Fha Streamline Refinance Without Appraisal

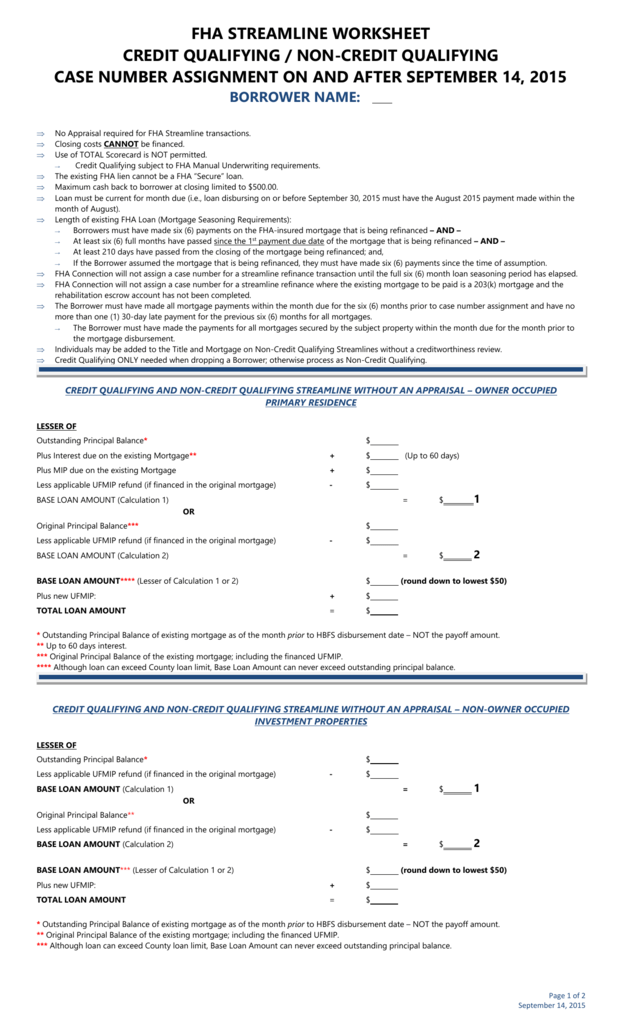

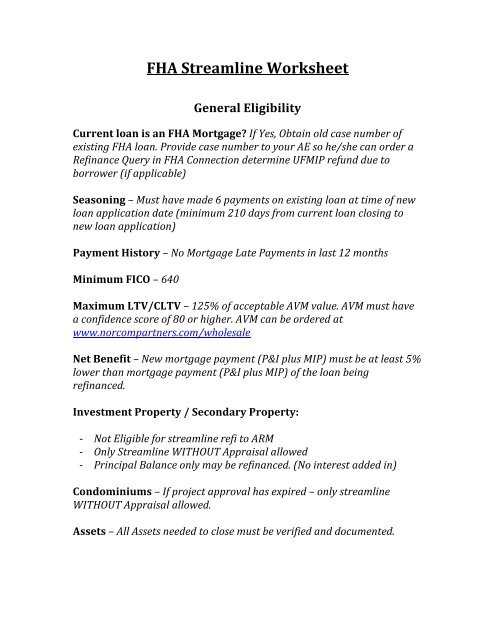

Investment properties properties which the borrower does not occupy as his or her principal residence may only be refinanced without an appraisal.

