High Risk Auto Insurance Average Cost

You will have to pay more for high risk driver auto insurance.

High risk auto insurance average cost. High risk auto insurance companies calculate your premium the same way that regular car insurance companies would but the difference is that surcharges of 25 50 and 100 are applied to convictions at fault accidents or driving violations making high risk auto insurance premiums very high. Of course it s a good idea to be up front with any insurance agents when discussing policy options and mention that you ll need to file an sr 22 form from the outset. You might have to pay an additional fee for the filing costs that come with an sr 22 but most high risk insurance companies will not be surprised if you mention this requirement. High risk auto insurance companies will typically cover drivers who need an sr 22 also known as an fr 44 in some states.

High risk car insurance is the insurance category reserved for drivers with past driving violations inexperience behind the wheel or poor credit. At covermarket we work with the right licensed insurance professionals that completely understand your needs. In ontario high risk auto insurance can be challenging to find and purchase especially if you are cost conscious. Auto insurance for high risk drivers is indubitably more expensive than regular car insurance with the prices varying based on which type of a dangerous driver you are.

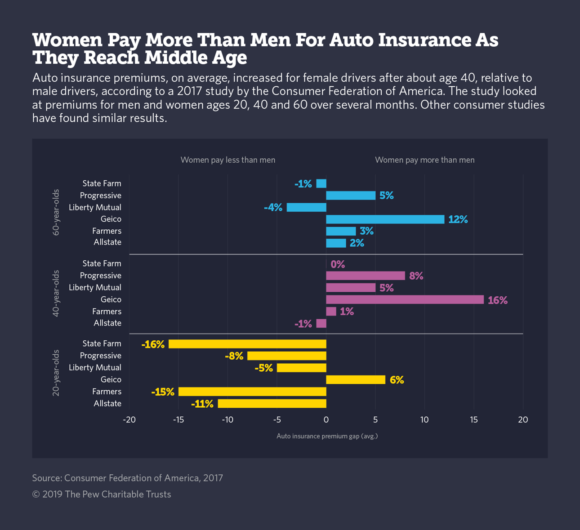

Insurers will file the form with your state s department of motor. For minor speeding tickets you will pay around 10 15 more than a driver of the same group with a clean record while if you had a dui citation your premium would be 30 50 higher. A high risk driver might pay 10 to 50 percent more than a low risk driver in the same age range according to investopedia. If you caused a crash filed a claim or received a ticket for a serious violation you might be a candidate for high risk car insurance.

How much more depends on your overall record and why the insurance company considers you a high risk in the first place. Many websites might offer instant insurance quotes but will reject you because of your special needs. Car insurance for bad drivers is almost always expensive but the extra cost you face varies based on your auto insurance company your driving history and the area in which you live. Since there are many different types of drivers that could be classified as high risk it s hard to provide a single average cost of high risk auto insurance.

What is high risk auto insurance s average cost.