Durable Power Of Attorney Sign Tax Return

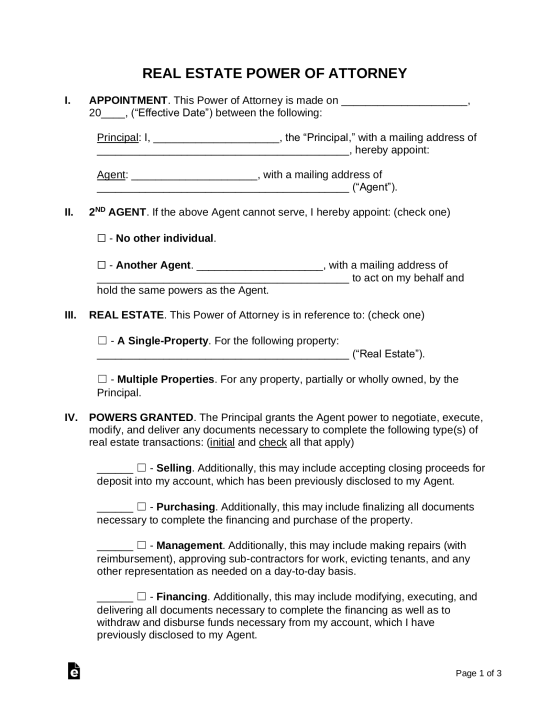

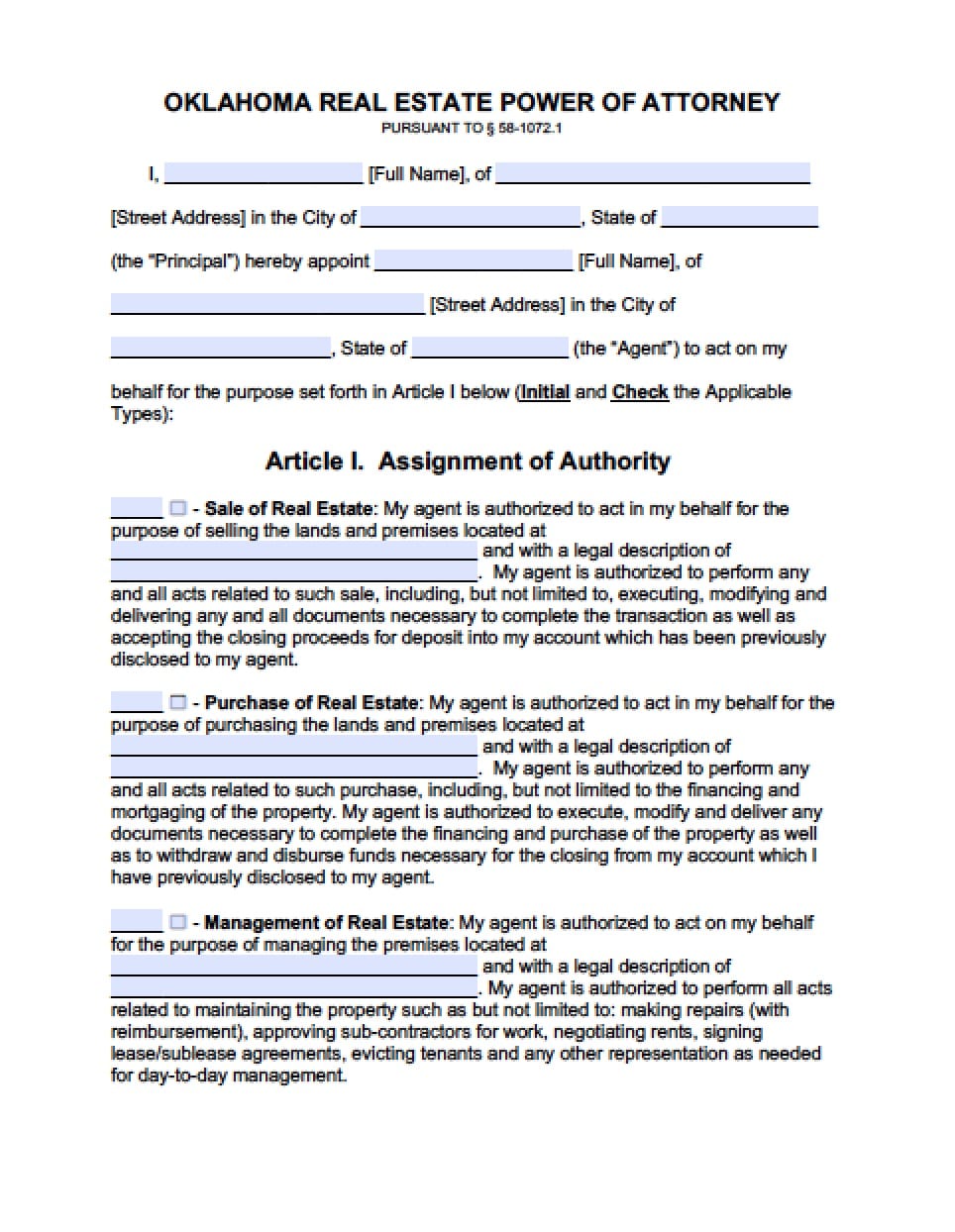

Filing the return you may be able to sign the tax return with a properly executed power of attorney.

