Hedge Fund Taxation

Analyze new issues for hedge fund structuring and tax reporting.

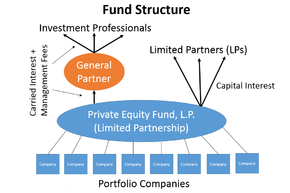

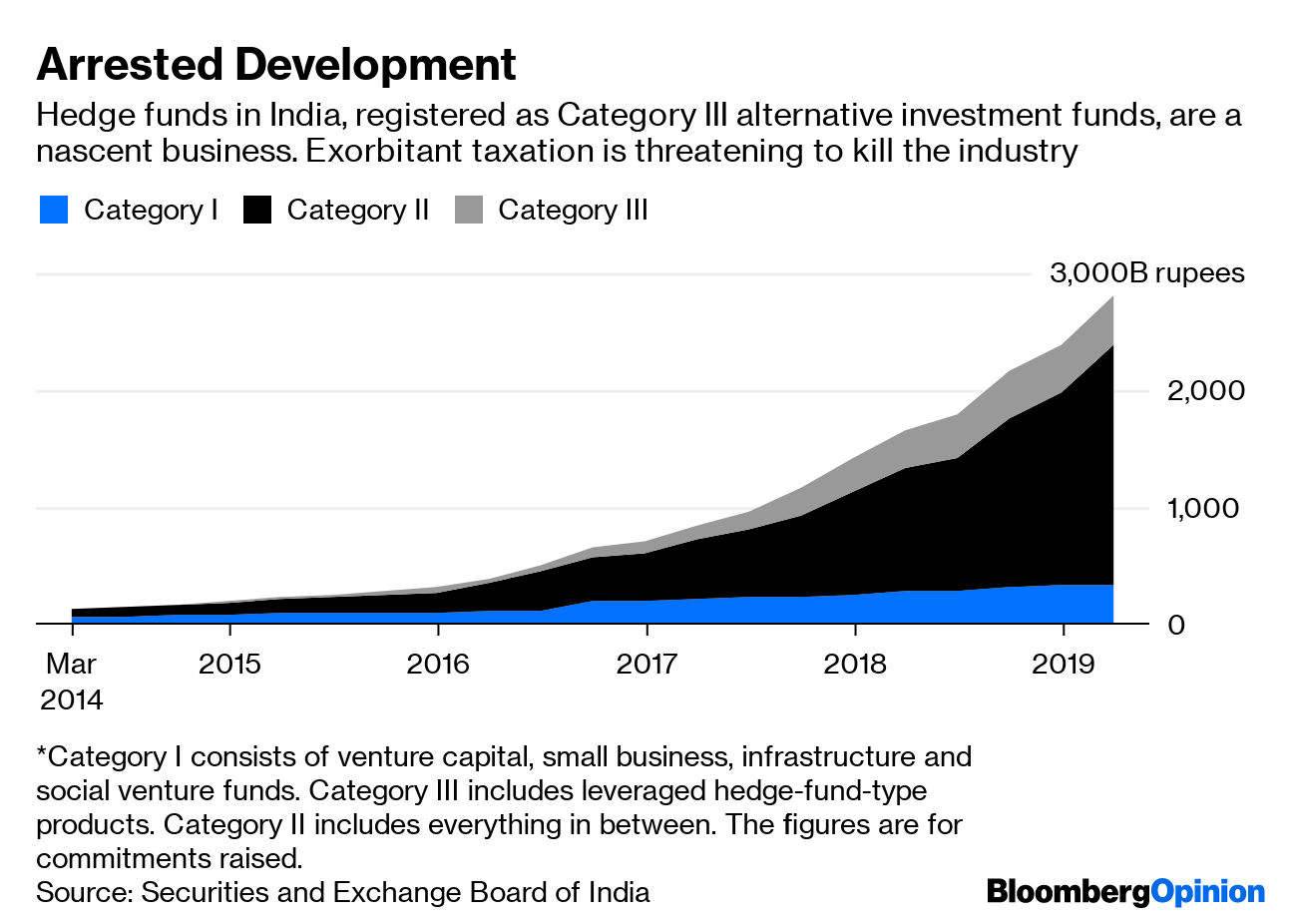

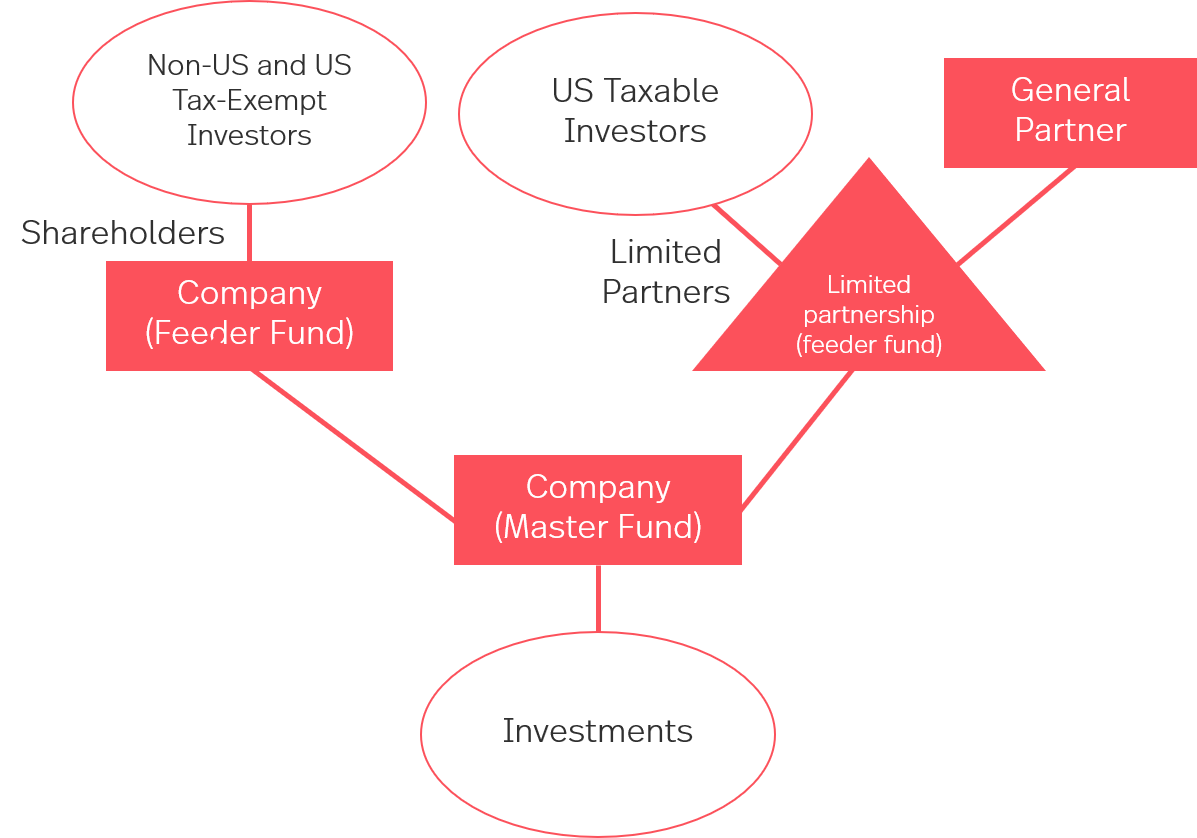

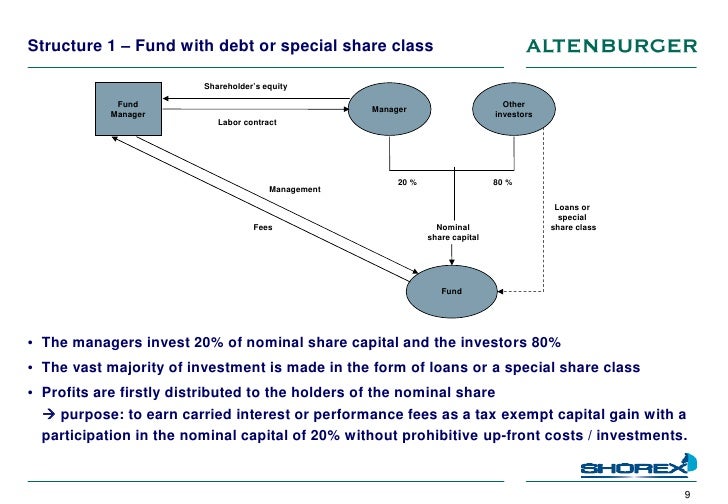

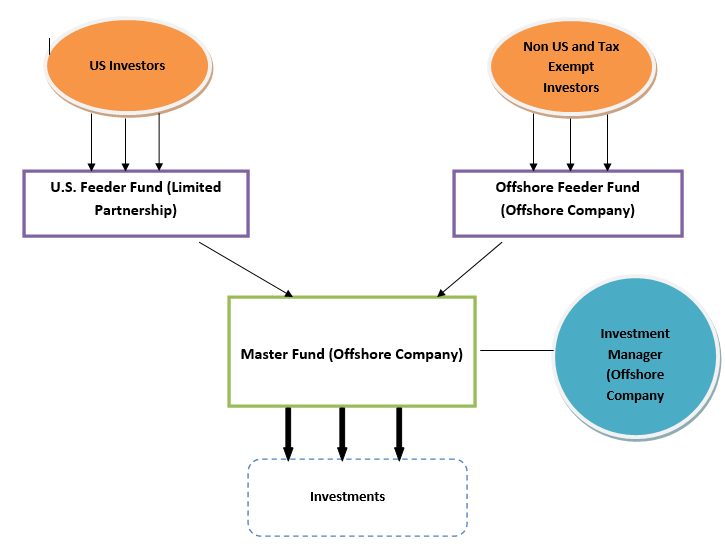

Hedge fund taxation. A private equity or hedge fund located in the united states will typically be structured as a limited partnership due to the lack of an entity level tax on partnerships and other flow through entities under the u s. Taxation of the hedge fund industry and its participants carried interest. Taxation of hedge funds structure of the hedge fund vehicle. Act in 2013 to cater for the taxation of hedge funds as collective investment schemes and these amendments will take effect as soon as the minister of finance declares hedge funds to be collective investment schemes under s63 of cisca.

A hedge fund is an investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading portfolio construction and risk management techniques to improve performance such as short selling leverage and derivatives. Hedge fund managers are compensated with this carried interest. This practice note examines how hedge funds are commonly structured from a tax perspective looking in particular at the choice of structuring a hedge fund onshore or offshore as a tax transparent partnership or opaque corporation and the impact of the uk s offshore funds rules. Because of its use of complex techniques financial regulators typically do not allow hedge funds to be marketed or made available to.

