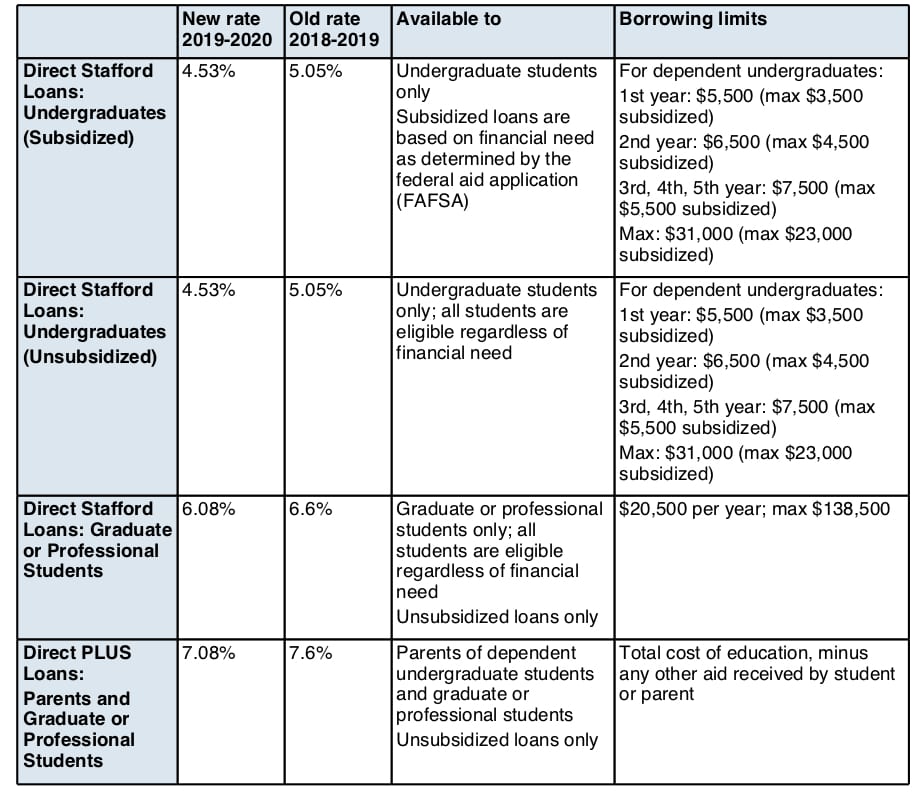

Direct stafford loan interest rate. Key takeaways all federal student loans are 0 interest and. Concerned that private lenders will drop out of the ffel program if it keeps the current interest rate formula congress fixes student loan interest rates at the short term treasury note plus 2 3 until 2003 to keep banks from leaving the program. The majority of students still take out ffel loans not direct loans. Rates for federal loans issued between july 1 2020 and june 30 2021 will be 2 75 for undergraduate stafford loans according to the may treasury auction down from 4 53 this year.