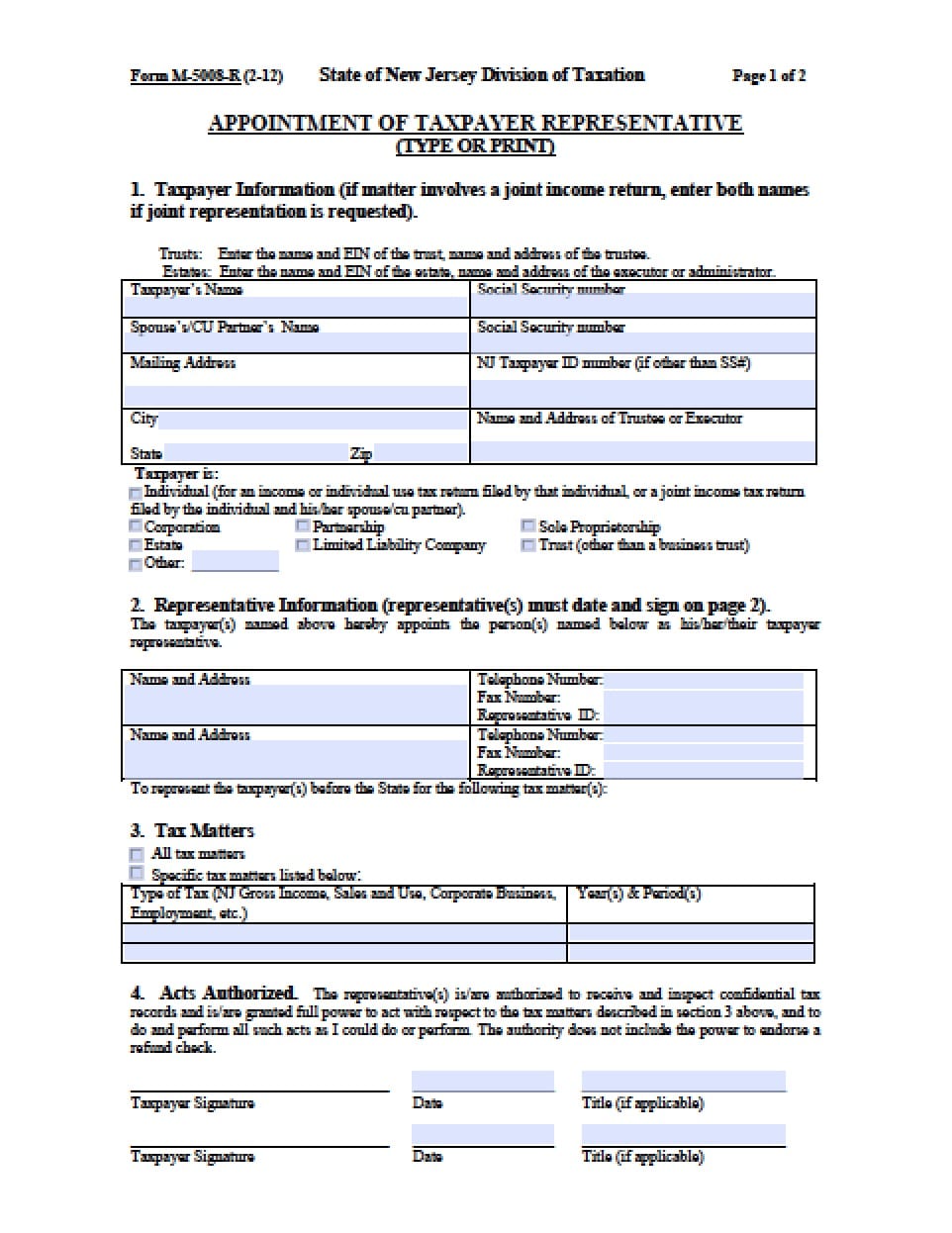

Durable power of attorney sign tax return. Otherwise you should sign the return and send it to your spouse to sign so that it can be filed on time. In the case of married couples filing a joint income tax return each spouse must sign a separate form 2848 naming a representative as power of attorney. Individuals estates or trusts. A power of attorney gives me authority to prepare and sign tax returns for my father.

