Fixed Life Insurance Policy

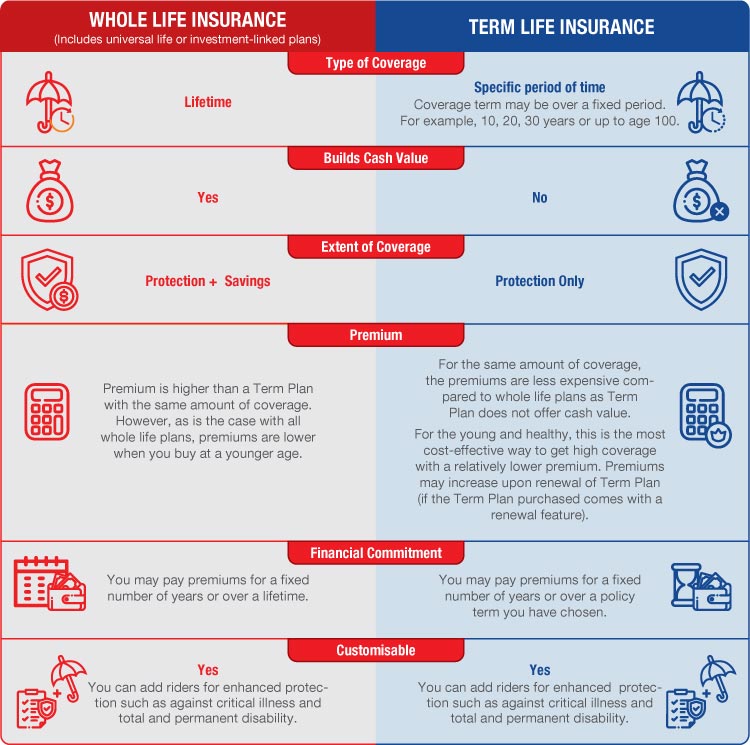

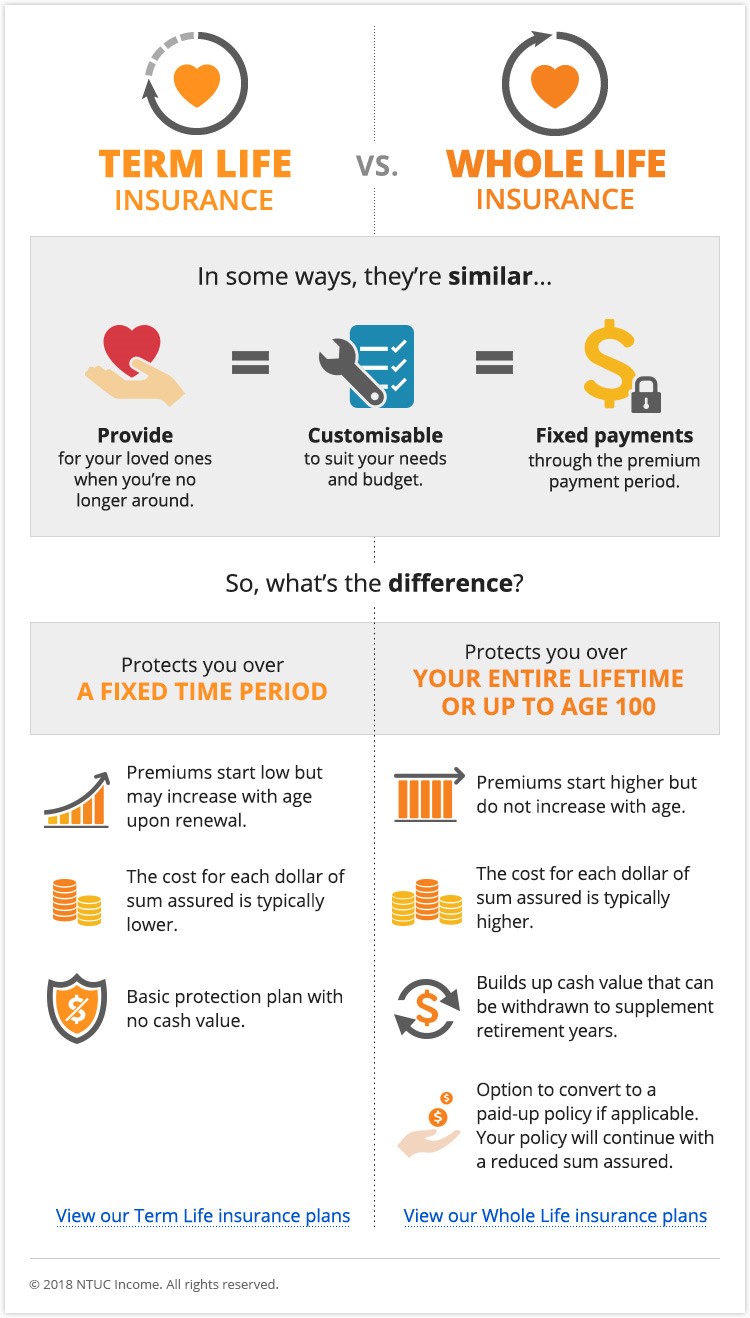

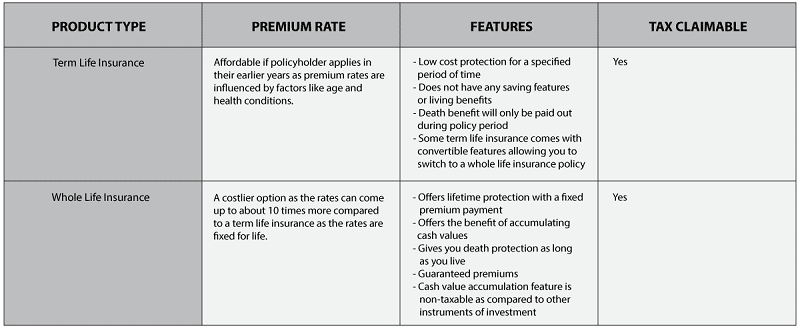

Whole life insurance policies commonly referred to as whole life build cash value at a fixed interest rate that you can access as a loan while you re still living.

Fixed life insurance policy. Unlike whole life insurance policies which have fixed premiums over the life of the policy a ul insurance policy can have flexible premiums. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. As long as you re alive and paying the policy this premium rate remains the same even if you age or develop a medical condition. Here you re buying a policy that pays a stated fixed amount on your death and.

Policyholders can remit premiums that are more than. Fixed life is another label for whole life which combines life insurance and savings into one account. Whole life policies a type of permanent insurance combine life coverage with an investment fund. Fixed universal life is less risky than other universal life policies so its growth potential is the most limited.