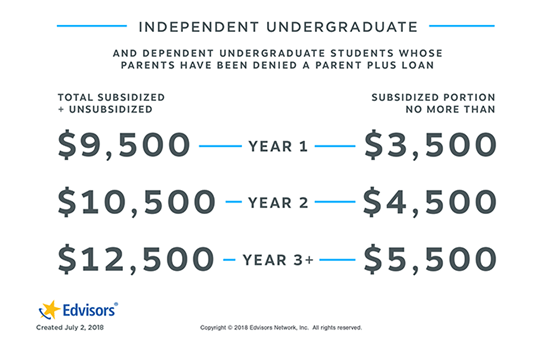

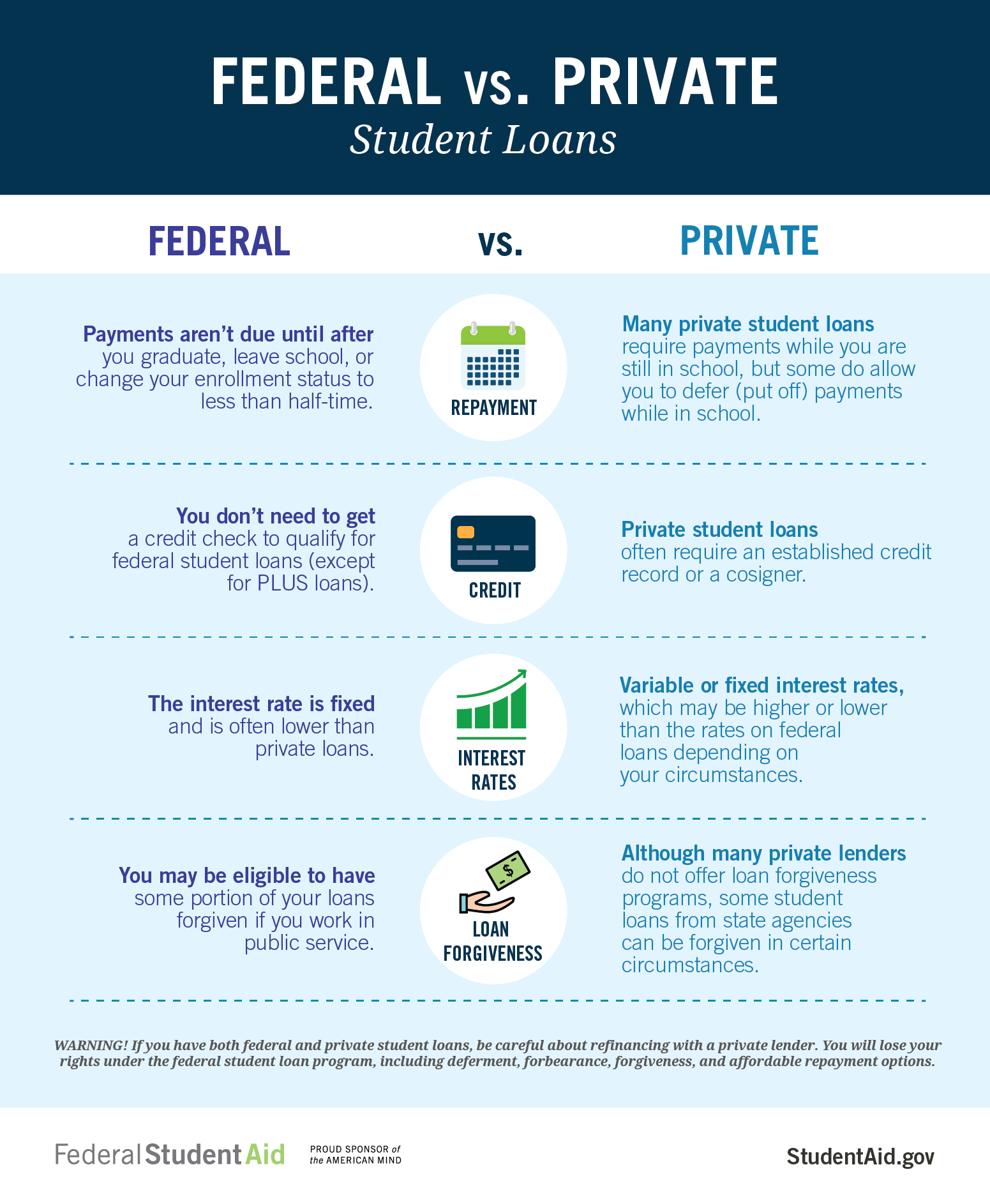

The interest rate for direct stafford loans varies depending on whether you choose an unsubsidized loan or a subsidized loan. Direct stafford loans from the william d. Ford federal direct loan direct loan program are low interest loans for eligible students to help cover the cost of higher education at a four year college or university community college or trade career or technical school. 6 on august 9 2013 president obama signed the bipartisan student loan certainty act of 2013 changing how student loan interest rates are determined.

