Five Year Term Life Insurance

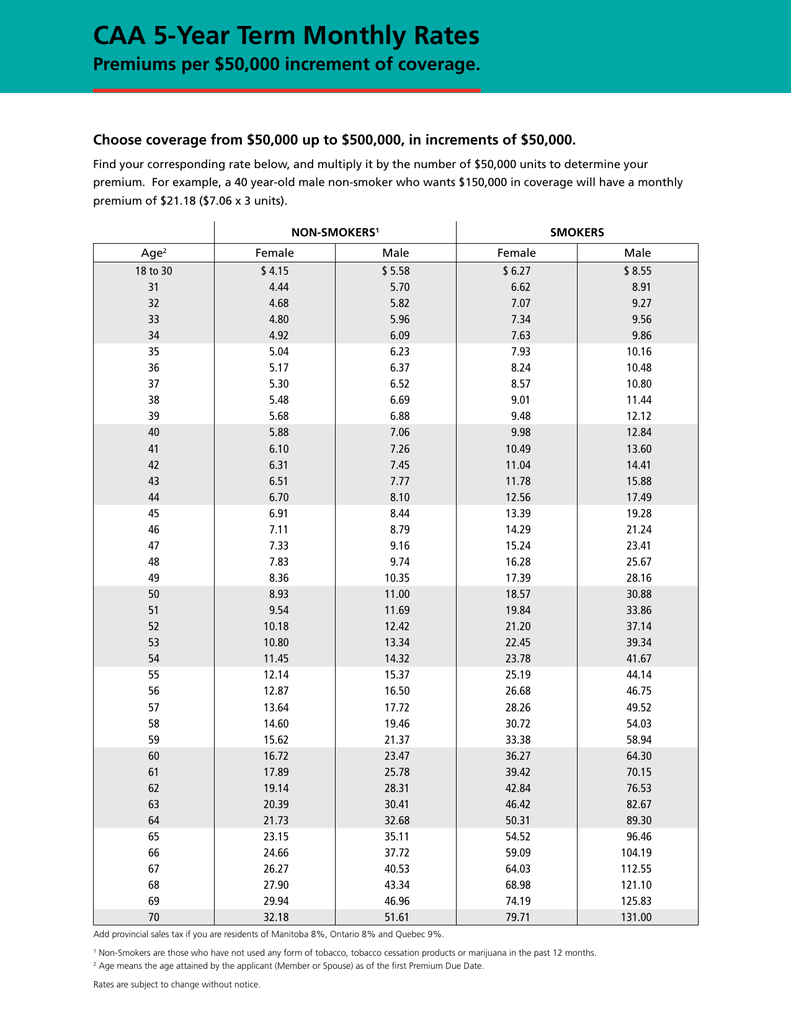

The plans listed above come with an optional term of 5 years.

Five year term life insurance. Others don t make that guarantee enabling the insurance company to raise the rate during the policy s term. 5 year term life insurance. Yet there are many people who opt for these short term plans rather than dealing with the uncertainty of a long term plan. Simply make your choices from the options below to get a quick quote.

