How Does Auto Insurance Deductible Work

/what-is-a-property-damage-claim-527109-V1-98ea220c8cf842708c2e789bfcdce113.jpg)

Homeowner renters and auto insurance deductibles usually apply to every claim with no annual maximum.

How does auto insurance deductible work. How do car insurance deductibles work for different types of coverage. How do car insurance deductibles work. How does an auto insurance deductible work. Car insurance deductible in a nutshell.

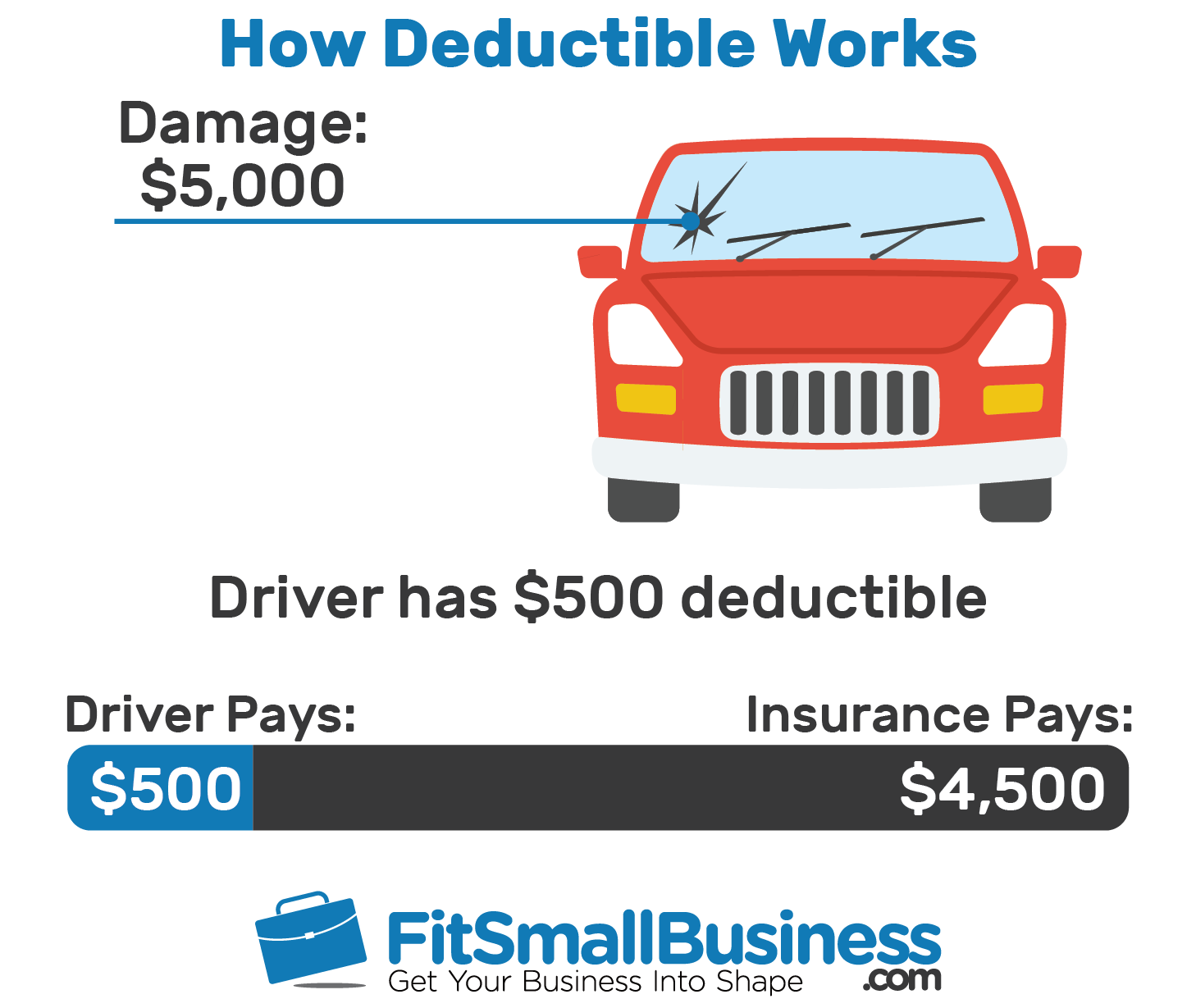

A deductible on a car insurance policy is a pre determined amount of money that you must pay before your insurer will cover a claim. The auto insurance deductible is the amount of money you will first be responsible for before the insurance company begins to cover costs. Unlike health insurance there are no annual deductibles to meet when it comes to auto insurance. Comp collision coverage apply to a number of incidents in which the vehicle is stolen or damaged by a crash fire vandalism and other situations.