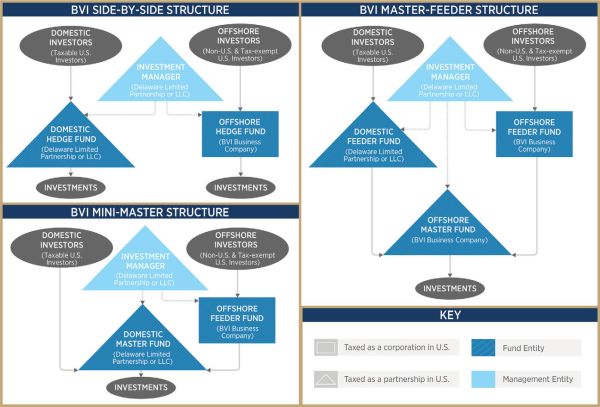

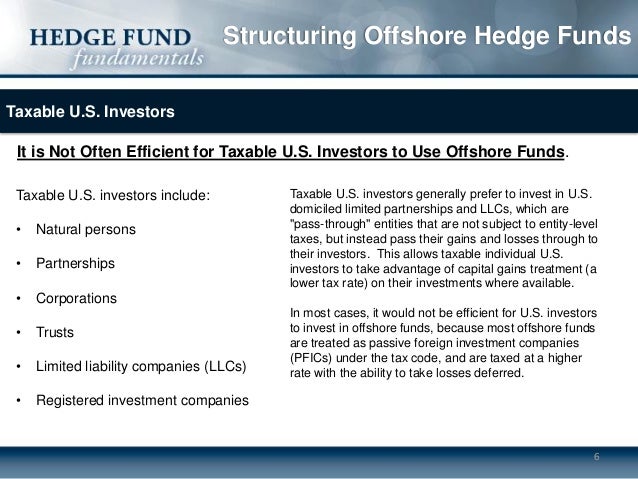

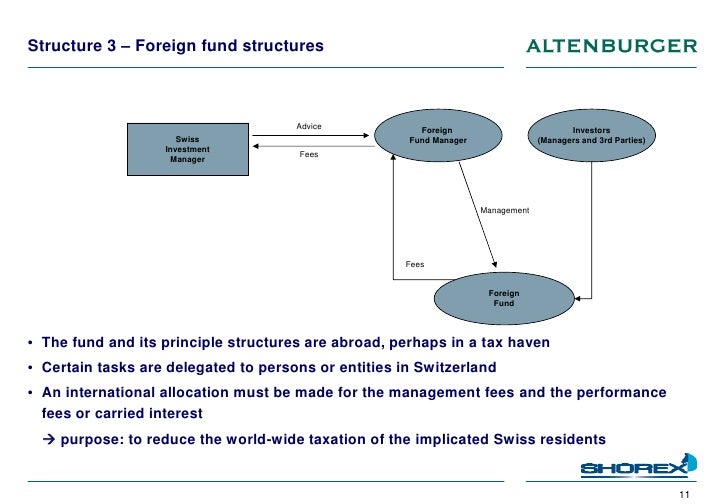

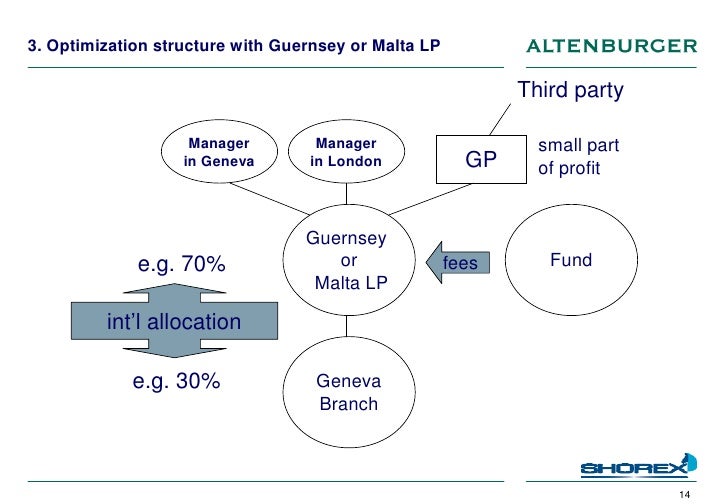

Offshore funds principal tax consequences for each structure methods of tax. Taxation on hedge funds is similar to that on private equity at least in the united states. This has created a host of new taxation issues. Evaluate new legislative developments and their tax implications for hedge funds.

A hedge fund is another form of pass through entity allowing the fund itself to operate free of taxation. The limited partners will be the institutional and individual investors. Review of current hedge fund structures onshore vs. How to draft for the new regime.

The income they receive from the fund is taxed as a return on investment as opposed to a salary or compensation for services rendered. Qualified business income exclusion cryptocurrency assets partnership audit rules. Investors will report these gains and losses on their individual tax returns and will pay tax on items of income and gain according to the character of the income or gain reported on a k 1 form provided by the fund.

:max_bytes(150000):strip_icc()/2-and-20-ff874d5360854f68b8dfca31b43e9223.png)

/GettyImages-687054066-c550851609794d5bb4f536175016e9ce.jpg)