Does A Cash Out Refinance Cost More

Another hidden cost of cash out refinancing is that you might have to pay private mortgage mortgage pmi again.

Does a cash out refinance cost more. It s not a free refinance though your lender will either charge you a higher interest rate or add the closing costs to your new loan balance which costs you more money. In most cases the cash comes in the form of a check or wire transfer to your bank account. So if you owe 150 000 on your mortgage and use a cash out refinance to borrow another 50 000 you re paying closing costs of 3 6 percent on the entire 200 000. One of the big drawbacks of a cash out refinance is that you pay closing costs on the entire loan amount.

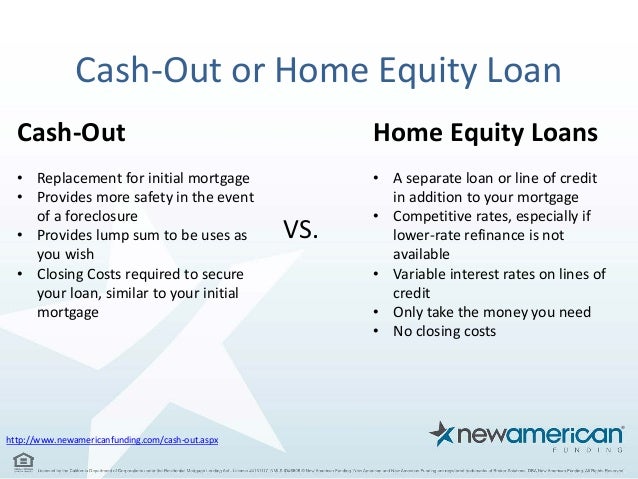

In this case the amount of cash you can get is limited to 240 000 minus 200 000 to pay off your current loan minus the 10 000 in costs for a net cash out of 30 000. Use it to pay for college tuition home improvements or to buy a vacation. Step 4 consider a no closing cost refi. Home equity loan vs.

If you re low on cash. Learn more about a traditional refinance. A heloc or cash out mortgage refinance. Consider a no closing cost refinance.

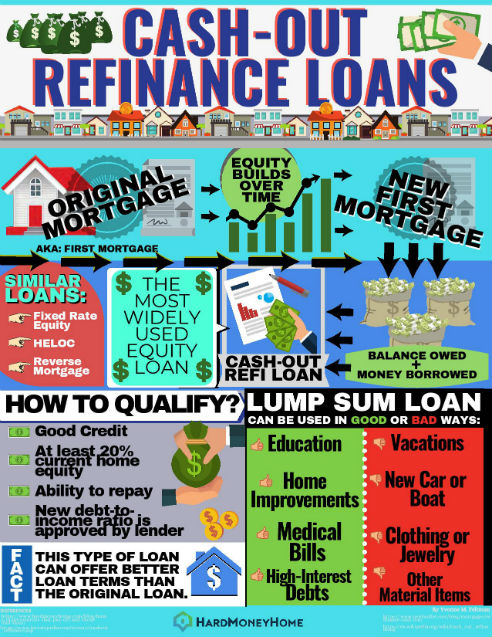

A cash out refinance will happen when you replace an existing home loan by refinancing with a new larger loan. Plus you re going to have to pay interest on the cash that you get out in addition of course to the mortgage amount which can add up to thousands of dollars over the life of the loan. By borrowing more than you currently owe the lender provides cash that you can use for anything you want. Closing costs are typically 2 to 5 of the mortgage that s 4 000 to 10 000 for a.

Private mortgage insurance is required if you have less than 20 equity or more than 80 ltv in your home so many homeowners pay it at the beginning of the loan term. A traditional refinance might be a good option if you re looking for a lower interest rate or a shorter term. Disadvantages of cash out refinancing. How cash out refinancing works.

It s a low cost way to get the most our of your home. A cash out refinance is similar to a regular refinancing of your mortgage in that you re going to have to pay closing costs. You ll pay closing costs for a cash out refinance as you would with any refinance. If you do a cash out refinance for 250 000 on a new 30 year mortgage and are able to drop that interest rate from 4 5 down to 3 your payment will go down to about 1 054 a month again before.

Take advantage of the equity in your home.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)