Employee Insurance Policy

A workers compensation insurance company.

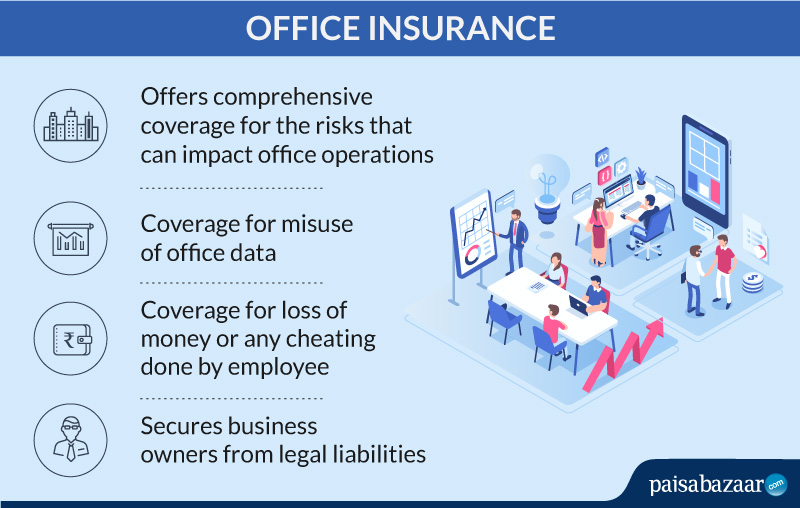

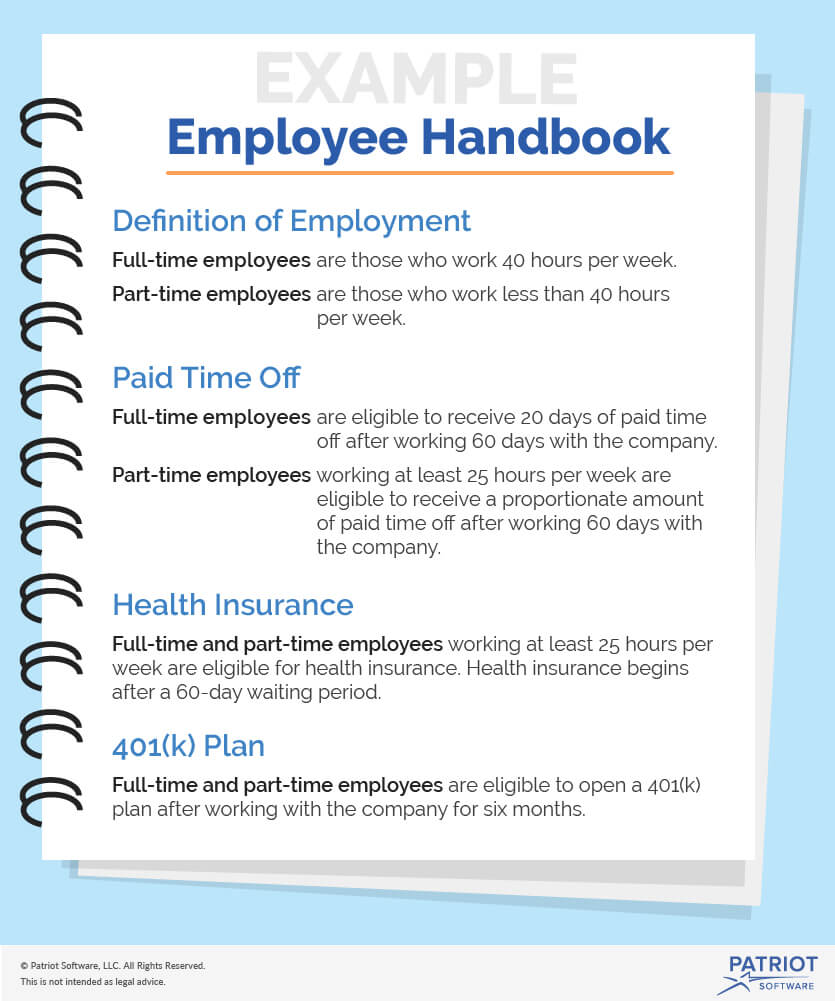

Employee insurance policy. Personal insurance policy where employee is the policyholder. Employee health insurance is a benefit extended by an individual s employer to their employees. You must get employers liability el insurance as soon as you become an employer your policy must cover you for at least 5 million and come from an authorised insurer. In addition to policies your employee handbook should include information about who to contact should an employee need to report policy violations.