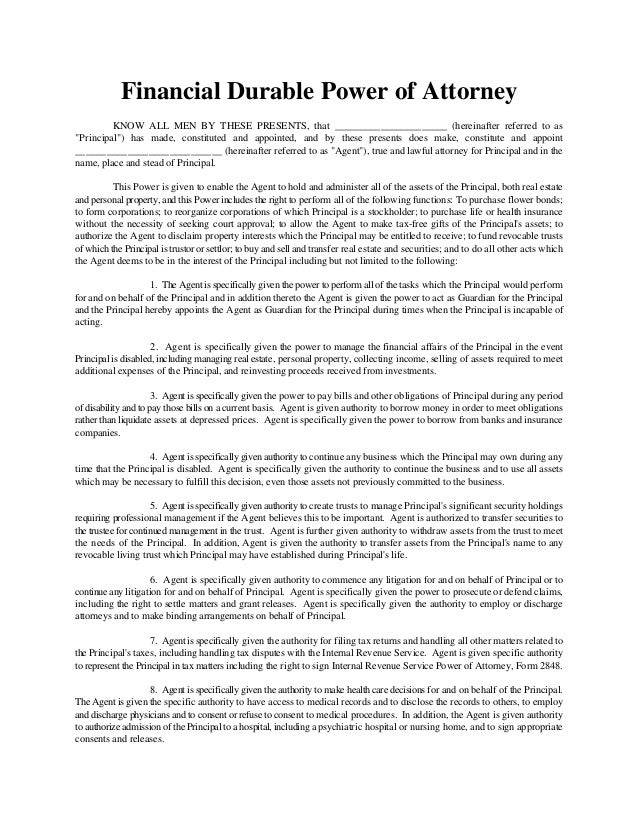

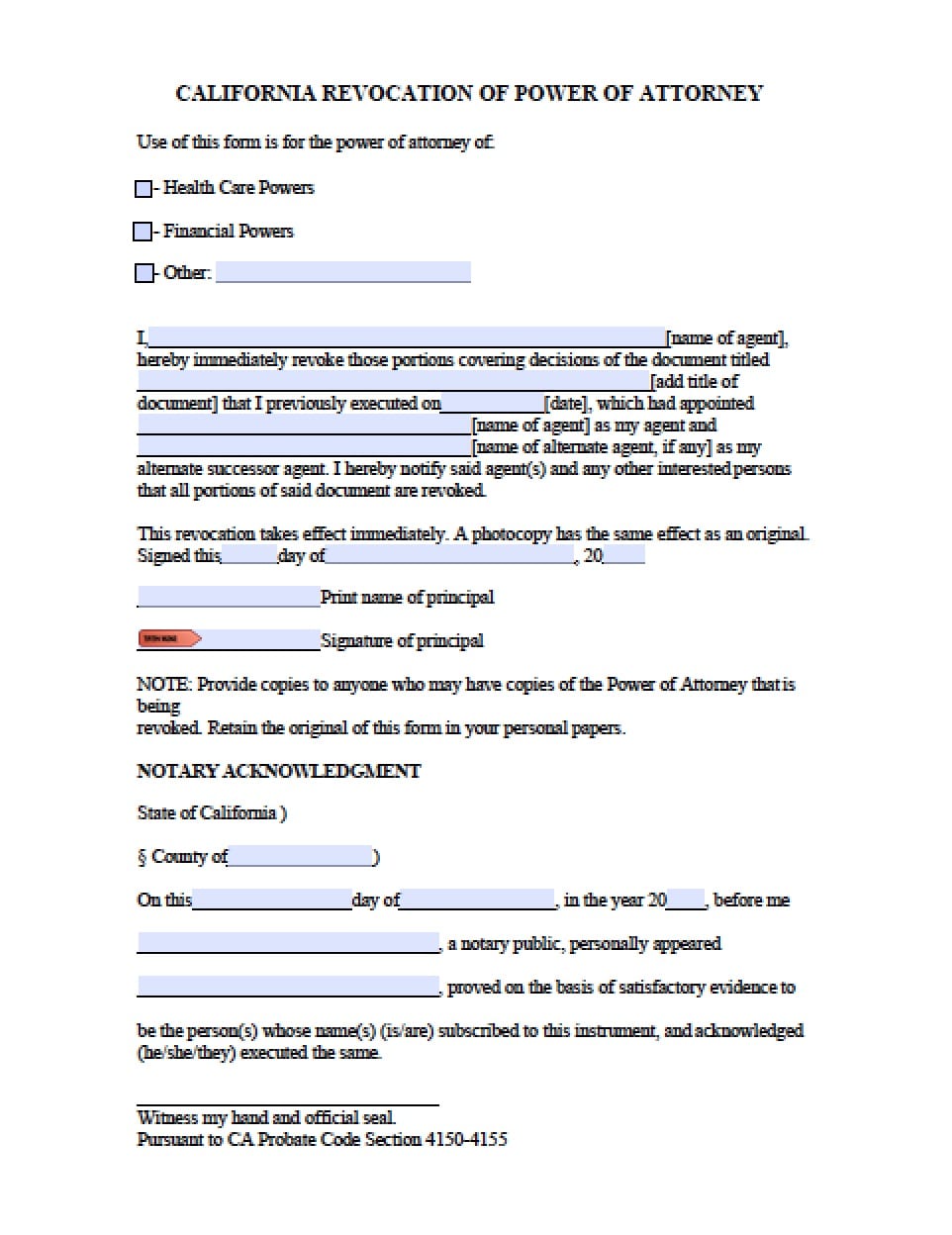

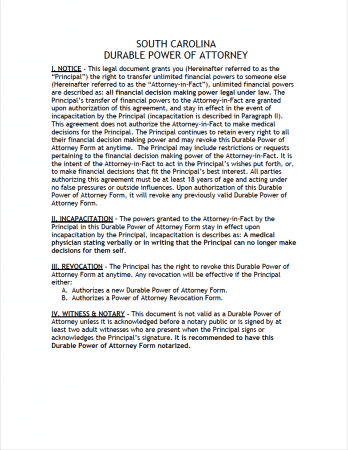

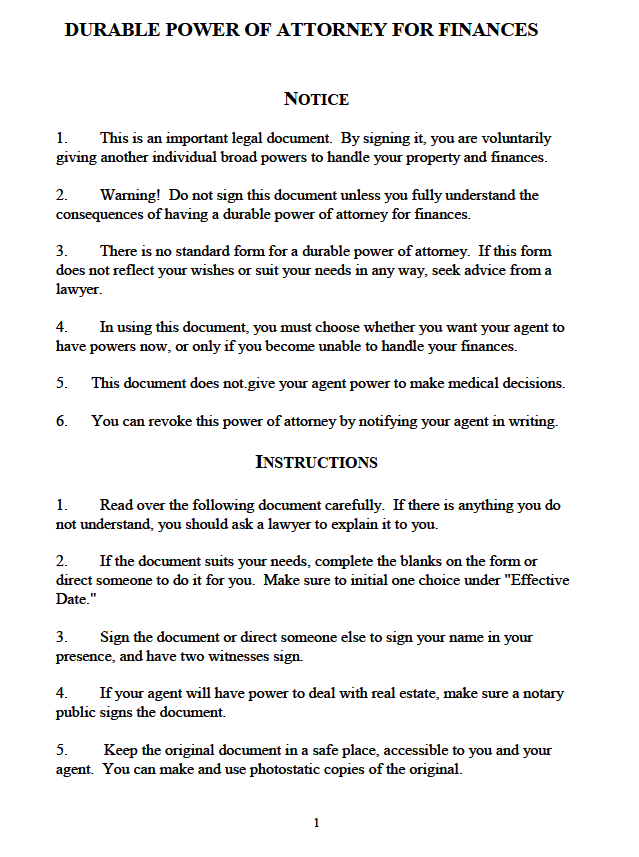

However it does not list specific tax related information such as types of tax or tax form numbers. A complete form 2848 is sufficient to meet this condition. Someone holding power of attorney normally can act on behalf of a taxpayer when dealing with tax officials for example during an audit. John elm a taxpayer signs a non irs durable power of attorney that names his neighbor and cpa ed larch as his attorney in fact.

The irs says that as my father s poa agent i can submit a tax return if he s unable to sign the return due to. The power of attorney grants ed the authority to perform any and all acts on john s behalf. Tax information authorization for more information. I searched for the answer on google and on the turbotax site p p i found 3 completely.

