Easy Working Capital Loans

The 5 best working capital loans of 2020.

Easy working capital loans. This credit line is available as a draft to the business whenever funds are needed for the operations. They re meant to cover gaps in immediate working capital and meant to be paid back quickly. Best for bad credit. Apply for business working capital loans from mission valley capital.

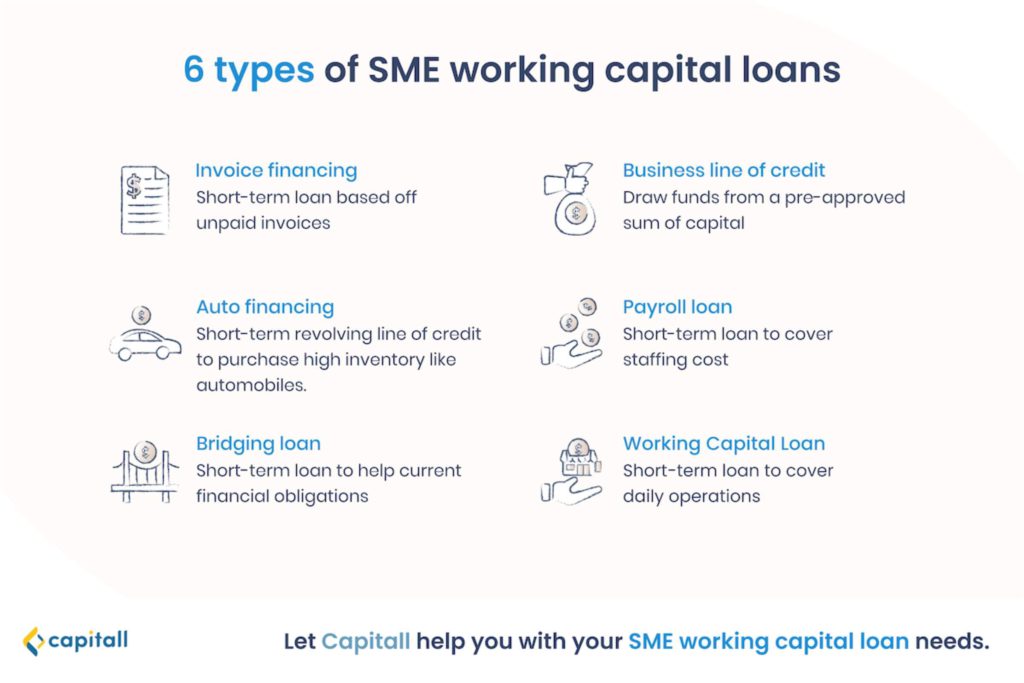

These are our picks for the best working capital loans for 2020. Working capital loans are designed to address such needs of businesses. Learn more and compare options up to 5 million. A working capital loan is a loan taken to finance a company s everyday operations.

A working capital loan is a loan used to finance everyday financial operations for small businesses that are lacking current cash flow. Working capital loans also offer lower borrowing amounts than business term loans and sba loans. Finance your daily business operations or boost your cash flow. Remember working capital loans work best for short term needs as opposed to investments that may take years to produce results.

A working capital loan can be exactly what you need to take your business to the next level from payroll support and supplies to emergency repairs and advertising campaigns. Working capital loans are usually taken when a company requires cash asset liquidity to cover day to day operational expenses so that they can put more money into expansion. 48 hours loan processing. They are used to provide working.

Working capital loans are not used to buy long term assets or investments. Working capital loans are running loans which are also called credit line extended to the businesses for a certain period. Because they don t have many requirements and are easy to obtain they have higher interest rates than other loans. Business capital loans for small and medium business fast and easy working capital loans.

This loan type is used to sustain business growth on a daily basis to help you visualize long term success. A working capital loan is designed to cover short term business expenses such as payroll and inventory. They re not meant for long term investments or expenditures. Working capital loans are used for short term needs rather than long term needs assets or investments.

A working capital loan is a loan used by a company to finance its everyday operations such as payrolls rent and inventory.

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)