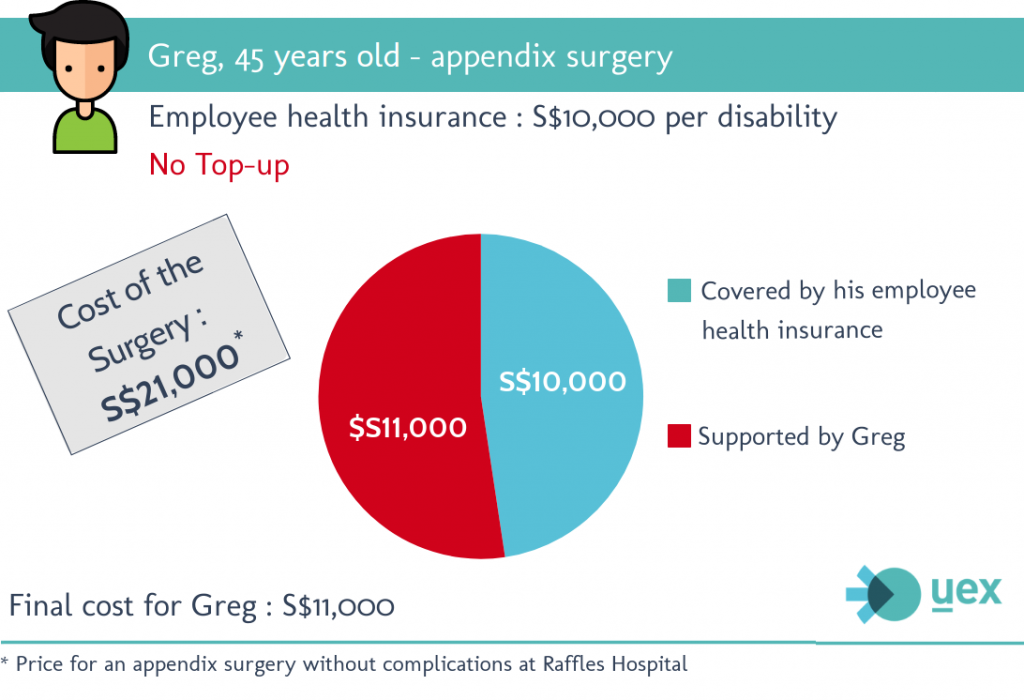

If you re only covered under a project wic policy you may be charged for non insurance. Employers must get wic insurance for your employees. Health insurance for employees provide better benefits in comparatively lesser cost than individual health insurance policy. Are employers obliged to take out employees compensation insurance policies for all employees.

This is because a project policy does not cover some instances of work injury such as injury that occurred while working outside the project site. For over a century we ve been providing america s small businesses with cost effective workers compensation insurance with our emphasis on financial stability and fast efficient claims service we now serve clients in 46 states and the district of columbia employers remains focused on keeping america s main street businesses not only. Taxable not taxable. These limits might be as low as 100 000 per employee 100 000 per.

According to section 40 of the ordinance no employer shall employ any employee in any employment unless there is in force a policy of insurance to cover his liabilities under the laws including the common law for injuries at work in respect of all his employees irrespective of the length. Pre existing disease is covered from day 1. One of the key employee benefit packages provided by employers a group health insurance plan in some cases may also provide cover to family members of employees. Group medical insurance policy covering employee employee s spouse and children where the benefit is available to all staff.

Unlike any individual health plan a group health insurance policy starts covering pre existing diseases from the day an employee joins the organization. Be sure you include key state and federal policies and realize that new laws and regulations mean revisions to your handbook to remain compliant. Better benefits in low cost. Employee health insurance benefits.

Employers liability insurance policies also place limits on what they must pay out per employee per injury and per illness. El insurance will. A group or corporate health insurance policy is purchased by an employer for eligible employees of a company. It does not only cover the person working for the employer but also covers the rest of family members under the policy.

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png)

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png)