Does Your Credit Score Affect Car Insurance

How credit based insurance scores work most u s.

Does your credit score affect car insurance. Also relevant to your rate according to insurance companies is your credit score. That means that your credit score won t be. There s no hard credit pull for auto insurance quotes. Insurance companies use credit based insurance scores along with your driving history claims history and many other factors to establish eligibility for payment plans and to help determine insurance rates.

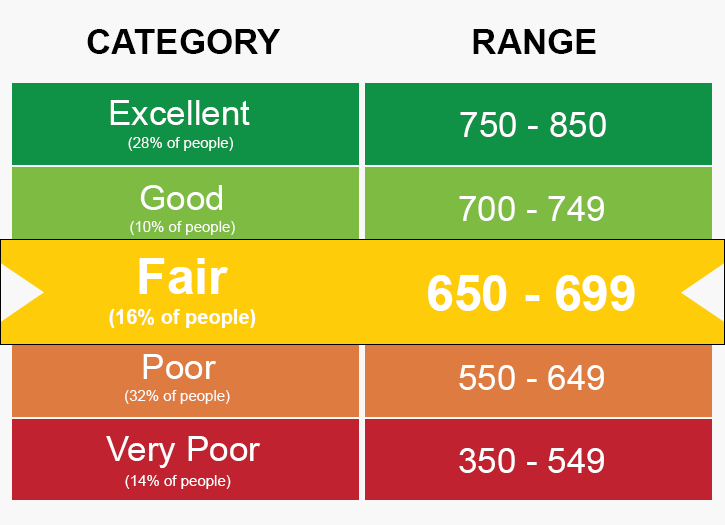

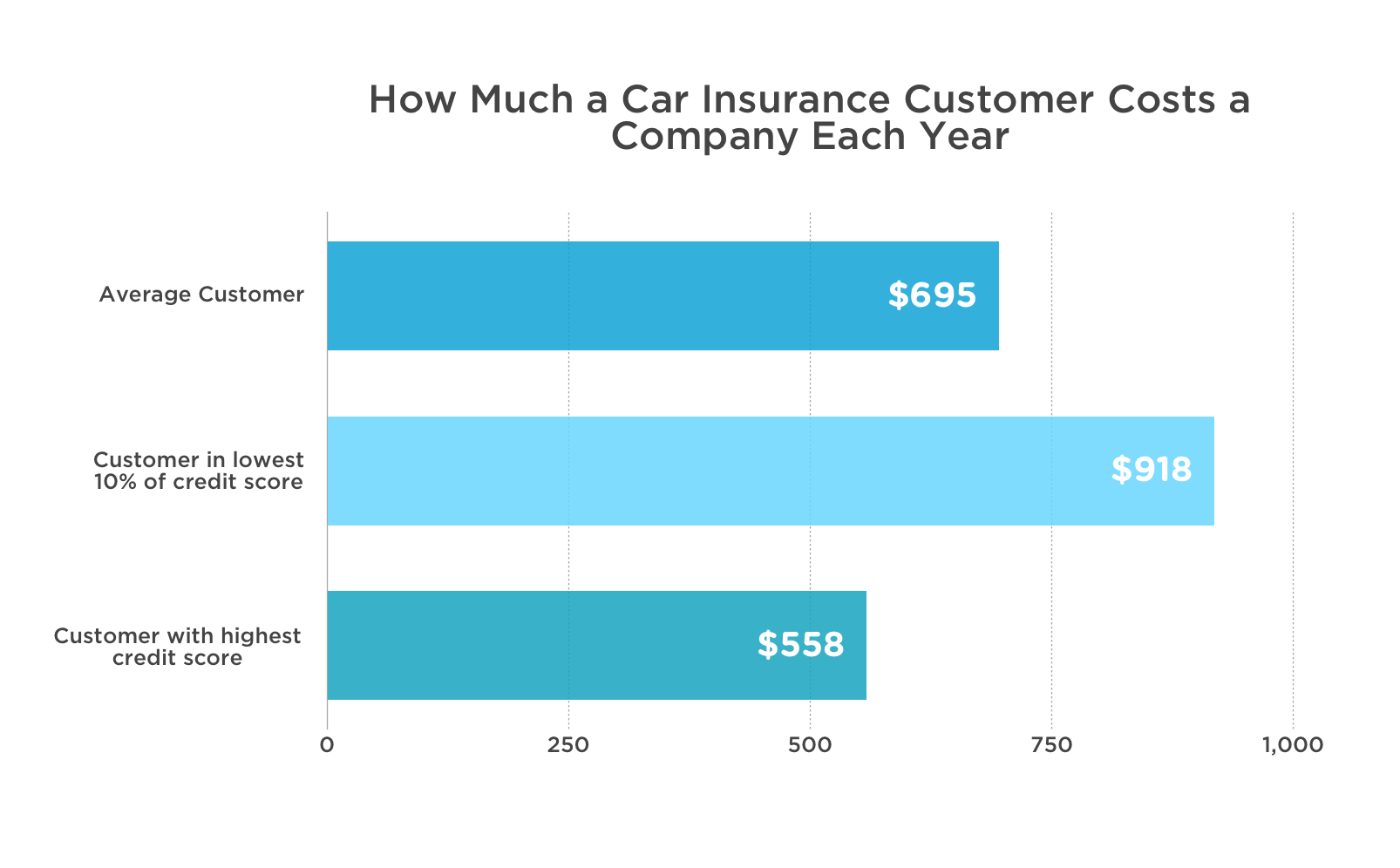

When determining your car insurance credit score sex marital status age ethnicity address and income are never considered. But you might not know that car insurers are also rifling through your. Drivers with poor credit may pay as much as 42 more for car insurance than drivers with stronger credit. This is a term from the us where most insurers check a credit based insurance score not a traditional credit score when someone applies for cover and they use it to set premiums.

Again except in california hawaii and massachusetts. How can my credit insurance score benefit me. The practice of using credit scores in setting insurance rates has been around for at least 20 years.