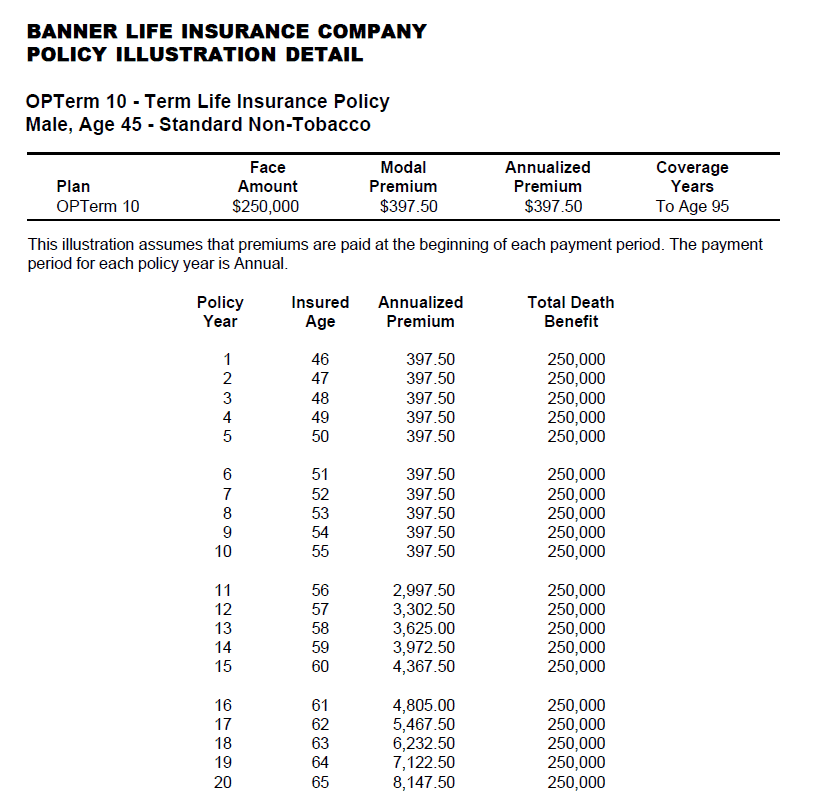

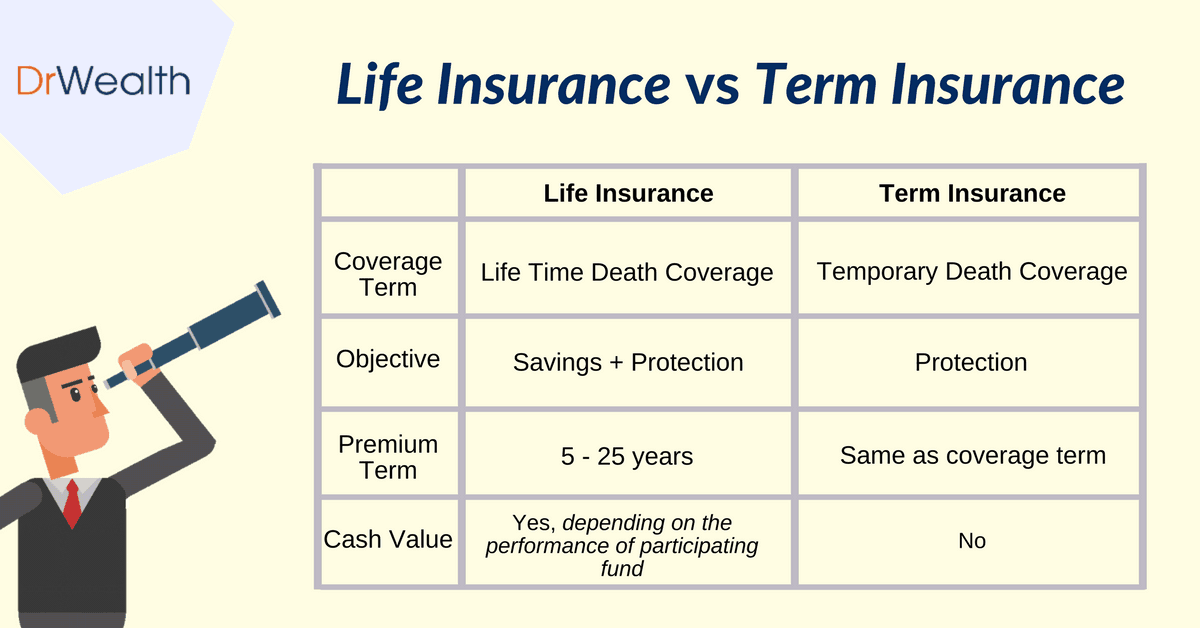

In other cases however the 5 year term life insurance premium increases at the end of the first 5 years and may increase every 5 years thereafter. So premiums for 5 year renewable term can be level for 5 years then to a new rate reflecting the new age of the insured and so on every five years. Other term life insurance lengths include 15 20 and 30 years. Lack of an insurance policy could have a huge impact on the lives of everyone surrounding us and a 5 year term life insurance policy acts as a great saviour during unforeseen circumstances.

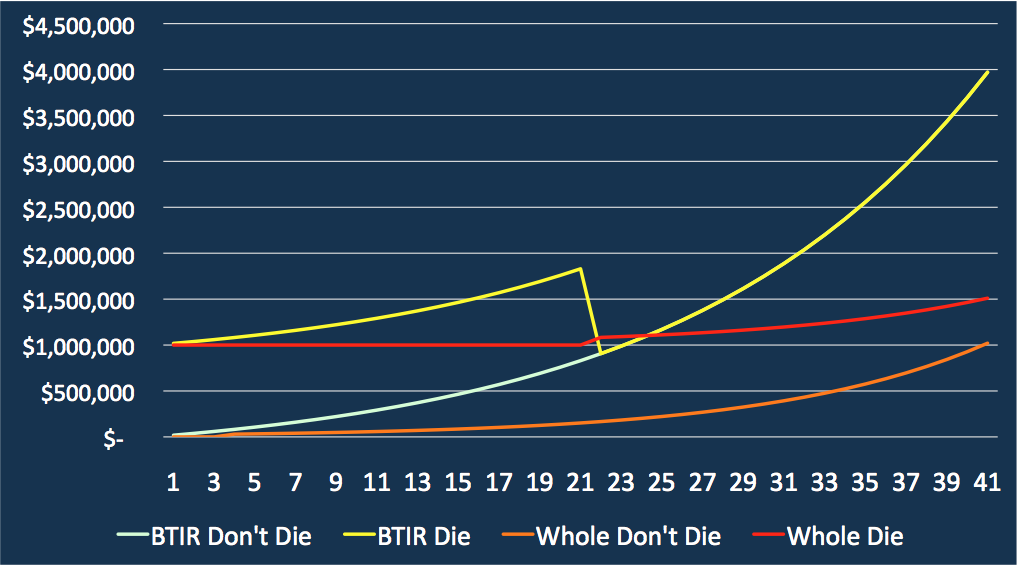

5 year term life insurance. Even if you only need a policy for 5 years most of the time it makes more sense to buy a 10 year policy because it s cheaper. 5 year term life insurance is designed to fulfill temporary insurance needs. The policy will renew at a higher premium until it expires at a given age age 85 for example.

