Do I Need Permanent Life Insurance

Permanent life insurance with a term rider.

Do i need permanent life insurance. This type of policy is also known as permanent insurance as you can hold it your entire life. Cancel permanent life insurance. Since permanent policies have an investment component canceling is a little more complicated. Take a look at this list to see if life insurance is the right choice depending on where you re at in life.

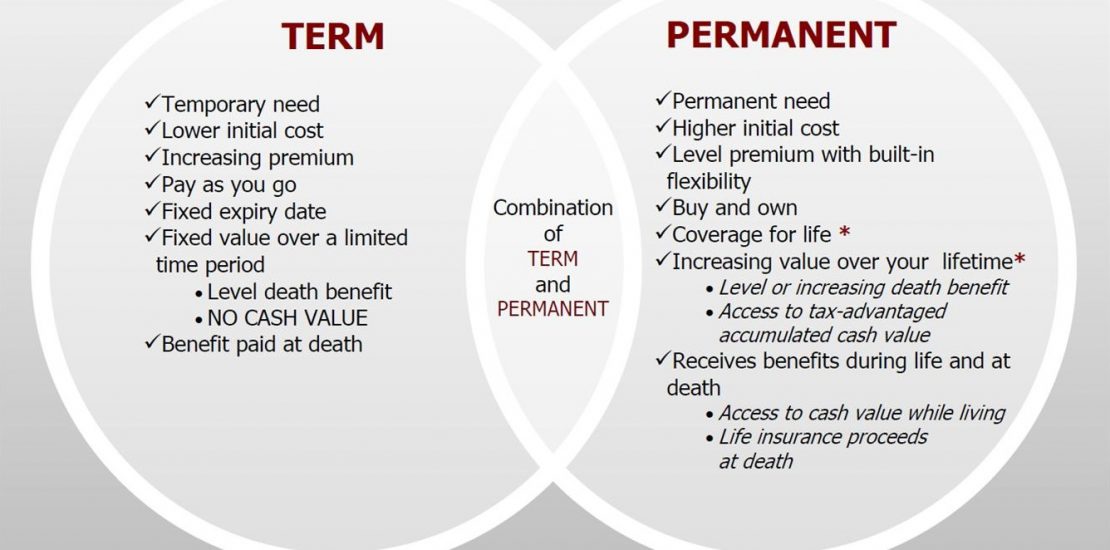

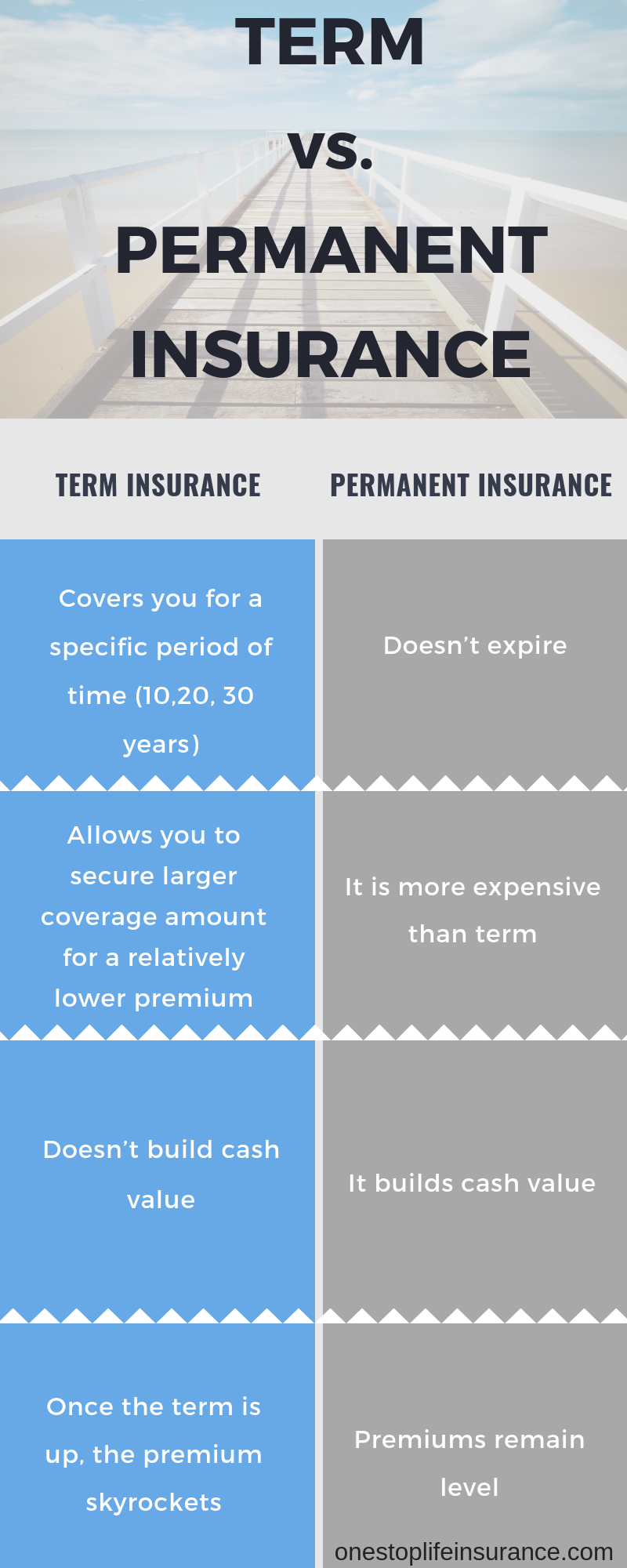

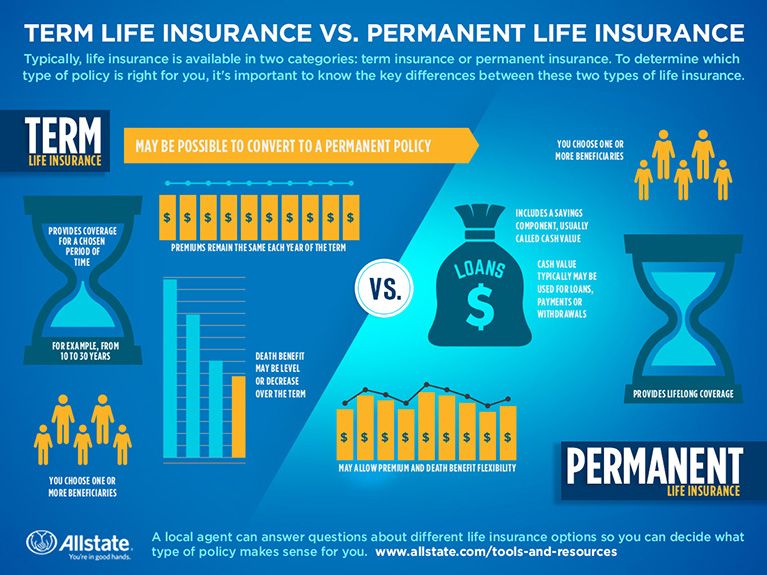

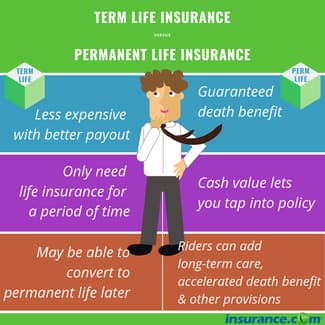

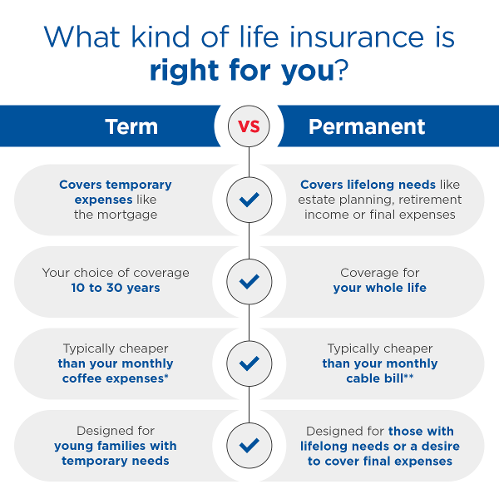

Term life insurance is more affordable than permanent insurance making it a good choice for young families starting out. An example would be life insurance for the benefit of a charity or to cover your final expenses. The types of permanent life insurance. So do you need life insurance or not.

Depending on your insurer s guidelines and how long you ve owned the policy they ll likely give you these options. You ll need to contact your insurer. With term insurance the policy lasts for a given period often 20 or 30 years and carries no cash. Premiums can sometimes be recovered by surrendering the.

His final estimated life insurance need is about 450 000. On average permanent plans cost around 5 10x more than a term plan so lower face amounts are much more common on permanent policies. Term riders aren t available for all permanent life insurance policies so you would need to confirm this before buying coverage. Permanent insurance is also the right choice for any life insurance policy that you want to be sure pays out even if you live to be 100.

If you re young and single there s no urgent need for life insurance because the only person you re looking out for is you. There are also convertible term policies that give you the option to convert to permanent life insurance without having to prove your insurability all over again. For example a premium payment that would net you a 500 000 term policy could only get you around 50 000 in permanent coverage. Term life insurance acts as a short term financial safety net.

You purchase a specific amount of coverage and the policy stays in effect for a set period of time usually anywhere from five to 30 years. You re young and single. We re here to help. A term rider acts like a term policy in that you can add coverage during years when you have greater financial obligations such as until your mortgage is paid off.

Jason might also want to figure income replacement into his policy says johanna fox turner a partner and vice president of fox co.

.jpg)