Homeowners Insurance Quotes Pa

Average cost of homeowners insurance in pennsylvania.

Homeowners insurance quotes pa. 1 features are optional and a part of the enhanced package. Max deductible rewards that can be used in event of a claim is. In most cases earthquake and flood damage are excluded. We quote by text text us at 610 617 8850.

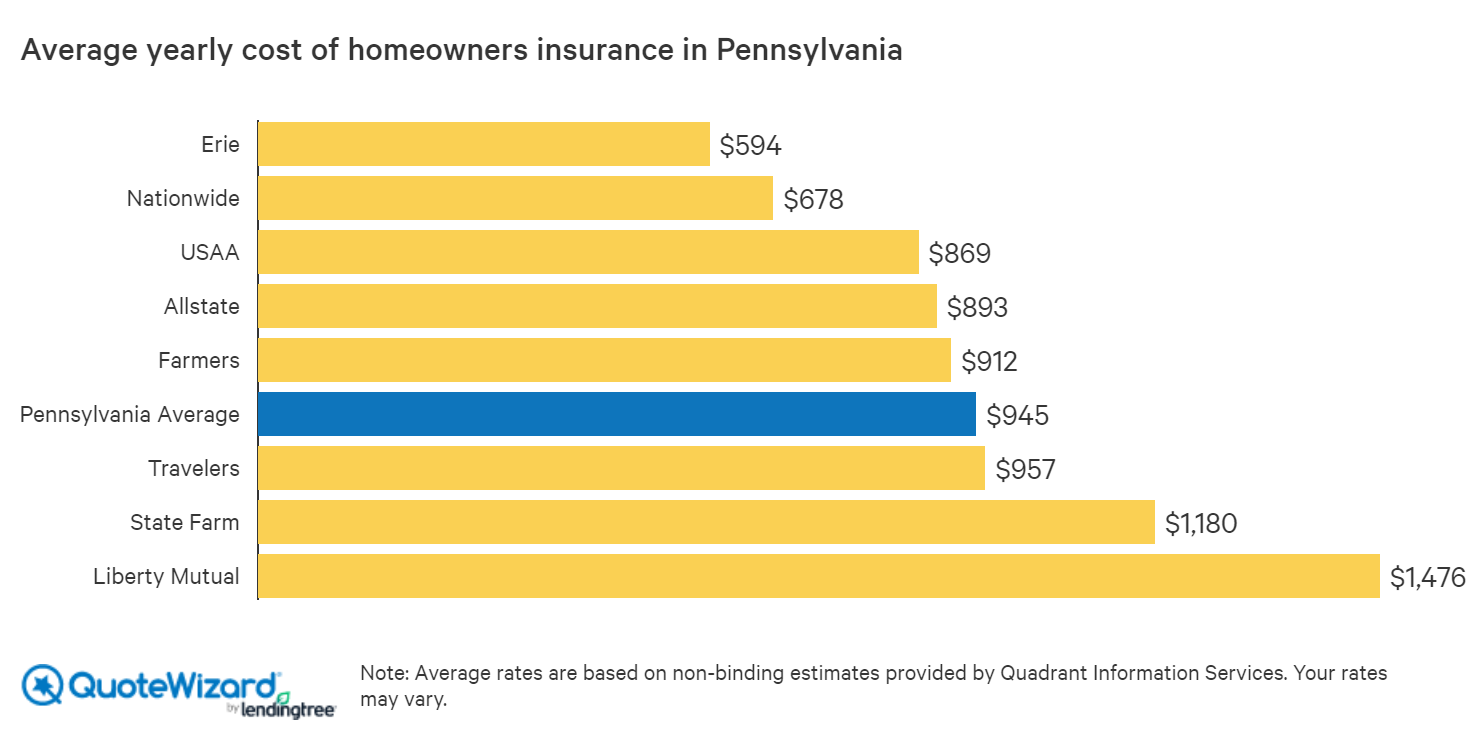

To help you get your best rates and the right coverage for your needs we studied the home insurance market in pennsylvania to find the best companies. Text us for a quote. And with our home insurance discounts members can save even more on our affordable rates. Pennsylvania homeowners insurance rates by zip code.

