Homeowners Insurance Rates Increase

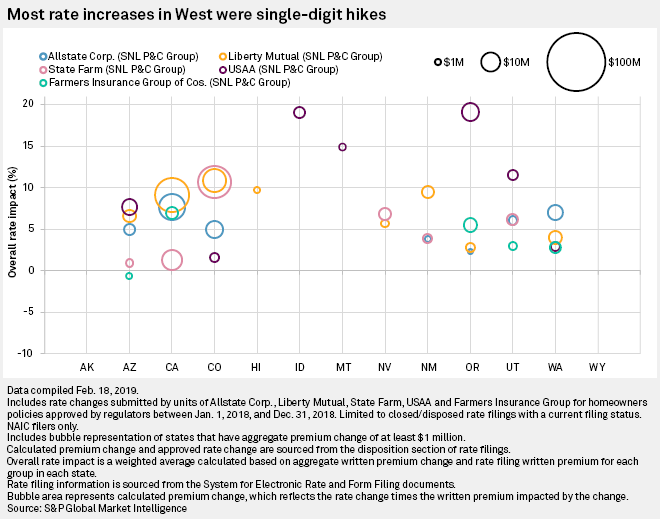

The company also found that 31 states have seen home insurance rates outpace the cumulative rate of inflation 9 14 within the past five years according to rate filings.

Homeowners insurance rates increase. While many factors go into calculating your rate where you live is chief among them. Homeowners insurance rates in north carolina have not increased since 2012. That s an average 1 703 home insurance rate increase. This situation is to be expected to a certain extent.

Other states including california hawaii and massachusetts don t allow the practice. Rates will rise an average of 4 8 statewide after state officials settled a legal dispute with north carolina insurers who originally sought an 18 7 increase. Typically any increase should amount to only a few. In the table below you can find homeowners insurance rate increases for each state and washington d c.

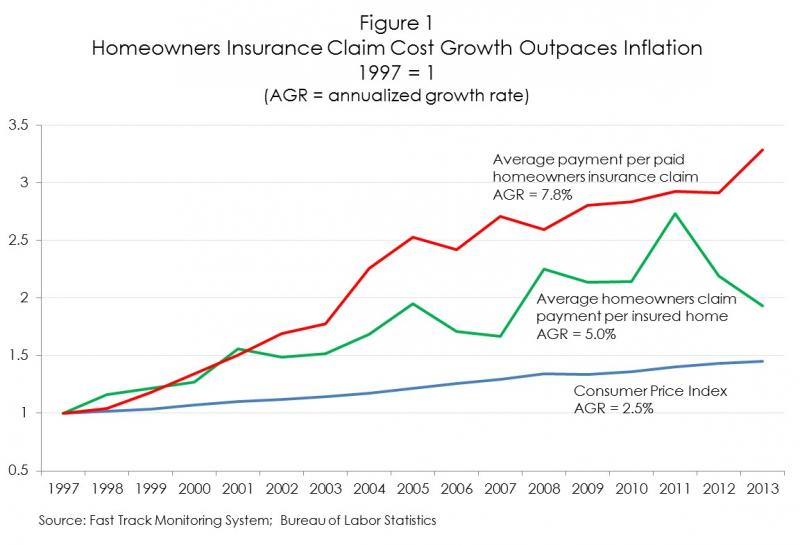

Your insurance score went down. Homeowners in states that are prone to hurricanes hail storms tornadoes and earthquakes tend to pay the most for home insurance. Increasing their homeowners insurance deductible from 500 to 1 000 will decrease homeowners insurance premiums by 13 and increasing it from 500 to 5000 will decrease premiums by a third. If your inspector determines that your home s structure is in bad condition and could use some upgrades you may see a rate increase on your next bill.

If you have homeowners insurance you may wonder if your rate will fluctuate from one year to the next. The increase for bad credit varies by state. Rates can increase in some states due to an insurance claim but that could be because these states have lower premiums to begin with. There are a variety of factors that can make your insurance rates change usually as an increase.

The states are ranked starting with highest dollar amount increase. Ohio and indiana homeowners with poor credit pay 270 more than those with excellent credit. A renewal notice comes in the mail indicating a rate increase for your homeowners insurance policy. Rates go up a bit although never at the same pace auto insurance does.

Average home insurance cost by state. States with higher premiums could have less of a rate increase due to claims. Updated march 6 2019. To calculate the rate increases we compared average rates from the naic reports from 2015 and 2016 for ho 3 policies for each state.

That will change in october.