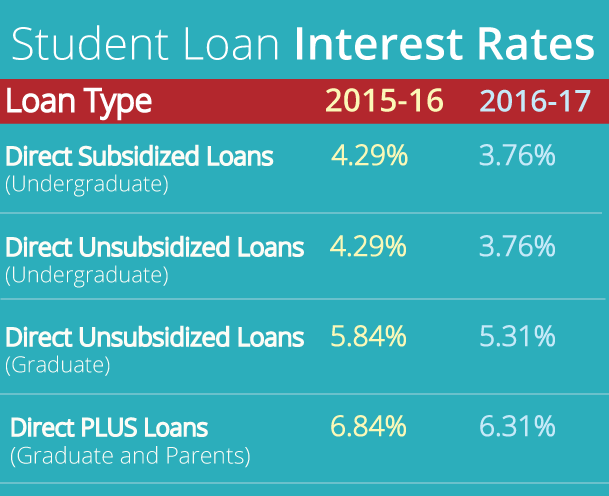

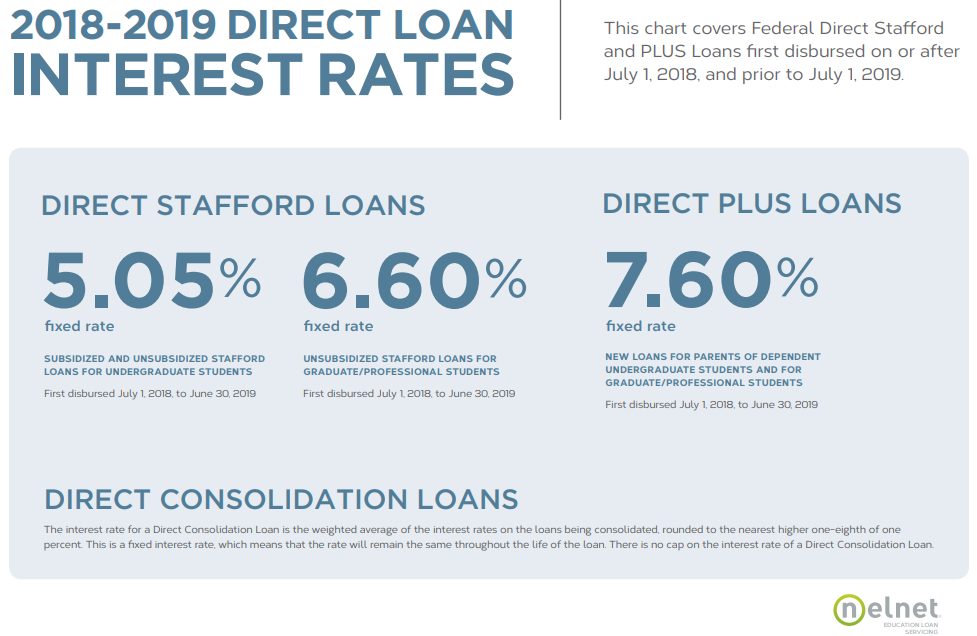

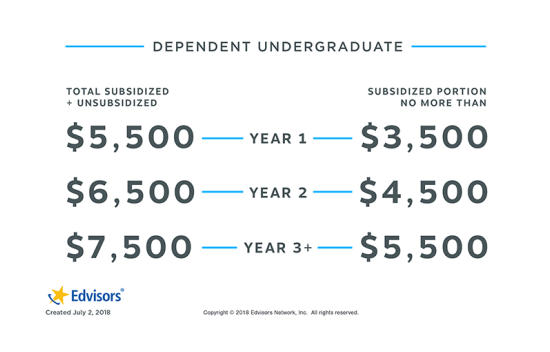

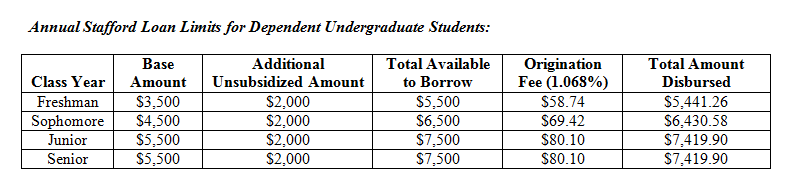

Interest rates for direct subsidized or unsubsidized loans vary depending on loan type when the loan was first disbursed and your degree status undergraduate or graduate. This beats the previous record low interest rate of 2 875. A fee of 1 059 is deducted from your loan before the funds are sent to your school. For loans taken out for the 2020 2021 school year undergraduate students receive a 2 75 interest rate and graduate students receive a 4 30 interest rate.

Rates for federal loans issued between july 1 2020 and june 30 2021 will drop from 4 53 to 2 75 for undergraduate stafford loans. For direct loans and most loan providers the rate is currently set at 6 6 for unsubsidized loans with lower rates for subsidized loans for undergraduates usually about 5 05.