How Many Ira Rollovers Per Year

Just be sure you allow 12 months to elapse between rollovers from a single account.

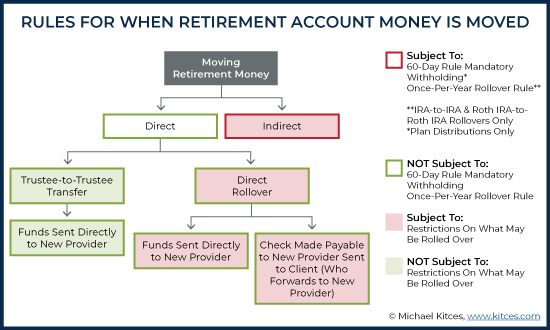

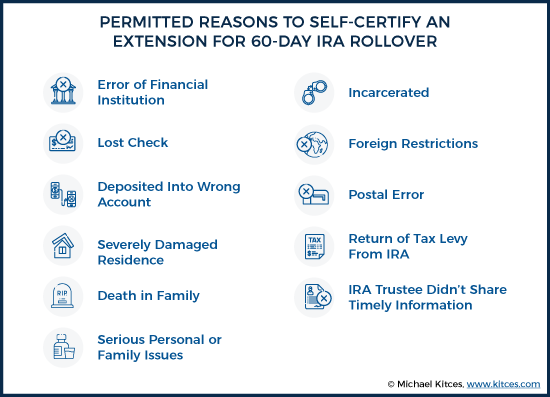

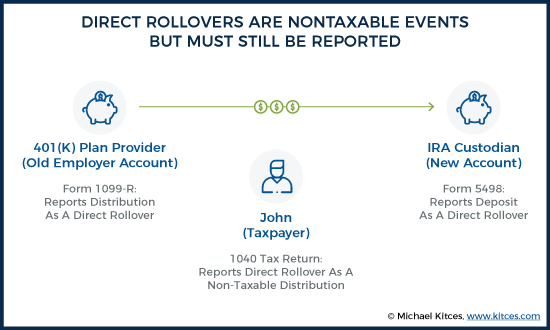

How many ira rollovers per year. Taxes for ira transfers in direct. So if you have three iras you can perform a rollover for each in the same 12 month period. The court s surprising ruling conflicted with a long standing irs position in earlier editions of irs publication 590 and in private letter rulings. Ira rollovers are subject to some strict rules including the transfer of funds be made between accounts within 60 days and only one direct rollover per year.

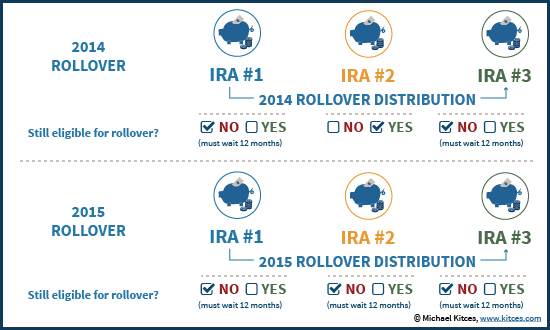

The 12 month period will start with the date that ira or roth ira funds are received. Several years have now passed since this ruling but there is still a. Previously the irs interpreted the one rollover per year rule as applying separately to each ira an individual held moreover this one rollover per 365 days rule applies to every type of ira traditional roth sep and simple. Beginning in 2015 you can make only one rollover from an ira to another or the same ira in any 12 month period regardless of the number of iras you own announcement 2014 15 and announcement 2014 32.

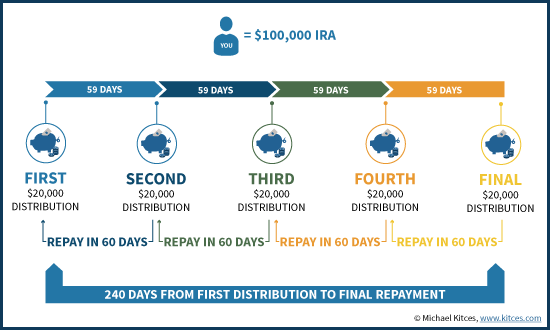

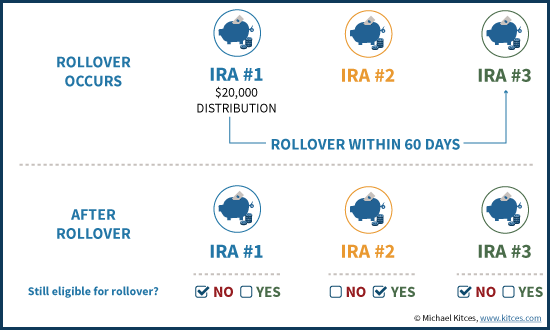

You can only complete one tax free rollover every 12 month period per ira account. The upside is that the irs once per year rule is applied separately to each ira you own. Tax law permits one distribution from your ira in a 12 month period as long as you return the distribution to your ira within 60 days with no tax consequences. An ira can receive any number of rollovers per 12 month period but once an ira has received a rollover a distribution from that ira can t be rolled over within 12 months.

This rule applies no matter how many ira and or roth ira accounts the ira owner might have. You also cannot make a rollover during this 1 year period from the ira to which the distribution was rolled over. In 2014 the tax court in the bobrow case ruled that the once per year rollover rule applies to all of an individual s iras not to each of their ira accounts separately. Ira one rollover per year rule you generally cannot make more than one rollover from the same ira within a 1 year period.

The 12 months is a full 12 months not a calendar year. Rollovers to an ira.

:max_bytes(150000):strip_icc()/iStock-512752254.kroach.IRA-675837a730c744938bf57072739e65c8.jpg)

/GettyImages-1017300682-3086d9bb0cc942df8fc62401a5286372.jpg)