How Insurance Deductibles Work

What deductible should i choose for car insurance.

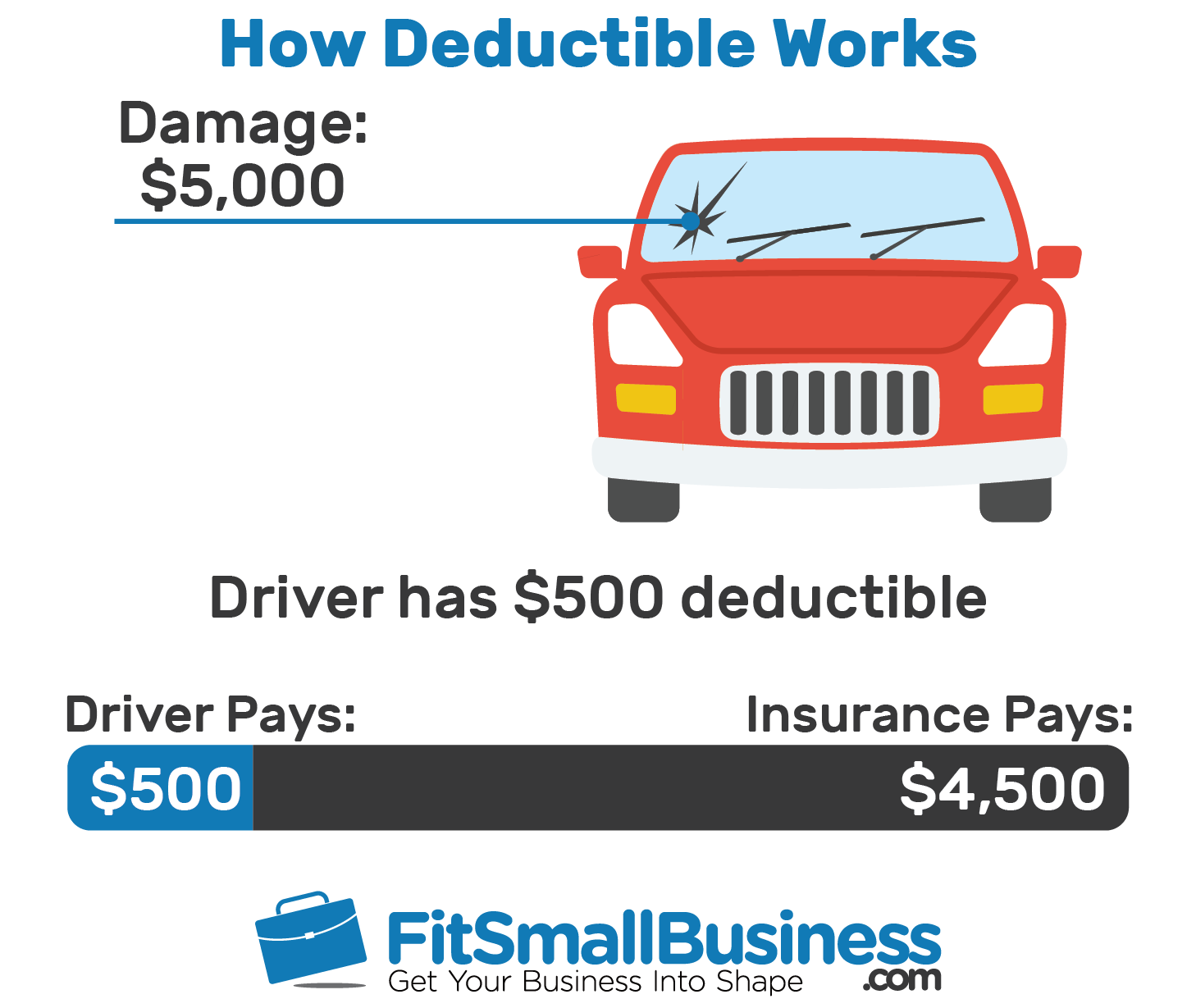

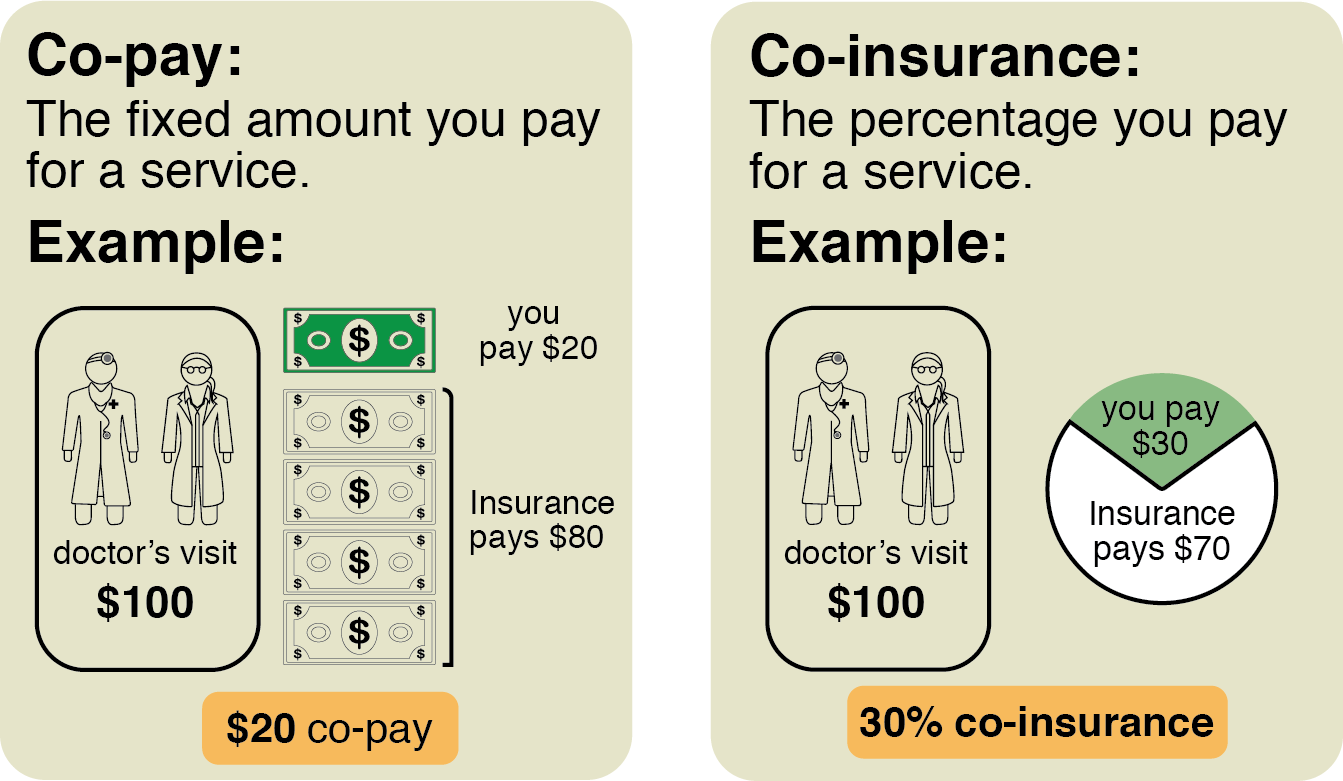

How insurance deductibles work. Deductibles premiums copayments and coinsurance are important for you to consider when choosing a health insurance plan. A deductible is the amount you pay for health care services before your health insurance begins to pay. Many providers offer customizable plans allowing you to choose a deductible that suits your budget and your pet s needs. If a health insurance policy has a 50 co pay and a 500 deductible then the insured is responsible for paying for the first 500 of health care costs under his policy.

However this cost sharing method works differently according to the type of insurance. Here you ll learn the basics of insurance deductibles including what they are how they work and how much they cost. If your plan s deductible is 1 500 you ll pay 100 percent of eligible health care expenses until the bills total 1 500. You can compare health plans and see if you qualify for lower costs before you apply.

Health insurance deductibles are not the same thing as co pays. You may pay less money by having low premiums and a deductible you rarely need. Understanding the what and how of deductibles is vital to understanding how your insurance policies work. High deductible insurance plans work well for people who anticipate very few medical expenses.

Most people who apply will be eligible for help paying for health coverage. An insurance deductible is the amount of money you will pay an insurance claim before the insurance coverage kicks in and the company starts paying you. Most types of insurance including home rent auto and health insurance incorporate a number of deductible options in every contract. Deductibles work exactly the same for all coverages.

Learn more about how car insurance works. The most common deductible our drivers choose is 500 but know that there s never a wrong choice when selecting a deductible. So if you have a 5 deductible on a 300 000 home then 15 000 would be the amount of the deductible holder would be responsible for before the insurance policy would kick in said davis. After that you share the cost with your plan by paying coinsurance.

Types of deductibles there are two types of deductibles on home insurance policies. Deductibles are what you can expect to pay out of your pocket before the insurance steps in to pay for damages knowing about hidden deductibles in your policy will save you a lot of time money and frustration if anything terrible happens to your home.