The fixed indexed universal life fiul product is a flexible premium universal life insurance policy that may possibly be the ideal solution for protecting your dreams while helping you reach your long term financial goals. Paying insurance premiums for your entire life doesn t necessarily make sense if you only need protection for a finite amount of time. Here we discuss what is fixed indexed universal life insurance. Whole life insurance is a basic type of permanent life insurance policy that provides a fixed death benefit and a fixed premium.

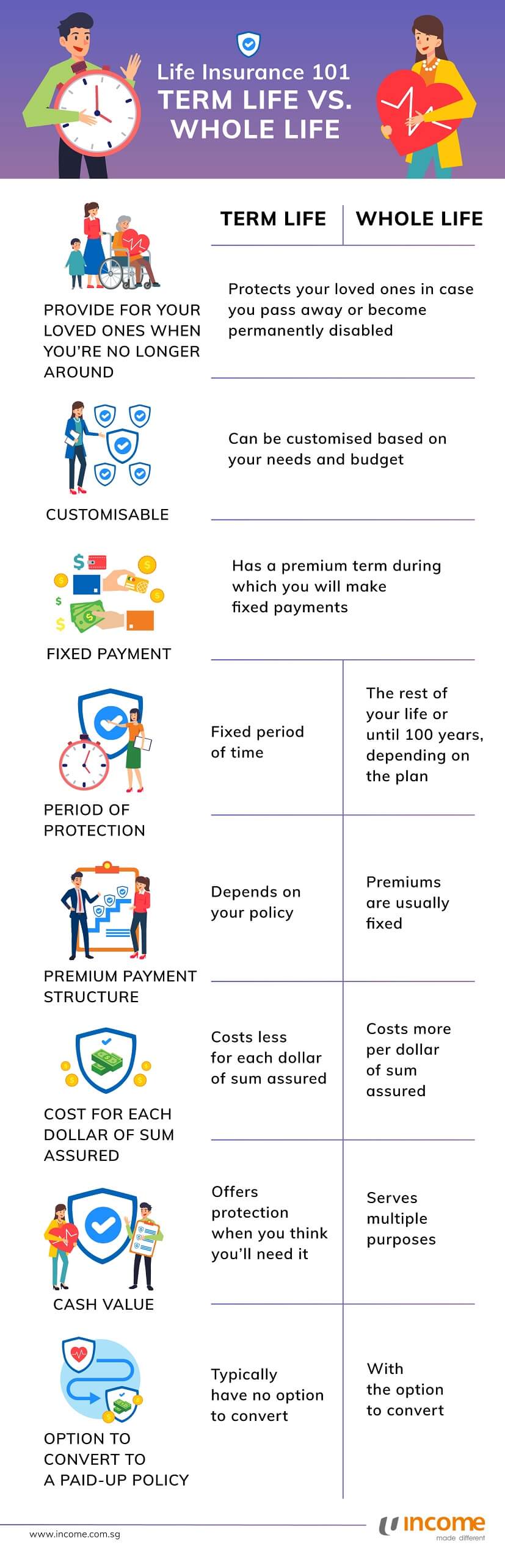

Depending on the contract other events such as terminal illness. When you die the whole life insurance policy pays a pre specified amount called a death benefit to the person or people you ve chosen as your beneficiary typically your spouse children or other family members. A renewable life insurance policy lets you renew your cover when the initial term expires without having to undergo another health review though the premiums you pay are subject to change if you do. Term life insurance is a defined policy that guarantees a benefit payout if the covered person dies during the policy term.

Fixed universal life insurance from securian financial group provides flexible life insurance coverage with flexible payments and stable cash value growth opportunities.