Dwelling Homeowners Insurance

Homeowners insurance is designed to protect you from the things that can damage your home personal property or hurt you financially.

Dwelling homeowners insurance. Dwelling coverage is usually subject to limits and deductibles. Hazard insurance describes a type of home insurance coverage that covers catastrophes like fires and severe storms. Your deductible is the amount you ll pay out of pocket toward a covered claim. Average home insurance cost by state.

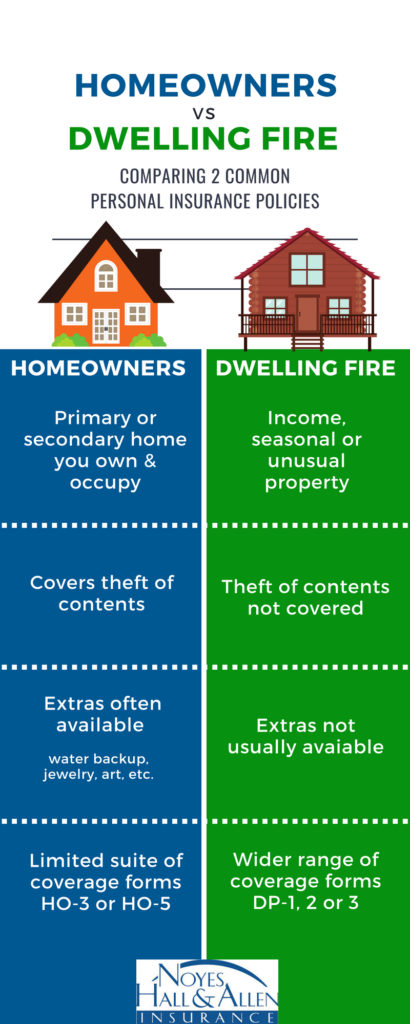

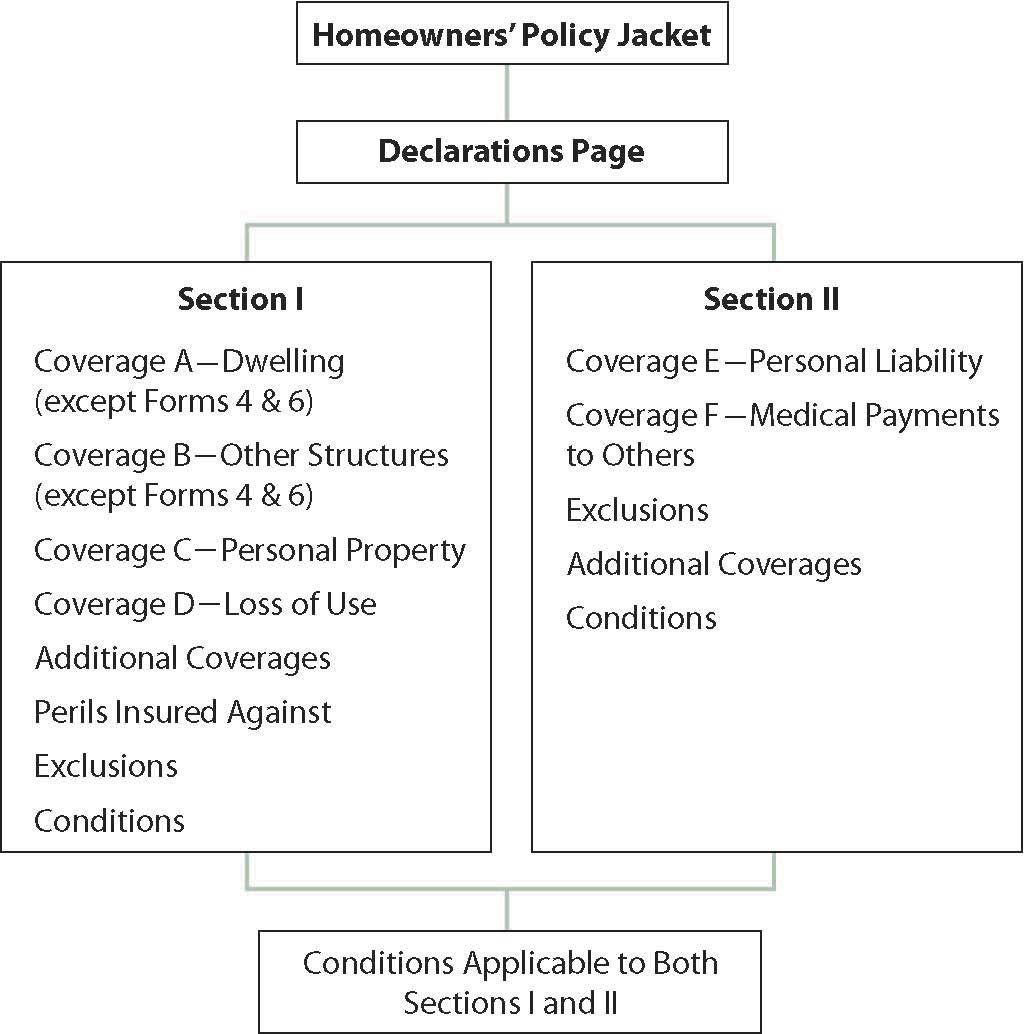

If you own a home and rent it out you need a specific type of homeowners insurance called dwelling fire or landlord insurance. Plus standard policies cover injuries that occur on your property and lawsuits against you such as someone suing you because they were hurt at your home. There are important limitations on coverage in homeowners insurance policies depending on the cause of damage or the location of your home and some types of damage aren t covered at all. There are different kinds of homeowners insurance policies so it s important to understand what homeowners insurance is and how a homeowners policy actually works.

An item located on a property that is appealing but potentially hazardous especially to children. Your limit is the maximum amount that your homeowners insurance policy will pay toward a covered loss. Coverage for damage from earthquakes for example may be available by adding it to a homeowners policy for additional premium or by purchasing a separate policy. 1 with our guaranteed replacement cost coverage you re covered even if you need to rebuild your entire home.

2 1 about sixty percent of homes are undervalued and potentially underinsured by 17 according to marshall swift boeckh a leading provider of building cost data to. Need to speak with us. While many factors go into calculating your rate where you live is chief among them. Contact a licensed agent to get a quote for this kind of policy.

Damage to your home from things like hail strong winds smoke and fire are all considered to be in this category. Many homeowners don t realize that actual cash value policies subtract for wear and tear and depreciation. You can reach a homeowners insurance sales agent at 800 841 2964. When you buy homeowners insurance you choose your dwelling coverage limit.

Homeowners insurance coverage is an important responsibility of owning a home as it adds a layer of financial protection for what may be you and your family s biggest investment. Attractive nuisances can lead to expensive injuries and pricey lawsuits. Homeowners in states that are prone to hurricanes hail storms tornadoes and earthquakes tend to pay the most for home insurance.