Factoring Accounts Receivable

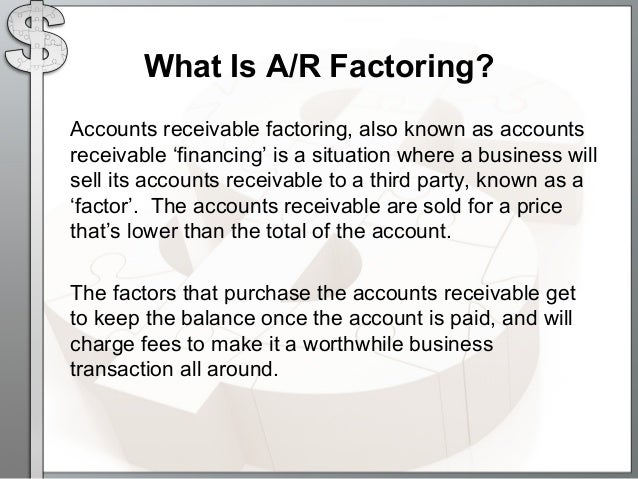

Accounts receivable factoring is sometimes called invoice factoring it refers to the process of selling your unpaid invoices accounts receivables to a business lender or a factor for a discount price.

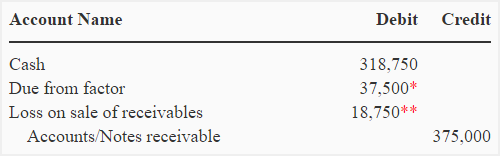

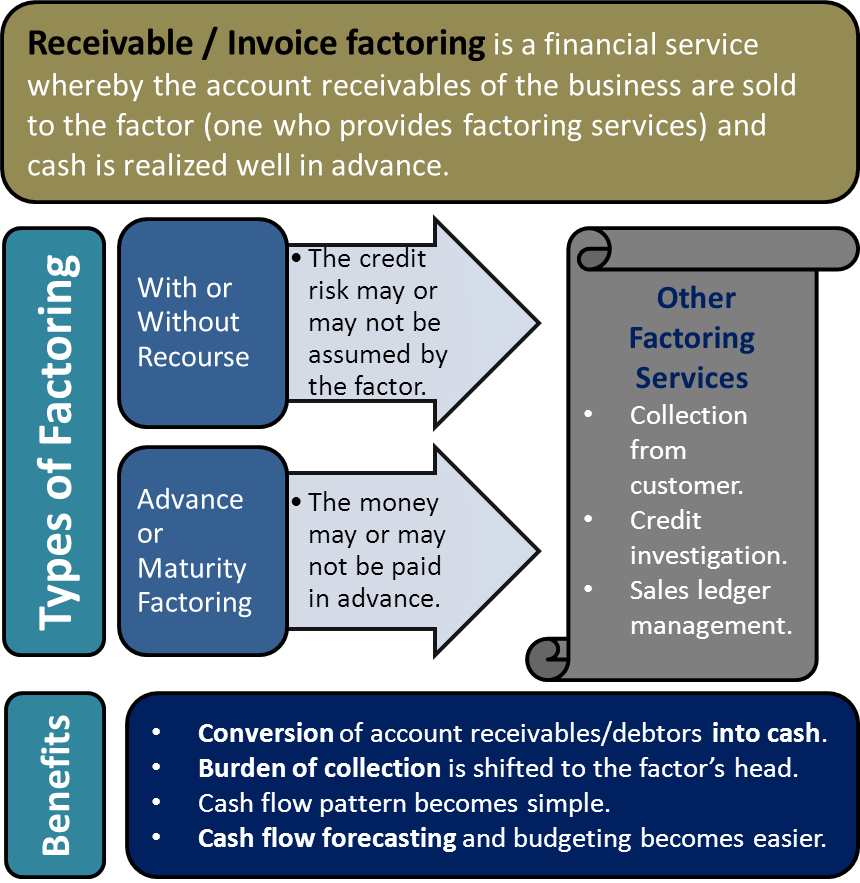

Factoring accounts receivable. Factoring company collected 247 000 by november 15 20x8. As far as all accounts receivable were collected in full factoring company will pay retailx ltd the retained amount of 42 500. Factoring helps a business convert its receivables immediately into cash instead of waiting for due dates of payment by customers. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount.

