Do Banks Do Reverse Mortgages

The short answer is yes.

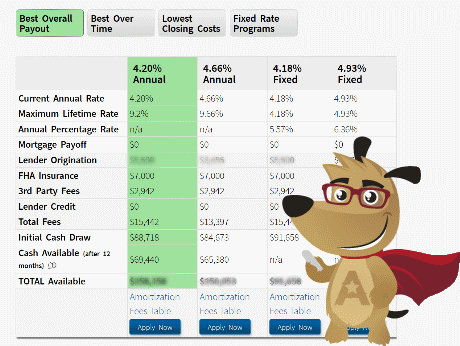

Do banks do reverse mortgages. Questions to ask a lender about reverse mortgages. The average fees in 2017 were as follows. Lenders also charge more because they claim they take on unique risks in that reverse mortgages aren t based on your income or credit score. How do reverse mortgages work.

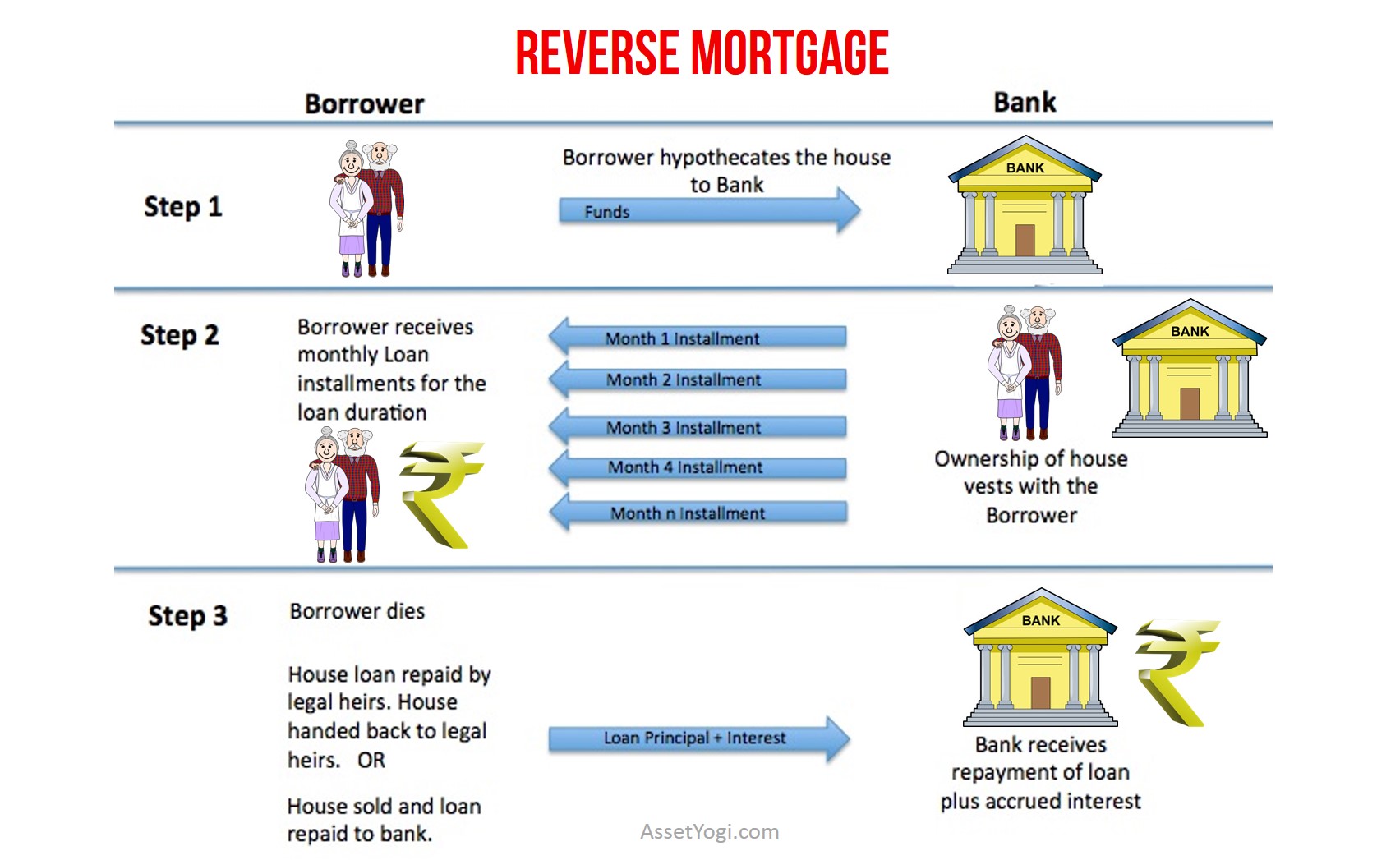

Here are the basic facts on reverse mortgages. Mortgage insurance is meant to protect lenders in case of. With 2 of the nation s largest banks out of the reverse mortgage business many homeowners who are cash poor and equity rich wonder if they can still get reverse mortgages. Property taxes and homeowners insurance to pay.

A mortgage broker is an intermediary who brings mortgage borrowers and mortgage lenders together but does not use its own funds to originate mortgages. Their obligation is to continue paying their property taxes homeowners insurance hoa dues etc. There are many banks that offer reverse mortgages although most of the major national banks such as wells fargo chase and bank of america do not offer them. Before getting a reverse mortgage ask your lender about.

More than eight years after bank of america exited the reverse mortgage industry people still ask if they do reverse mortgages. When we rated reverse mortgages in early 2017 the interest rates on offer for reverse mortgages ranged from 6 19 to 6 37 with an average rate of 6 25. How you can get the money from a reverse mortgage and if there are any fees you will have to pay. It s understandable considering bank of america is the second largest bank in the u s.

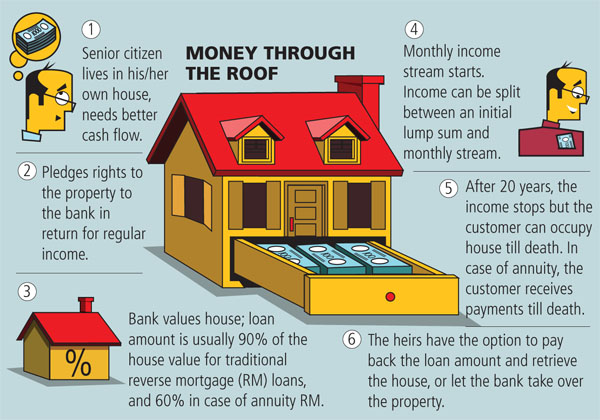

There are also varying fees charged on a reverse mortgage much as there are for a standard home loan. Costs associated with a reverse mortgage may be higher than a regular mortgage or other lending products. As long as they do that no payments are required. The hecm reverse mortgage is basically a home loan but it s designed to give seniors access their homes equity without taking on a mortgage payment or giving up ownership of the home.

A representative at one of these national banks may refer you to a loan originator outside the bank if you do inquire about a reverse mortgage at one of these institutions. What to look for in a reverse mortgage price. 7 while bank of america is no longer a reverse mortgage lender there are many other established lenders to consider.

.png)