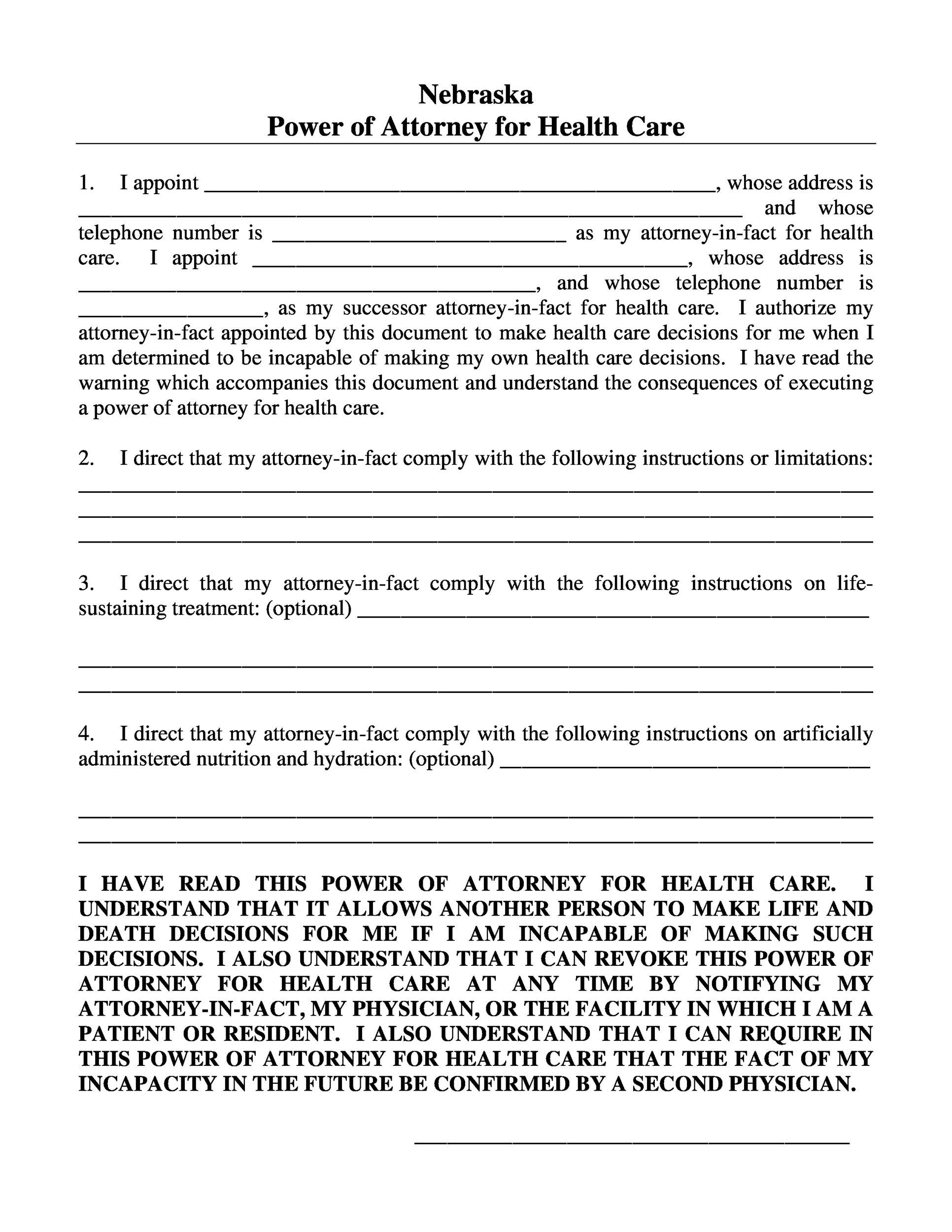

Sign your tax return s only if incapacitated or continuous absence from the u s receive but not endorse your refund check s. How do i sign 1040 as power of attorney for my mother with dementia. When an income tax return is signed by a representative a copy of the power of attorney must accompany the return. Just e file the return and bypass the issue.

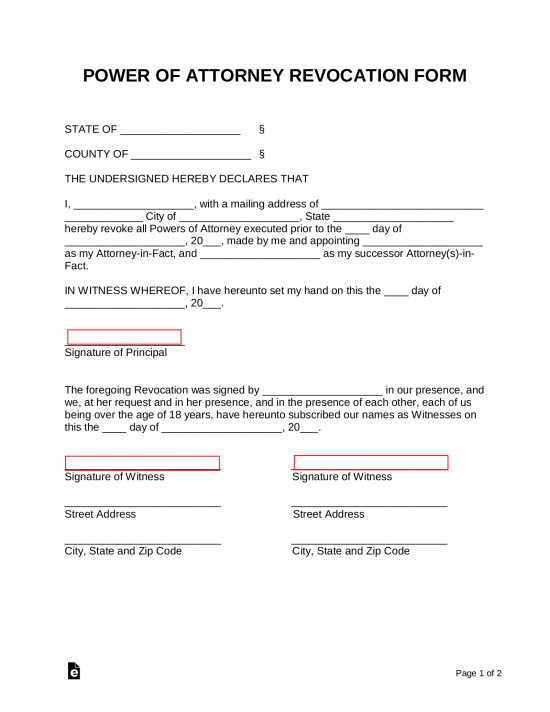

A simple way to grant another person the power to sign your federal tax return is to file irs form 2848 power of attorney and declaration of representative. Visit power of attorney vs. When a representative signs a return it must be accompanied by a poa authorizing the representative to sign the tax return. Disease or injury but i m confused about exactly how to use turbotax for this.

Do i sign as third party or in sign here section. Power of attorney forms. Cpas and eas for fort worth. However there are only three circumstances when he is allowed to sign the tax return itself.

Data typed into the online form may be saved. Or sign your name poa and mail it in. Form 2848 is available on the irs website irs gov. A spanish language version of the form is available as well.

If the taxpayer is physically unable to do so because of disease or injury if the taxpayer will be outside the united states for at least 60 days before the.

/2848POAandDeclarationofRepresentative-1-abe9639bbc8f4daf86889da0803dce58.png)