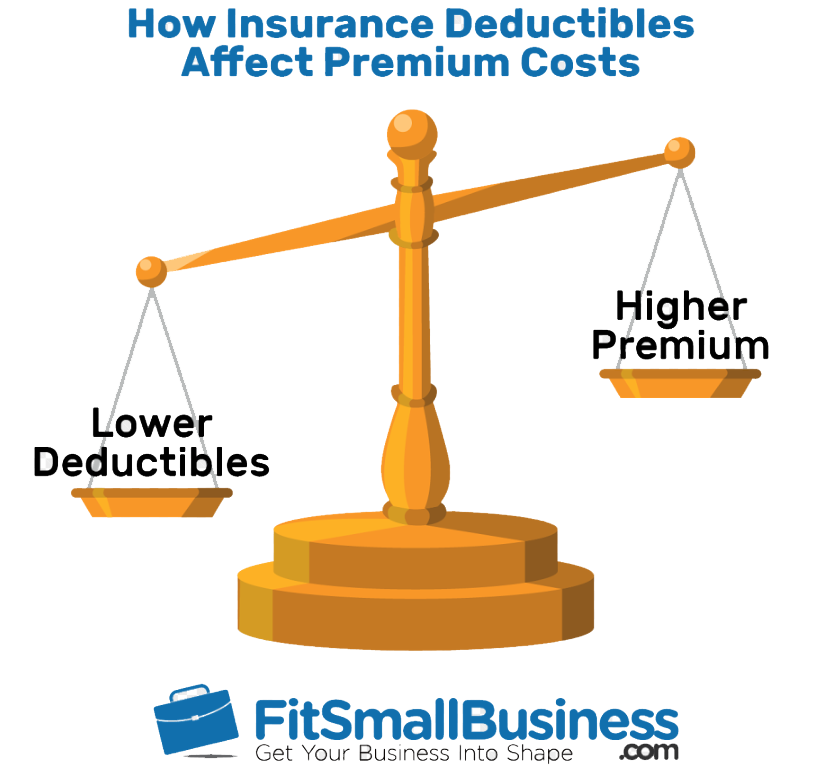

How does your car insurance deductible work. Car insurance deductibles work the same way for all coverage types and you will get to choose your deductible amount for each for example you could choose a 500 deductible for comprehensive insurance which tends to have lower premiums but 1 000 for collision which usually costs more. Let s say you have collision coverage with a 250 deductible and are involved in a car accident that causes 2 000 of damage to your vehicle. A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss.

Deductibles generally only apply to comprehensive and collision coverage if you purchased them. Before we explain how car insurance deductible works we first have to define what it is. It is really simple to understand with an example. If you file a claim with your insurance company then you will pay the 250 collision deductible and your insurance carrier will pay the remaining 1 750 towards your car repairs.

How does car insurance work. Unlike health insurance auto insurance policy deductibles are normally on a per claim basis meaning you would have to cover these costs every time you file a claim. Whether you re looking to save a few bucks on your insurance premium or you want to reduce your out of pocket risk in the event of an accident it s. Essentially when you have a car accident and file a claim your claim payment will be reduced by the amount of your deductible.

Your car insurance deductible is usually a set amount say 500. Car insurance works as a safeguard for your financial well being and your vehicle in case of accidents theft or other incidents beyond your control. The damage to your car comes up at around a 3 000. You re responsible for your policy s stated deductible each time you file a claim.

In most cases you pay the deductible at the time of service. Your car insurance company can pay for vehicle repairs medical expenses and damages or injuries you cause to another driver.

/GettyImages-113809074-6a59540e09ce460e88b49a81fdc601b3.jpg)