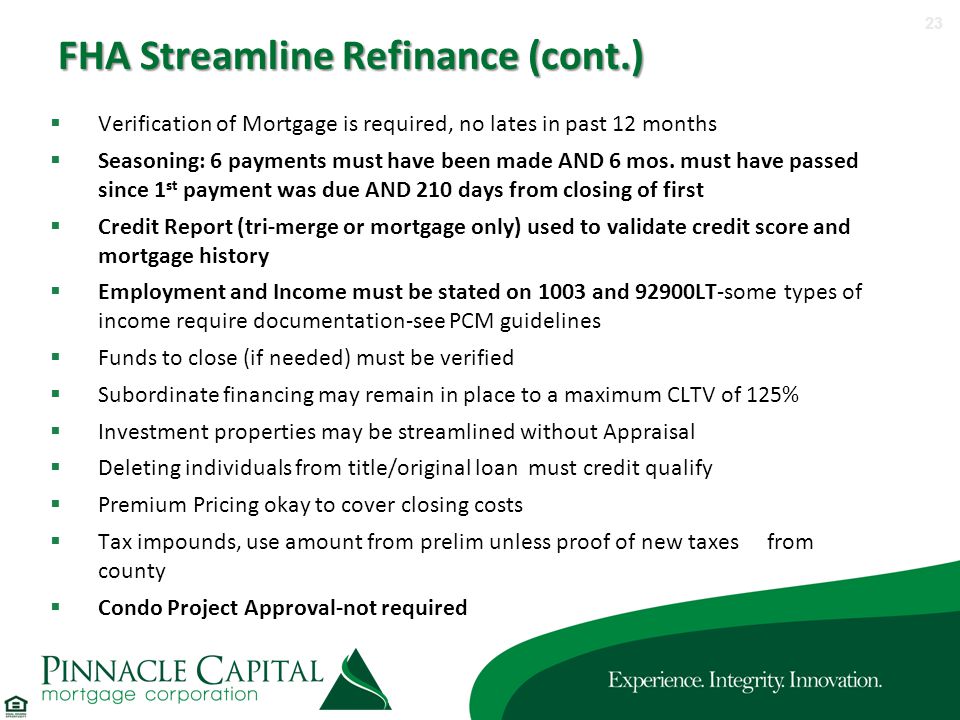

Fha streamline refinance without appraisal. In many cases you can refinance with fha streamline without a new appraisal on your home. More lenient credit requirements to refinance compared to most other loans. Fha does not require repairs to be completed on streamline refinances with appraisals with the exception of lead based paint repairs. According to fha loan rules when a streamline refinance is done without an appraisal the following applies.

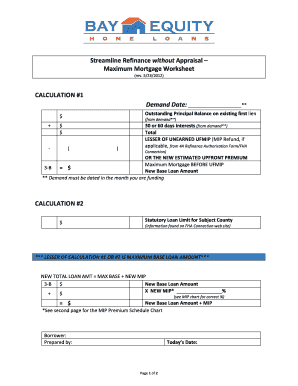

You must be current not delinquent on your mortgage now and at least 6 months must have. Statutory limit for county 1. Wrap closing costs into the fha streamline. However the lender may require completion of repairs as a condition of the loan.

How and why to do an fha streamline refinance loan types 4 minute read august 07 2020 an fha streamline refinance can help you refinance fast. Fha does not require an appraisal on a streamline refinance. That is unless you receive a lender closing cost credit. Yes hud made it to where if a borrower opted to not have an appraisal it meant that they can t finance their closing costs they have to bring them to close but with rates as low as they are now it is possible that you can opt for a slightly higher than.

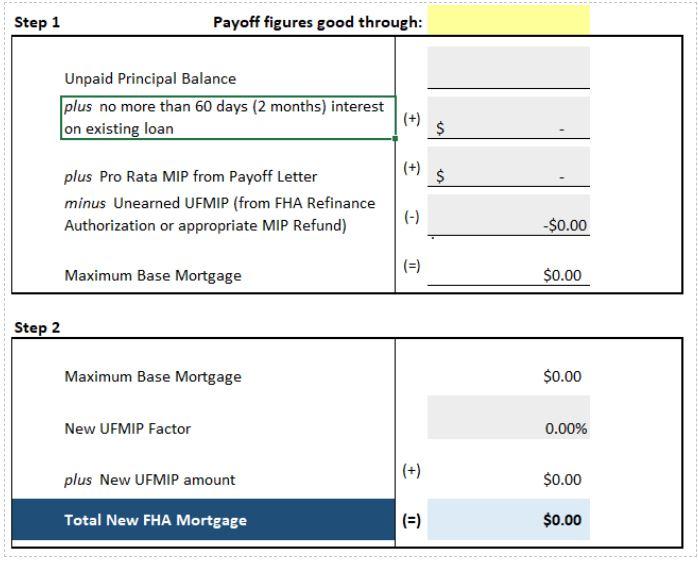

Even though fha streamline refinance changes changed last fall it is still possible to do an fha streamline without an appraisal. Find out the requirements benefits and today s rates before you apply. Calculation 2 b existing debt 1. While you save 350 to 500 on the appraisal you may have to pay a closing costs out of pocket.

Hence you will need to be prepared to pay your closing costs out of pocket or talk to your lender about whether they can cover your closing costs in exchange for paying a higher interest rate. Fha does not allow lenders to include closing costs in the new mortgage amount of a streamline refinance. These transactions can be made with or without an appraisal. To refinance an fha mortgage without an appraisal you must apply and be approved for an fha streamline.

Fha streamline refinance without appraisal maximum mortgage calculation worksheet exhibit 4 17 affiliated mortgage company effective with case s assigned on or after november 18 2009 borrower name. The advantages of a fha streamline refinance because you already have an fha loan you ll need fewer documents to refinance. If you do an fha streamline refinance without an appraisal you are not able to roll your closing costs into the loan. Streamline loans may be done with or without an appraisal.

Generally the streamline refinance mortgage amount may never exceed the statutory limits except by the amount of any new upfront mortgage insurance premium ufmip. Standard fha streamline refinances do not allow the borrower to roll roll closing costs into the new fha loan amount.