Call us for an immediate pennsylvania homeowners insurance quote. Make sure to ask for quotes for the same coverage so you can compare them. This is the most common type of homeowers policy. Not only can buying homeowners insurance be extremely simple but the best homeowners insurance company in pa also allows you to apply online for coverage in minutes.

The average premium for homeowners insurance in pennsylvania is 931 according to data sourced from the national association of insurance commissioners. We gathered thousands of quotes from 11 providers across pennsylvania to find the best homeowners insurance in the state. Not available in all states. Harsh winters bring frozen pipes ice dams and snow.

Hot summers mean thunderstorms and hail that unexpectedly can damage property. Nationwide s pennsylvania home insurance can cover you in the event of theft certain natural disasters water backup damage and more. 2 this feature applies to one claim every five years. In today s post i will cover which insurance company is the best for homeowners in pa how their product works as well as how to get pennsylvania home insurance quotes online.

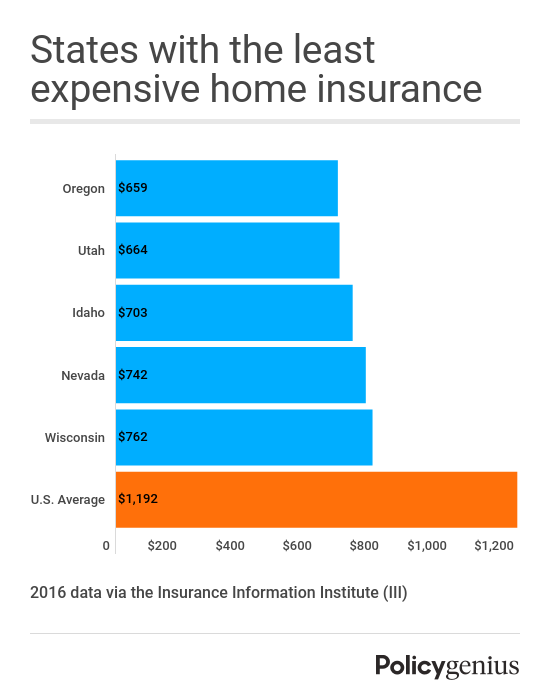

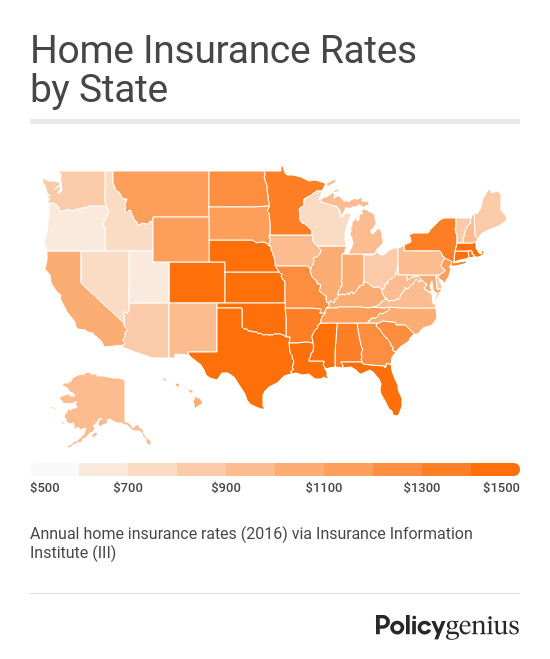

The most affordable rate we found for typical homeowners in pennsylvania was 640 per year. Get a pennsylvania home insurance quote and start protecting your home today. Subject to terms conditions and availability. Average for a homeowners insurance premium is 1 211 so pennsylvania residents can expect to pay less for their home insurance than in many other states.

Once you re ready get quotes from at least three home insurance companies. Liberty mutual understands the needs of pennsylvania homeowners and offers customized homeowners coverage to fit your specific situation. 3 must add enhanced packaged within 60 days of policy inception to earn an additional 100 reward at the 1st annual renewal. Pennsylvania homeowners face many challenges throughout the year.

Look at the features of our pa homeowners insurance programs. The average cost of homeowners insurance in pennsylvania is 945 a year which is 270 below the national average of 1 215. This policy type protects your home against all perils except ones that are specifically excluded. In addition to price we compared each company s customer service quality policy offerings and range of online tools.