Homeowner Insurance Policy

Attractive nuisances can lead to expensive injuries and pricey lawsuits.

Homeowner insurance policy. An item located on a property that is appealing but potentially hazardous especially to children. Dwelling protection one of the basic coverages of a homeowners insurance policy is dwelling protection which helps cover the structure of the home in which you live e g. A type of insurance that can be added to a renter s or homeowner s insurance policy to temporarily cover the value of the gifts a couple receives when they get married. However there are a few distinct types of policies that you can buy.

The house s foundation walls and roof dwelling protection may also help cover other structures that are attached to the home such as a garage or a deck against certain risks. Homeowners insurance and financial standing. It also offers retirement planning. A policy form represents the type of property insurance needed for a homeowner condo owner or renter.

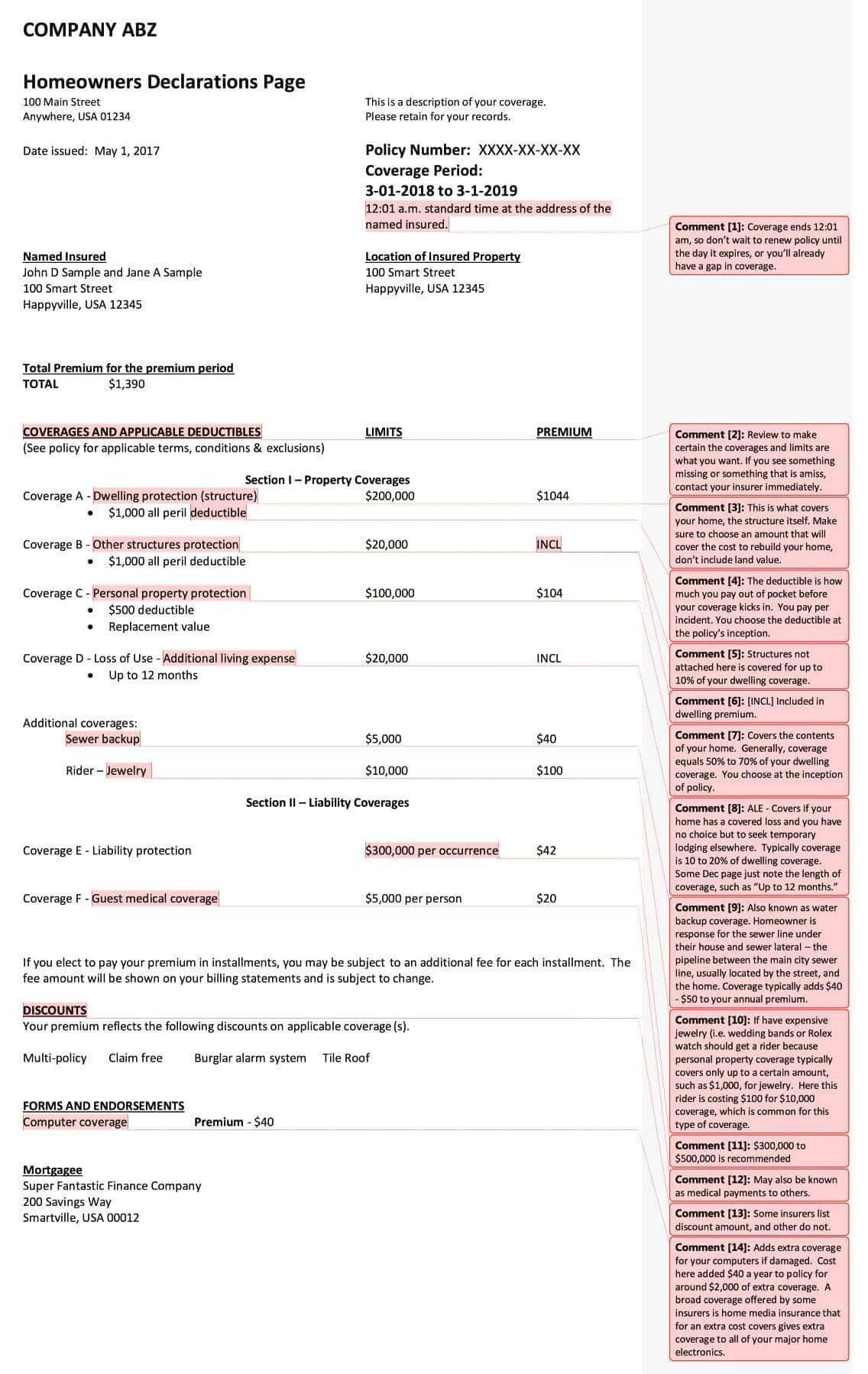

Types of homeowners insurance policies. The geico insurance agency can help you get the affordable home insurance coverage you need. We also offer insurance policies for owners of second homes and vacation homes. Every standard homeowners insurance policy has the same basic coverage but some companies provide more comprehensive coverage and additional protection at a better value than others.

If you currently carry homeowners insurance elsewhere you may gain even more savings by switching. In addition to homeowners policies erie sells auto insurance life insurance and policies for motorcycles boats and recreational vehicles. A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage from fire smoke theft or vandalism a falling tree or damage. Combining your home and auto insurance policies could save you time and money.

This way you your family and your guests are protected wherever you go. Get a homeowners insurance quote. Finding the right home insurance coverage starts with knowing what kind of policy form you need. Every insurance policy is different so you ll want to read yours carefully to make sure you understand what s covered.

/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)