Some longer term policies will guarantee that the premium will not increase during the term. If you re not sure how much term life coverage your family may need please try our needs calculator. When it comes to life insurance 5 years is a relatively short period of time. 5 year term life insurance is insurance that the premium stays level for a 5 year period and then increases.

This kind of life insurance policy is considered temporary life insurance. There are only a handful of life insurance companies that offer a 5 year term life insurance policies so it limits the companies you have to choose from. Short term obligations and debts can be covered by a five year term life insurance policy. Some insurers sell five year term policies which are ideal for those with short term temporary financial needs such as a mortgage or business loan or seniors inching toward retirement.

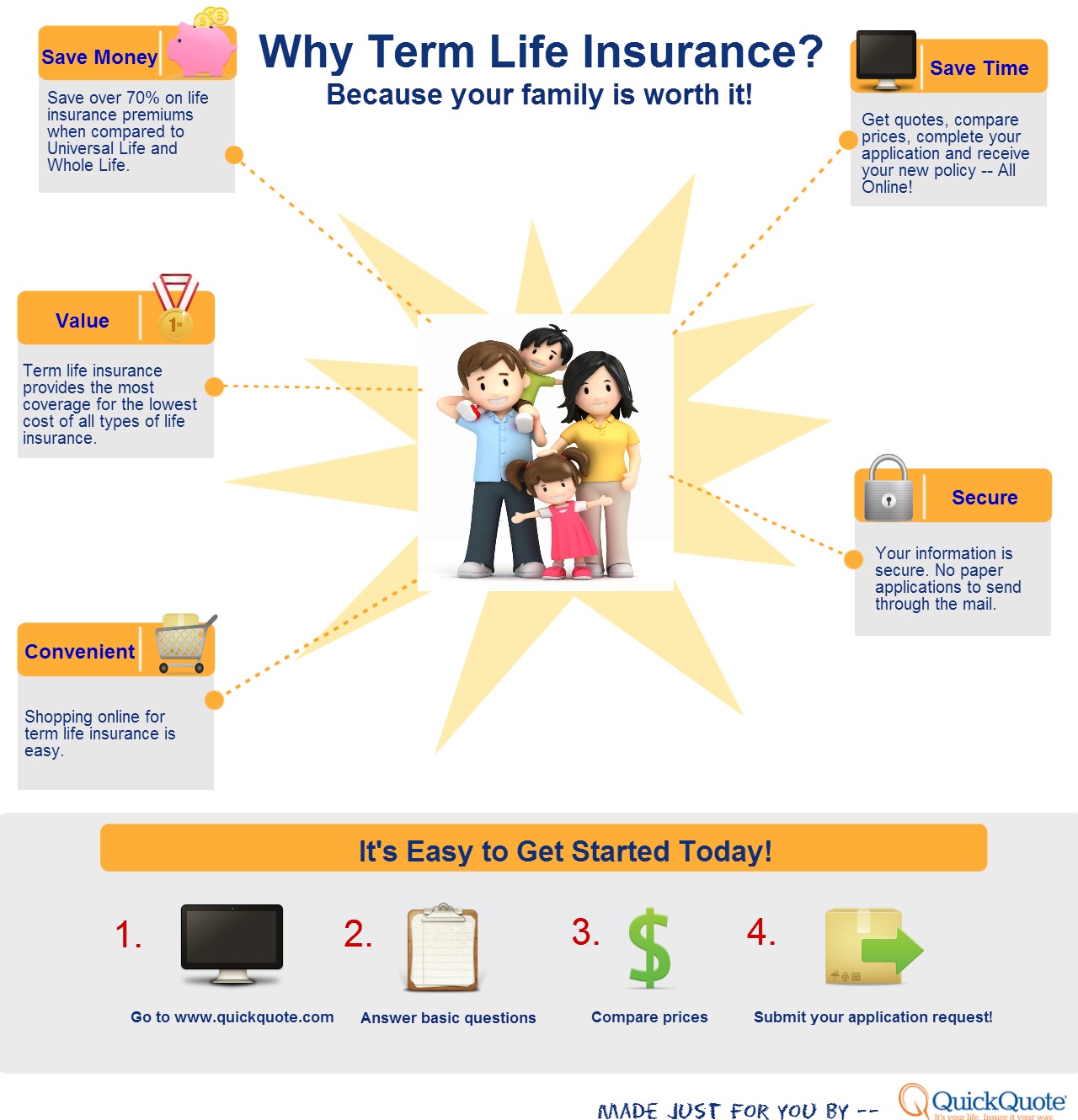

Term life insurance is flexible and affordable and provides protection for a set period of time. Get an instant quote. The premiums are low initially until the become very high in the later years. A 5 year policy offers short term benefits and is ideal in this fast moving world.

But a 5 year term is not the best short term life insurance policy. You can also find few five year term options but both the one year and five year term options are not nearly as standard as 10 year policies or some of the longer contract lengths.