How Long Can A Bank Hold A Deposit

Reasonable is not specifically defined.

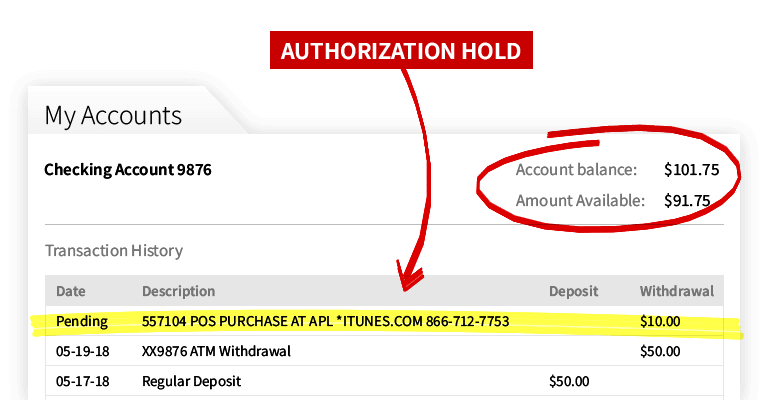

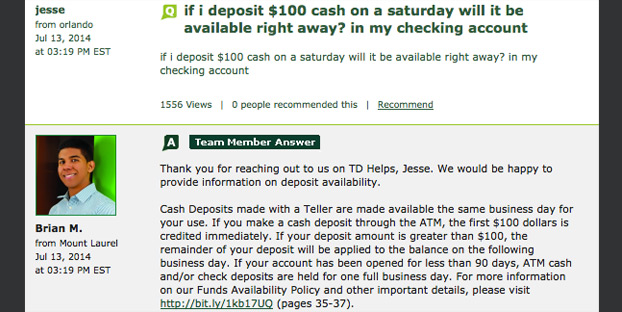

How long can a bank hold a deposit. The same rule that let banks hold your money for nine days also says that direct deposit has to be made available to the customer the same day. Banks may hold deposits into accounts of new customers. After the check has cleared the full amount will be available for withdrawal. Two banks have told me that federal law prohibits any deposits from being held more than seven business days my bank is holding 90 of the funds for 11 business days.

While i am no expert i d. 4 remember that business days are monday through friday excluding holidays so five business days means seven calendar days or more if there s a federal or state holiday in the coming week. Deposit holds typically range from 2 7 business days depending on the reason for the hold. The number of days the bank holds these.

Five business days or so is a typical hold time but longer holds are possible. They can let you walk away with cash immediately when you make a deposit but they almost always place a hold on deposits that can last for several business days. What is a business day. That funds will be available.

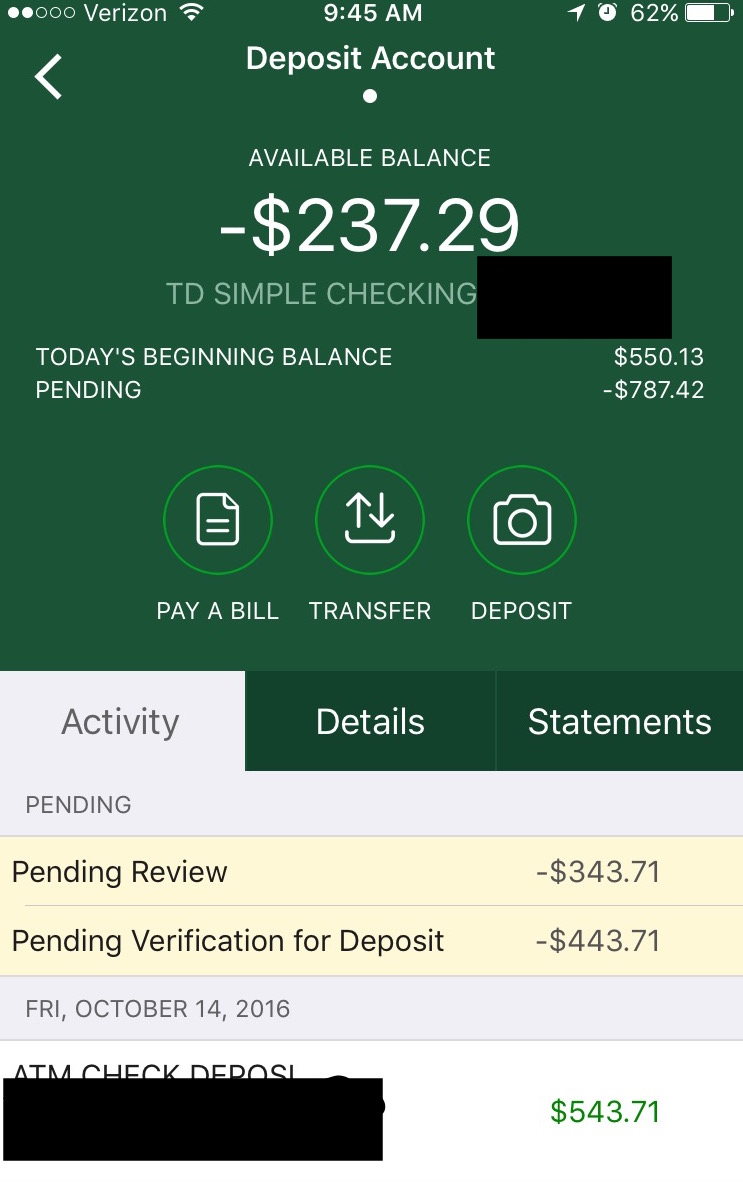

When an exception applies the bank may hold funds for a reasonable amount of time. A hold period allows sufficient time for td to verify that the promise to pay can be carried out i e. That s actually great for you because most banks. Some banks may hold checks that total 1 500 or higher for as many as 10 days.

You can now view your instantly available funds limits from a cheque deposit on the td app. In most cases a check will clear in two business days or less. For deposits made on weekends funds are considered deposited on monday the first business day so the hold will go into effect the next business day tuesday. It bears mentioning again that large deposits may come with longer hold time.

New customers are defined as those who have opened.

:max_bytes(150000):strip_icc()/checking-account-hold-315305-v2-5b73414c46e0fb002c12a554.png)

:max_bytes(150000):strip_icc()/funds-availability-315448-Final-5c58582d46e0fb0001c08aee.png)

:max_bytes(150000):strip_icc()/why-did-they-place-a-hold-on-my-checking-account-2385973-v2-5bc4c05646e0fb0058bbfcc8.png)

/why-isn-t-my-money-available-at-my-bank-61bb8056ab8e4c9aa0a051a73df571df.png)

:max_bytes(150000):strip_icc()/how-long-to-wait-after-depositing-a-check-315006-v4-5b4f5bb3c9e77c00375a0a69.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/bank-vault-door-ajar-digital-10185347-5748d1015f9b58516518ae95.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/checking_account-603705403-5aa1cb8c8e1b6e0036053f34.jpg)

/shutterstock_187267298.checkbook.cropped-5bfc3015c9e77c0051809f9c.jpg)