Do You Pay Taxes On Refinance Cash Out

You may not think of it this way because you know you will have to pay the money back.

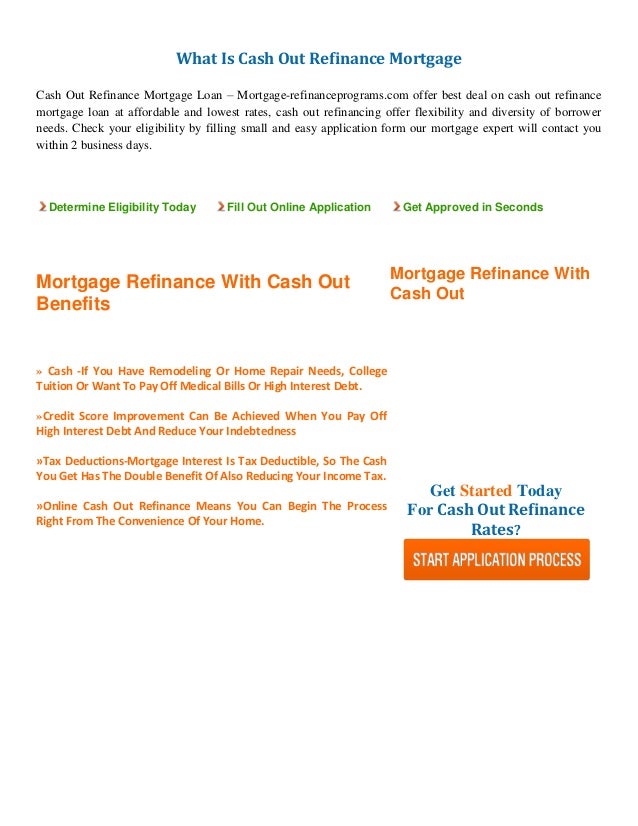

Do you pay taxes on refinance cash out. Cash back refinance mortgages are excellent ways to access large sums of cash. Overall you don t pay taxes on your cash out refinance proceeds. When you refinance your lender may offer you the option of paying points to receive a lower interest rate on the refinance. You don t need to include the cash from your refinance as income when you file your taxes.

Funds borrowed through a cash out refinance and used to pay off other debts are considered a home equity loan for tax purposes so they re subject to the limits noted above. If you use the proceeds of the cash out to pay for home improvements you can either deduct the points in the year you pay them or prorate them over the remainder of the mortgage. One area that you may want to be careful when it comes to refinancing and taxes is the interestthat you pay on the loan. The closing costs are a.

The irs knows the same thing so you will not be charged taxes on the income during the time the loan is alive in most cases. It s a form of debt that you must pay interest on over time. Especially with refinance rates near all time lows. For example let s say that you earn 50 000 per year.

In this case the amount of cash you can get is limited to 240 000 minus 200 000 to pay off your current loan minus the 10 000 in costs for a net cash out of 30 000. The irs doesn t view the money you take from a cash out refinance as income instead it s considered an additional loan. Deducting the interest on your loan. If you are lucky enough to make more than 250 000 as a single person or 500 000 as a married couple you will pay taxes on any amount you make above that number.

So you don t have to pay taxes on your earnings from a cash out refinance. If you don t use the proceeds to improve your home you have to prorate the points. This is when the reason for the refinance will play a role in what you owe. Single persons can deduct the interest paid on up to 50 000 borrowed for debt consolidation while couples can go up to 100 000.

If you are cashing out to improve your home the new debt is considered acquisition debt and the interest on your mortgage is deductible on the first 1 000 000 or 500 000 of the mortgage s balance depending on if you are filing as a married couple or with some other status such as. A cash out refinance on a rental property is a great way to get money out of your investment.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/GettyImages-1171659710-149c5671e12b4e4d855730507df022ef.jpg)

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-fe0a396be99740e699238edc273e4311.jpg)