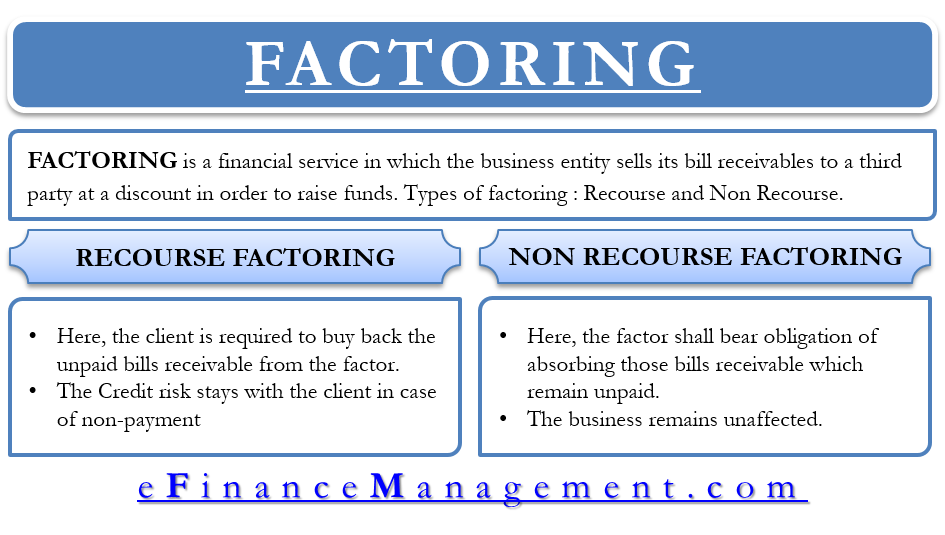

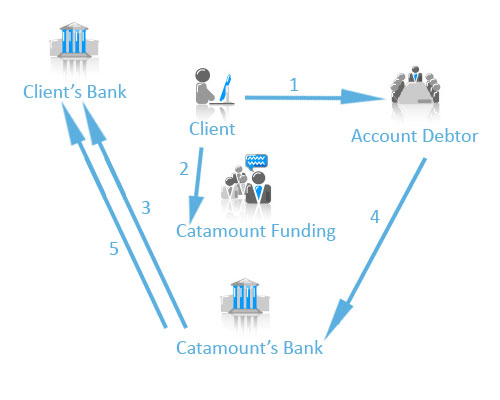

Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier. Factoring is the sale of accounts receivable of a company to a financing company at discount.

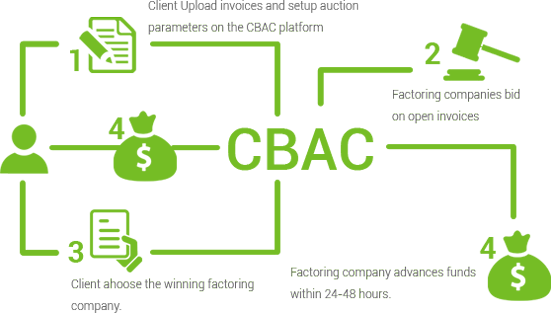

What is accounts receivable factoring. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. What is accounts receivable factoring.

Accounts receivable factoring popularly known as factoring is a financial instrument used by businesses for raising quick money by selling their accounts receivable to another specialized company known as factor it is also known by the name of invoice factoring. The financing company which buys the receivables is called a factor. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Factoring company collected 225 000 by november 15 20x8.

Accounts receivable factoring is a simple way to get paid faster typically within 24 hours for outstanding receivables. Factoring is a common practice among small companies. Factor finders specializes in flexible accounts receivable factoring solutions for both start ups and long established companies. Companies allow their clients to pay at a reasonable.